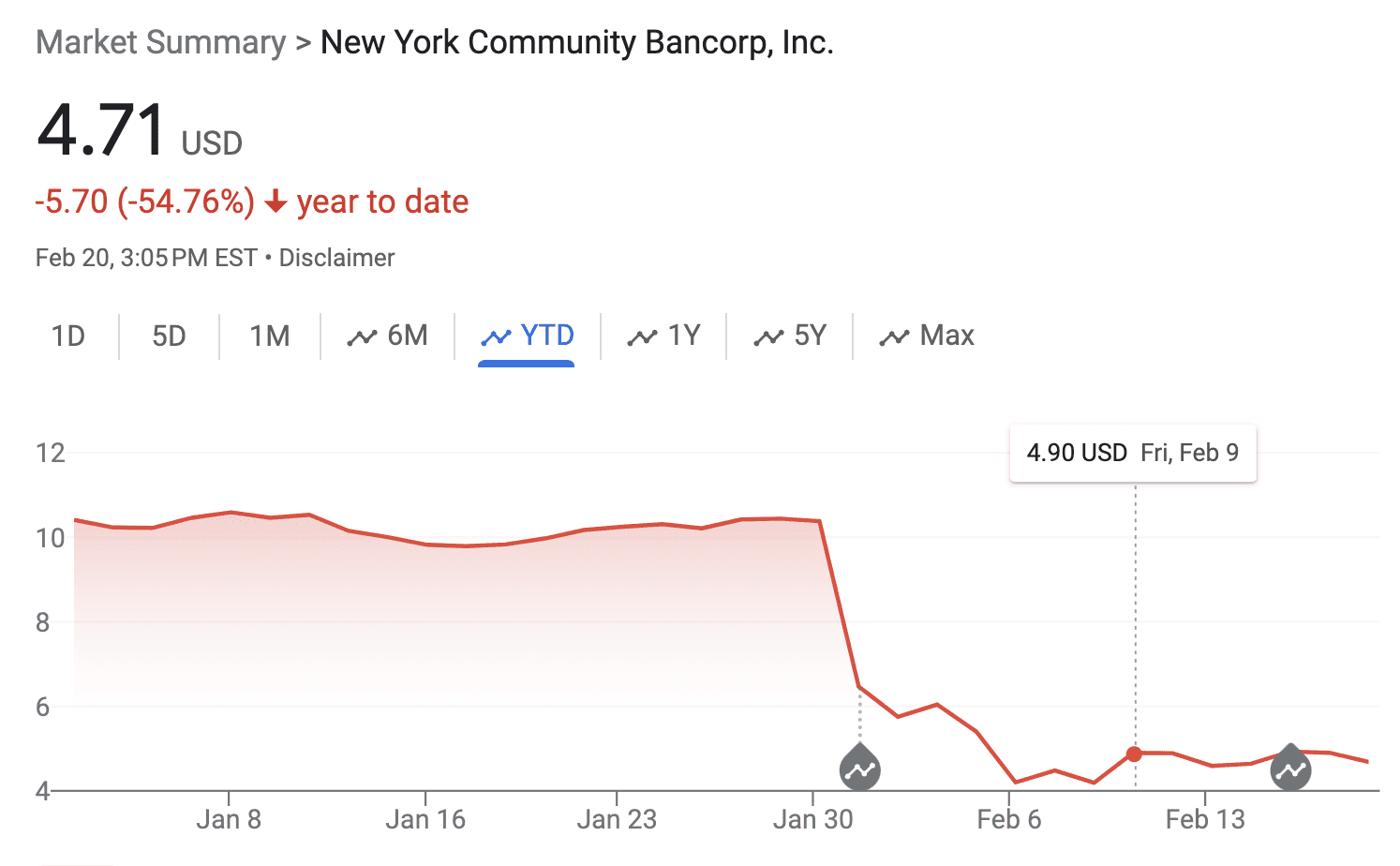

If you read investing news, you know that New York Community Bank reported a surprising loss (and a provision for loan losses that was more than 10 times what Wall Street analysts had been modeling) in late January. NYCB’s bad results – stemming from commercial real estate losses – lead to the stock’s collapse and even regulatory inquiries.

But haven’t we known since COVID and the work-from-home trend that commercial real estate was in trouble?

We have, but it’s taken time for a base of comparable transactions to build.

People of course suspected that commercial property values were lower, but because large buildings get bought and sold less frequently than houses, there simply weren’t a lot of recent “comps” with which property owners could impute a current realizable market valuation.

The comps are emerging, and the comps are not good. (Great Bloomberg piece on this phenomenon here explaining how markdowns can beget further selling.)

Rising interest rates also increased the burden on anyone who financed with variable-rate debt. And with NYCB in particular, rent controls on properties it had financed meant those costs couldn’t be passed on to end consumers.

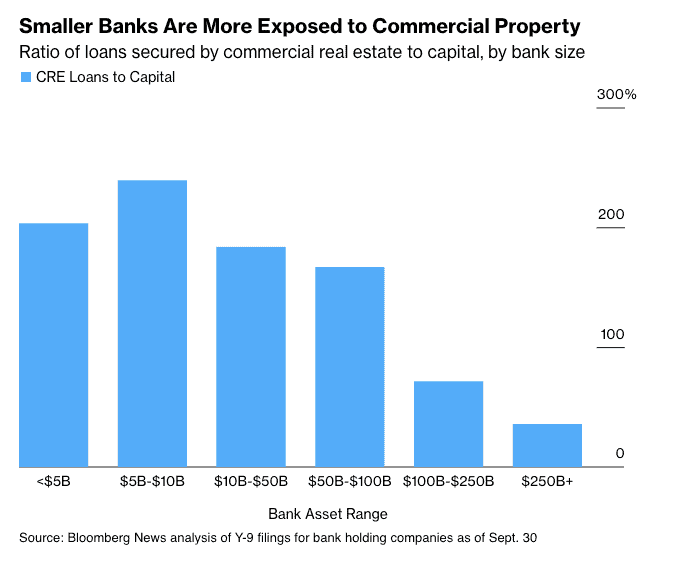

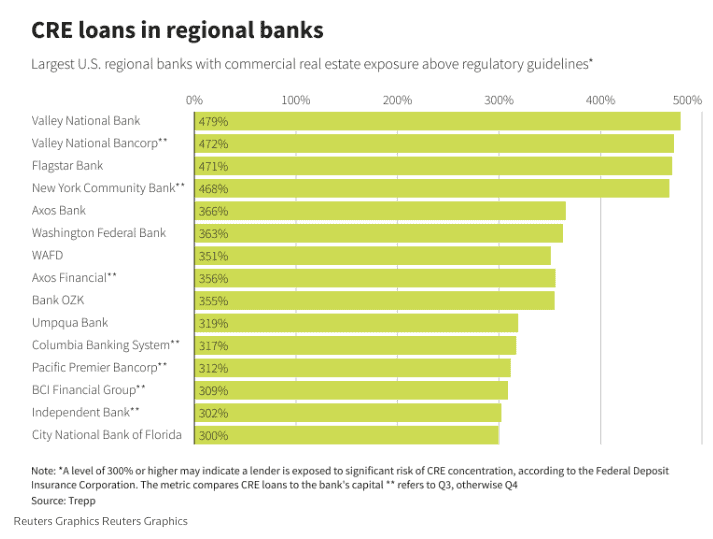

NYCB isn’t alone. Regional banks account for 70% of commercial real estate lending (data from Apollo). Loans for commercial real estate are 29% of regional bank assets, according to Bloomberg. Real estate is a local game, and so is real estate financing, as this Bloomberg chart shows:

Source: Bloomberg article

Run into the banking fire – or away from it?

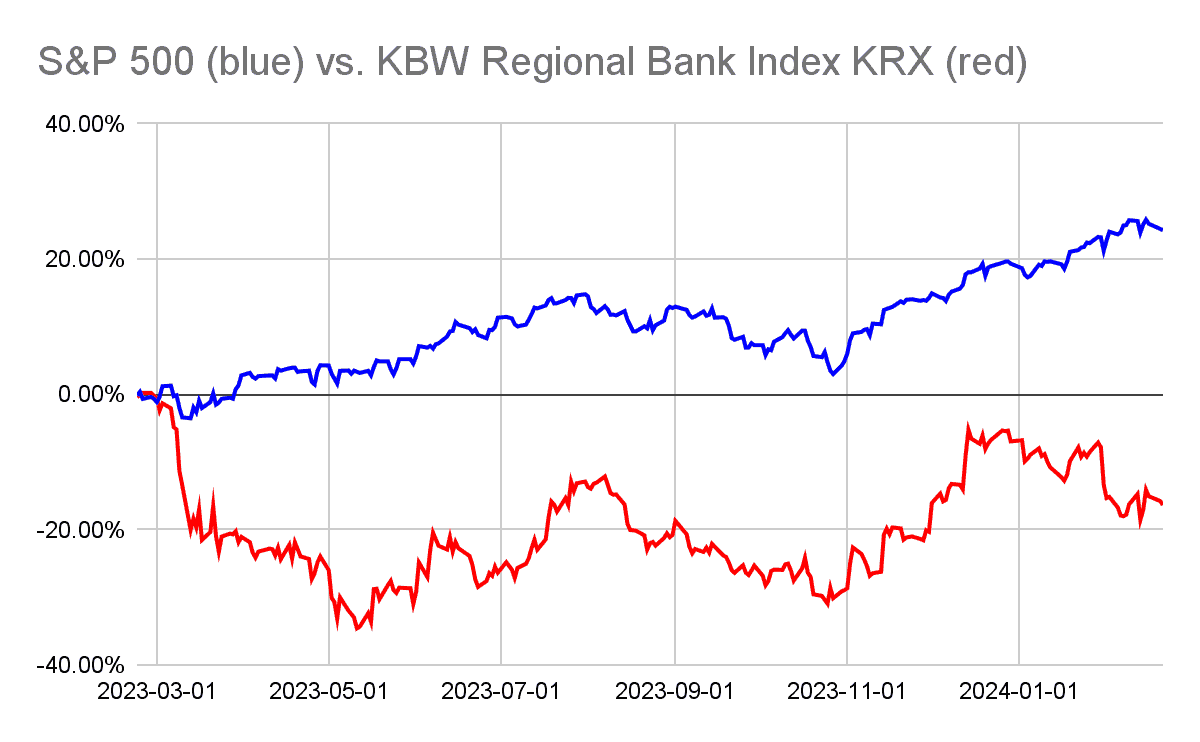

If you’re a value investor, you’ve likely evolved an attraction to calamity, because that’s where the bargains are. Humans frequently overreact – but not always, and there’s an argument that the poor recent price performance of regional banks doesn’t quite make up for the risks they still present investors.

Mainly, there’s the slow-motion train wreck of the US’ $20 trillion commercial real estate market, or at least parts of it (offices are hit hardest, whereas some data center properties are doing well).

New York Community Bank may be the poster child because of rent controls (and difficulty digesting Signature Bank, which it acquired in 2023), but plenty of other regional banks – which sit in between smaller community banks and larger nationally chartered banks and do the brunt of the real estate lending – are heavily exposed to commercial real estate, as Reuters shows:

Source: Reuters article

Additional bank risk #1: Interest rate risk

This normally wouldn’t be such a “thing,” but the Federal Reserve’s rapid rate hike caught banks by surprise, and not in a good way.

Interest rate risk was Silicon Valley Bank’s biggest domino, and while it’s not enough to topple most banks, it can still make their results wobbly. In an economy fuelled by low rates and flush with pandemic-era cash (that’s now drying up – see below), banks had to do something with their cash. Many bought Treasuries, which seems like a safe and defensible move.

But as SVB demonstrated, while US government debt may be free of credit risk, it’s not free of interest rate risk. Old, low-yielding bonds become less valuable when new bonds pay more – in 2022, for instance, the value of 30-year T-bonds dropped nearly 40%.

Additional bank risk #2: Credit risk

This overlaps with commercial real estate risk, but is worth spelling out. See, Treasuries may be free of credit risk but bank loan customers aren’t.

Pretend you’re a bank. Pretend you loan money to a customer to buy an asset that generates income for the customer – and which the customer uses to pay you interest and principal payments. Pretend the asset is no longer good at generating income, and becomes worth a lot less.

In that scenario, there’s a strong chance that you, the bank, are going to lose a customer and gain a severely marked-down asset at the end of the day.

Interest rate and credit risks can snowball…

And if you’re a bank holding assets that are now less valuable – regardless of whether interest rates or credit issues are the villain – you may risk running afoul of capital adequacy measures, in which case regulators, borrowers, depositors, and shareholders alike all get spooked and your problems snowball.

As I’ve written before, accounting treatment doesn’t help, in my view (or it helps too much, from another lens): banks can use historical valuations of certain bonds if they state an intention to hold them to maturity. The point of this is to avoid gyrations caused by mark-to-market accounting appearing on banks’ financial statements. Banks fear these gyrations will spook investors and depositors.

However, mark-to-market accounting exists for a reason. And Silicon Valley Bank demonstrated something crucially important: intent to hold to maturity is different from ability to hold to maturity.

SVB had the former, but not the latter. It would seem logical to mark all bonds to market and then footnote banks’ intention to hold certain securities to maturity. Banks would hate this – that might mean something – for what it reveals. But if equally applied to all banks, it would be fair.

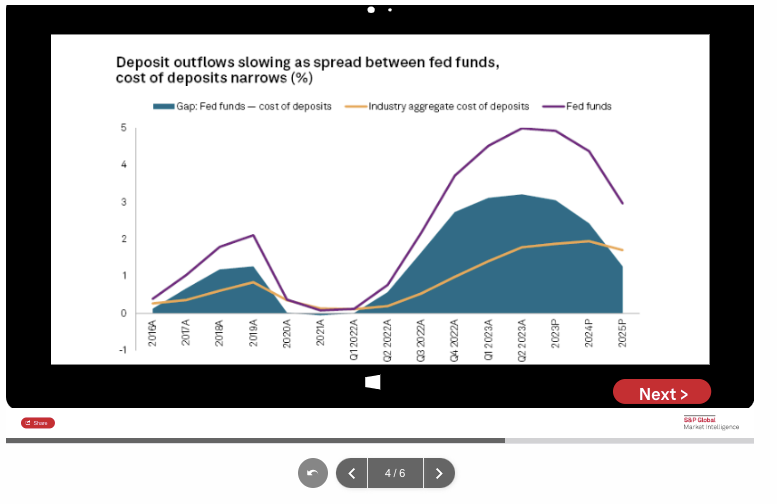

Additional bank risk #3: Deposit funding is expensive

The below chart from S&P Global analyst Nathan Stovall and Zain Tariq shows how deposit costs are expected (at least by S&P) to peak this year, even if they’re expected to slightly decline in the near future. Banks love deposits, but the mix of currently high interest rates and competition in an industry that had arguably become habituated to cheap deposits paints a difficult picture for banks, which either need to pay nearly 5% on CDs and high-interest savings accounts, or negotiate for brokered deposits, which is also expensive.

Source: S&P Global

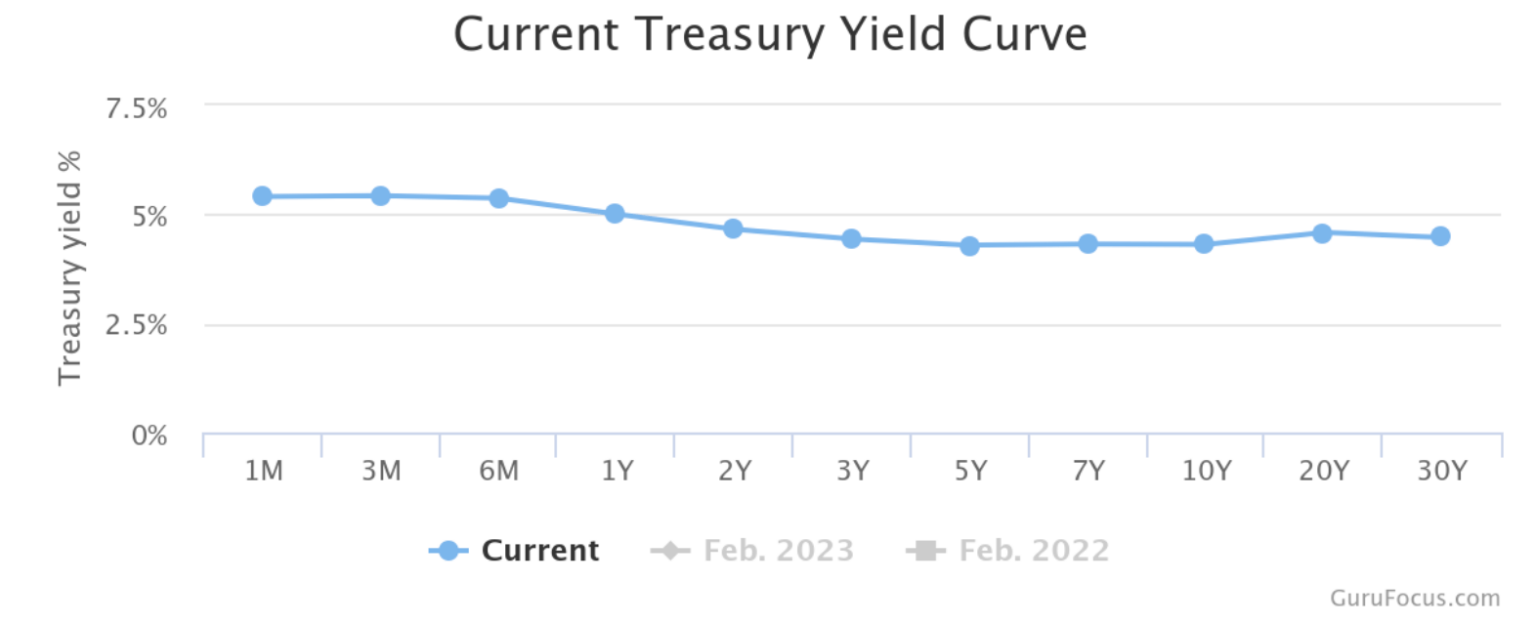

Additional bank risk #4: Inverted yield curve

Source: gurufocus.com

The blue line may be only declining slightly, but that’s the problem: short-term rates are higher than long-term rates. Such an “inverted” yield curve has been much discussed as a usually reliable predictor of recession that hasn’t been reliable at all lately (we’ve had one for years, with no recession).

But the yield curve is also a proxy for bank profitability, at least in banks’ traditional core business (banks have gotten heavily into fee income in recent decades, although consumer protection regulations have curbed that somewhat). Banks generally pay interest rates at the short end of the curve to “buy” or receive money – think: CDs and savings accounts – and receive interest rates at the longer end of the curve in the form of interest paid from borrowers using bank loans to buy homes, cars, commercial real estate, or whatever else.

Banks love low short-term rates and high long-term rates. What we’ve got now is as opposite as things practically get in the banking world.

Should you buy bank stocks?

Two pieces of good news: first, nothing lasts forever. Rates are generally coming down (many rates have declined in advance of the Fed’s expected lowering of the Fed Funds rate, which counters the common (mis)perception that the Fed Funds rate leads all others), and not all banks are affected equally. The big banks have tighter regulatory standards, yet also far less commercial real estate exposure. Plus, they’re arguably too big to fail, so they’re likely safer bets overall than regional banks.

Ultimately, I can’t tell you what to think of bank stocks. I can tell you that Warren Buffett’s Berkshire Hathaway has been fairly tepid on them in recent years. And I can tell you that regional banks seem riskier than nationally chartered banks in the current environment.

As a value investor, I’m always tempted by flames and carnage. But sometimes, things are on fire for a reason.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.