Weekly Roundup: Non-Magnificent 7 Taking Off, Dirt-Cheap International Stocks, Polluters Perform Better

Other 493 Stocks Finally Ready to Take Off?

Axiomatically, if you have 500 stocks (technically, roughly 500) and seven of them are magnificent, it means that 493 of them are non-magnificent.

And if the overall S&P 500 was up 25% for the year trailing June 27th, and if the Magnificent 7 were up 57% for that year, and if 35% of the S&P 500 by market cap is in the Magnificent 7, it means that the non-Magnificent 65% was up just 7.7%, if my algebra is correct.

Paul LaMonica of Barron’s (a friend of BBAE, incidentally; see our chat here) was inspired by Thursday, July 11th’s trading session to declare that rest of the S&P 500 is about to take off:

As Paul notes in Barron’s (registration may be required), Thursday’s session – a reaction to a soft inflation report – saw the cap-weighted S&P 500 down 0.88%, the tech-heavy Nasdaq index down as well (I’ll proxy the Invesco QQQ ETF (Nasdaq: $QQQ) which dropped 2.19%), while the equal-weight S&P 500 (proxied by the Invesco S&P 500 Equal Weight ETF (NYSE: $RSP)) was up 1.21%.

Equal-weight becoming a better bet than cap-weighted?

One day does not a trend make, but as Eoin Treacy and I discussed in a BBAE video a few weeks ago, the equal-weight S&P 500 has historically outperformed the market cap-weighted version.

This has been fantastically untrue for the past few years, but Eoin and I – and now Paul – feel that recent times are an anomaly and that the equal-weight index – the market’s version of the electoral college – may return to being the better performer sooner rather than later.

International Stocks: Wow, They’re Cheap!

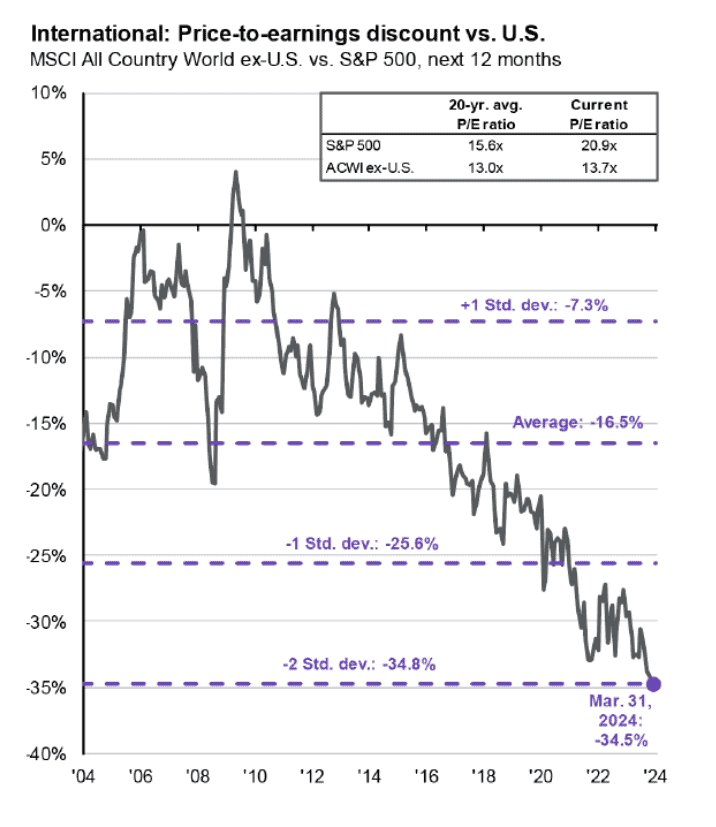

My friend Whitney Tilson shared a chart in his daily newsletter showing the (tremendous) valuation spread between the S&P 500 and rest-of-the-world stocks:

From a mean reversion lens, international stocks seem cheap, and therefore probably a good buy.

I don’t think this thinking is altogether wrong, but I do think there’s more to the story. Specifically, the US dollar. As I pointed out in a BBAE Blog article long ago about emerging markets, emerging markets (which comprise a subset of international stocks, and probably a subset holding disproportionate amounts of dollar-denominated debt thanks to sketchy home currencies) have been “cheap” for years, yet have just kept underperforming.

They did not, however, underperform from 2000-2010; they clobbered US stocks.

Not coincidentally, the US dollar fell during that time, as I showed in my January post.

So, yes, international stocks are cheap. But I am not getting too optimistic about them until I see a clear catalyst for the dollar to fall.

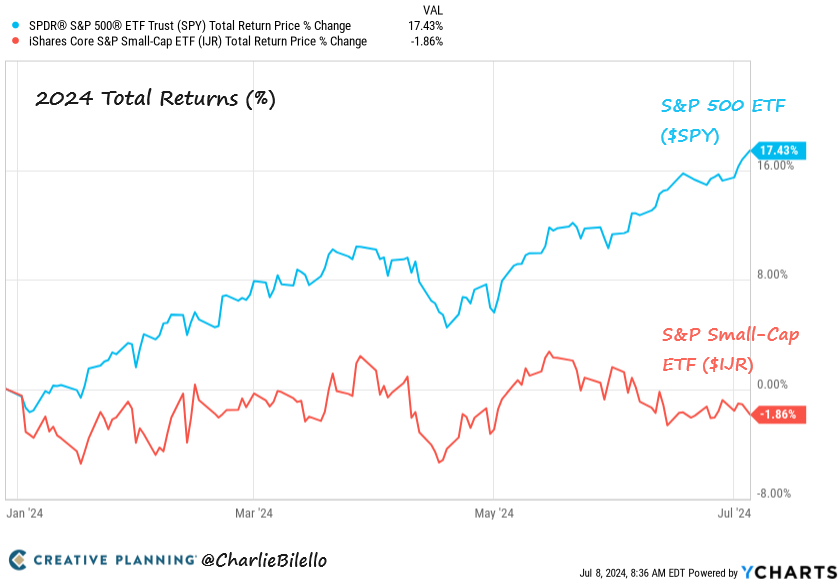

I’m slightly more optimistic on small caps, which have been flat to down this year, as they’re not so dollar-connected (unless there’s data I’m unaware of). They are, however, very much connected to interest rates (having more debt than large caps) and to the US domestic economy generally. US small caps are historically known for leading the stock market out of a recession, which we don’t have, though, so the cyclical signals appear to be mixed.

But, per the Paul LaMonica article referenced above, small caps may be turning the corner sooner.

Pollution Premium: Bad Companies Have Good Stocks

Let’s talk politics. ESG politics.

Larry Swedroe has a reputation for being inflammatory, and his latest piece claiming that polluting companies enrich stockholders more will ruffle feathers amongst the more optimistic of the ESG set.

Swedroe mostly cites a Turkish paper by Yigit Atilgan, K. Ozgur Demirtas, and A. Doruk Gunaydin (published in May 2024) showing that a portfolio of high polluters generates a monthly alpha (adjusted for other factors) of 35 to 57 basis points.

That’s pretty huge, although if you read the paper, you’ll see that Atilgan, Demirtas, and Gunaydin seem less confident about their findings than Swedroe is. They note that adjusting for those other factors is a pretty messy process, and the resultant returns are splotchy and irregular.

Ergo, Swedroe may be running with this finding a bit by minimizing the paper’s authors’ disclaimers. (I don’t know Swedroe or the authors; I’m just comparing what he said to what they said.)

But with matters of the heart (i.e., matters of strong opinion), biased behaviors afflict both sides: I remember being at an ESG (then called SRI) conference 10+ years ago where a young professor received an award for a paper hinting at better returns for SRI-ish companies, and, later, some glowing coverage in SRI-leaning media. “Doing well by doing good” was exactly what the SRI crowd wanted to hear.

However, I checked with some professor friends who’d been at a purely academic (i.e., non-SRI) conference where that same paper was presented – a crowd judging the rigor of the study’s methodology as opposed to whether or not the study’s results fit what they wanted to hear.

Word on the street was that this paper was roundly deemed to be the worst paper at the conference on technical merits and methodology. Academic junk, in other words.

Humans are filters. We see what we want to see, and we get the results we want to get. Or at least we often do.

ESG investing should entail some sacrifice

Bias aside, it’s worth noting that the Swedroe + Turkish professor point is logically consistent: In a pure ESG sense, ESG investors should be willing to accept lower returns – essentially making a “donation” in the form of some returns to the cause.

It’s not unlike paying a bit more for fair trade coffee: It’s logical. And if someone says they’ve got fair trade coffee – which is all about paying poor, unsophisticated coffee pickers “fair” wages instead of exploiting their low negotiating leverage – for a lower price than regular “unfair” coffee, it’s suspicious, right?

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.