AI’s Not-So-Secret Winner: Independent Power Producers

If you’re an investor and read any investing news at all, you know that AI is all the rage.

And if you’ve read that a ChatGPT search sucks up 10 times the electricity a Google search does, and that Google’s carbon emissions have gone up by 50% thanks to AI demand, you may have connected the dots to figure out that more AI means more electric power, which means companies that supply electric power should go up.

This is true.

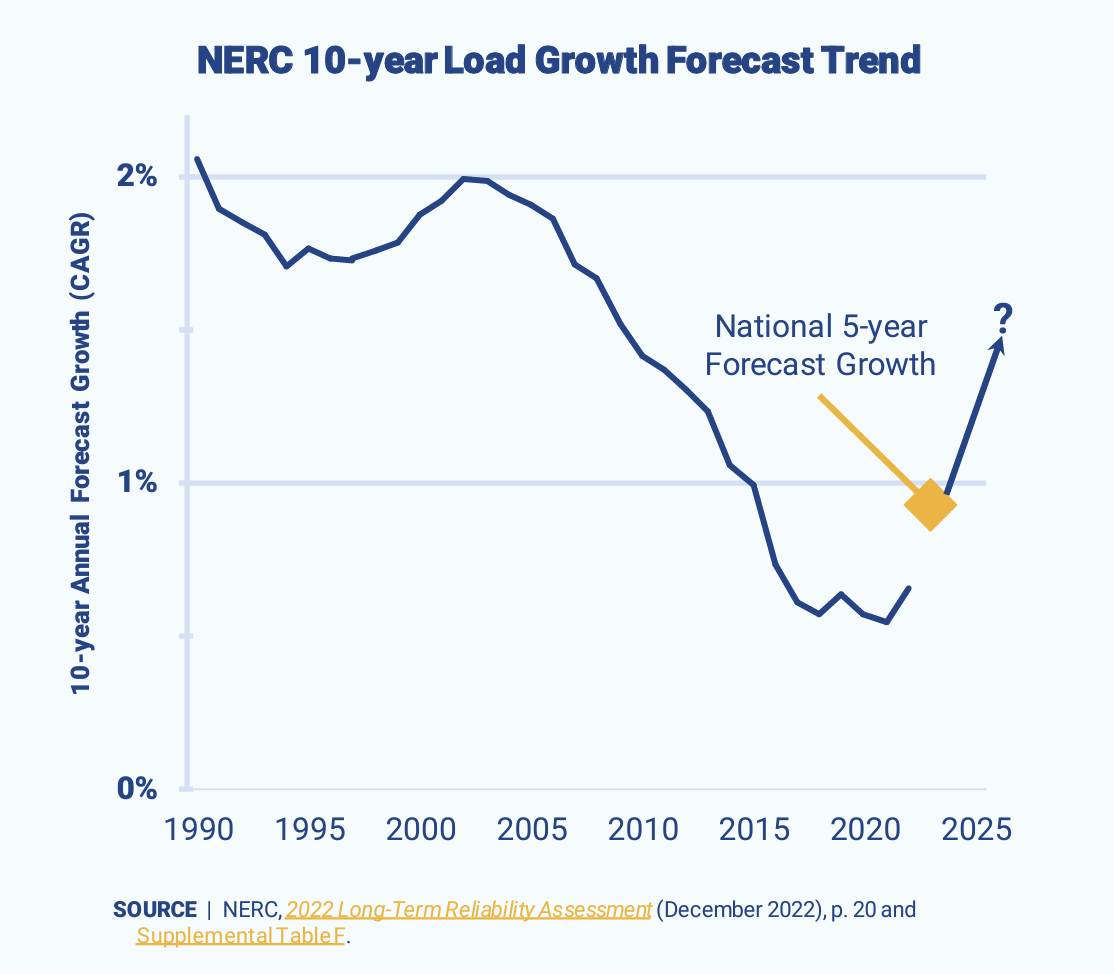

And in fact, after a quarter-century of declining power load growth (presumably thanks to increasing efficiencies), load growth has taken a sharp turn upward.

Analyst commentary on the above data – from 2022 – is that if anything, it significantly understates upcoming US load growth given how much progress AI has made since 2022.

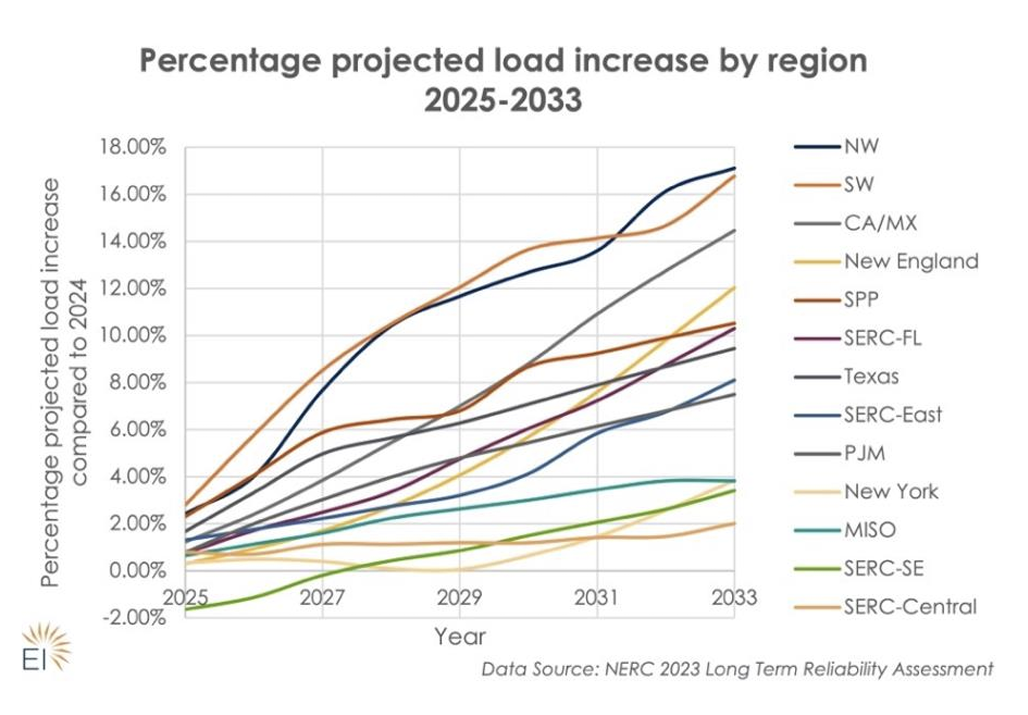

Load growth will vary significantly by region, but generally, it’s going way up, especially in the West. The hard-to-differentiate graph below makes me wonder if I’m slightly color-blind, but the trend is clear:

As an investor, you may wonder: Where is that electricity coming from?

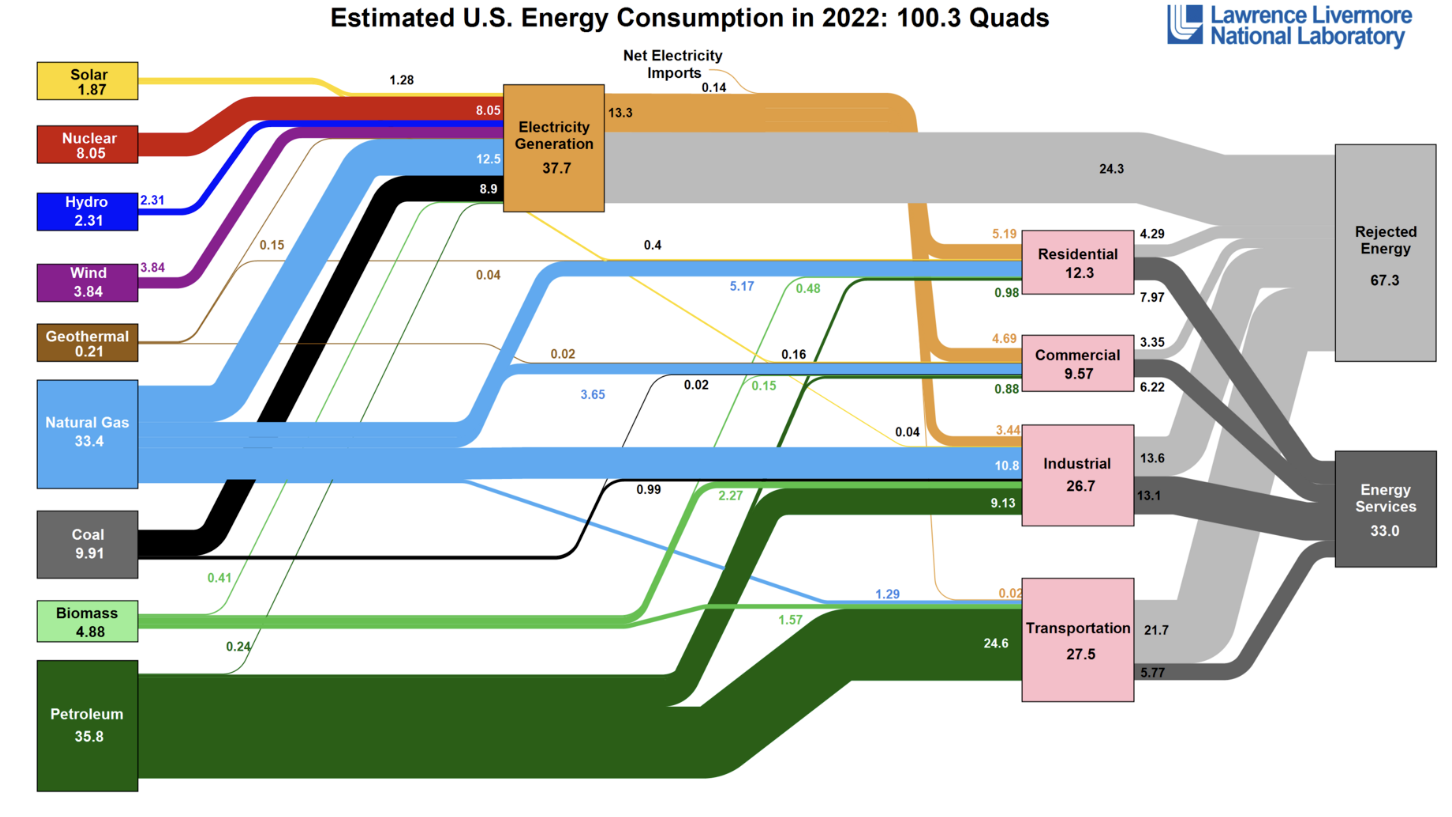

Let’s start with a look at the US energy mix.

The graphic below, which doesn’t seem quite to scale, shows all energy consumed, including petroleum, which is mostly used in cars (and makes up just 0.6% of electric generation).

You can see that natural gas is the single biggest source of electricity used.

As an interesting aside, also note that even in this modern era, the majority of energy actually goes to waste.

Anyway, what happens when the US needs more electricity?

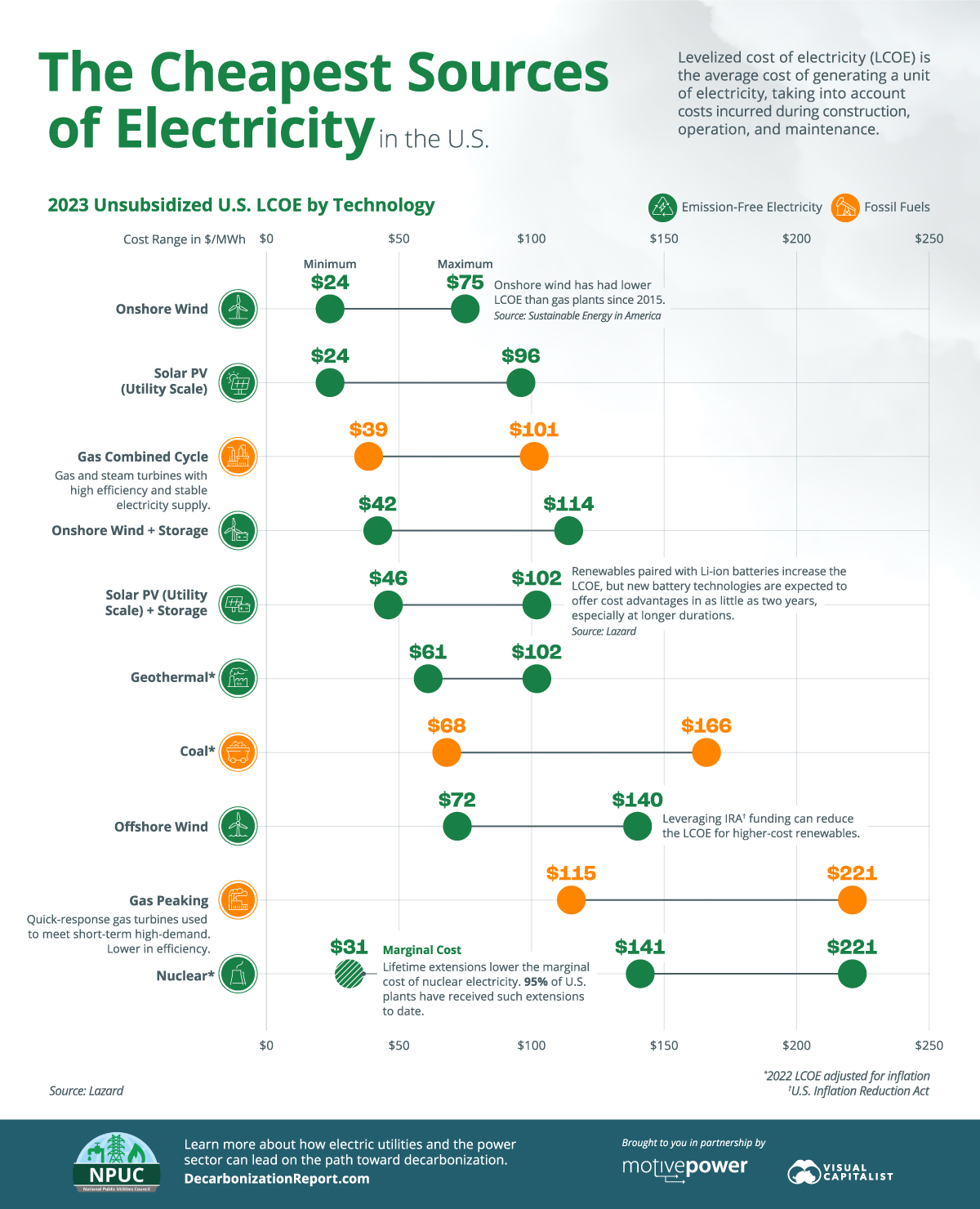

If you’re new to this industry – and if so, great, because this article is meant for you – know that methods of electricity generation are not created equal.

Where does electric power come from?

Nuclear power is my personal favorite, in that it’s zero-emission and seems like the only realistic way to address the world’s increasing power needs without increasing pollution. Detractors note periodic safety issues like Three Mile Island and Fukushima, though proponents note that modern nuclear plants are far better designed than these “dinosaurs.” Both sides agree that long-term storage of radioactive nuclear waste is a challenge. Environmentalists have been divided on nuclear, but arguably there’s been a bit of a nuclear renaissance lately in the US, and the US started work last year on the first nuclear plant since 2016 (getting approval and financing and NIMBY-ism have been hurdles). Currently, nuclear fission is employed, but there’s hype in the VC community about nuclear fusion, which would enable smaller reactors, but so far fusion hasn’t become workable.

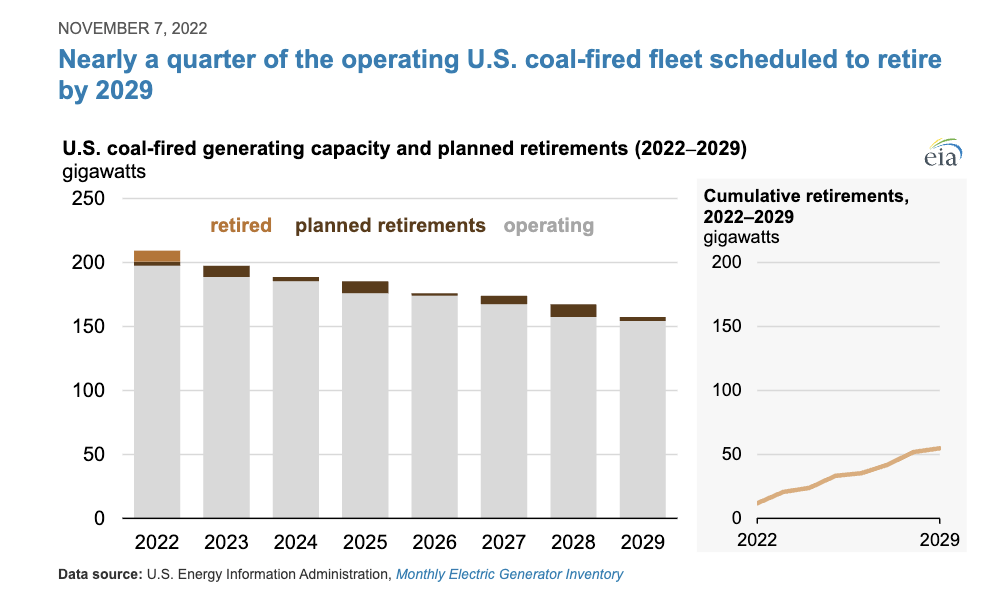

Coal power is dirty, though pro-coal folks argue it’s dirtier than it needs to be because it’s basically impossible to build a new coal plant. Many in use were built in the late 1930s and the average age is approaching 50. I’m not advocating for a coal renaissance, but if, as a thought experiment, newer coal plants were allowed to replace older ones, efficiency would go up and emissions would go down. Coal is reliable, though, and the US has a lot of it, but isn’t building new plants (China is building 95% of the world’s new coal plants).

Importantly, coal and nuclear are “baseload” power: They’re designed to run all the time, as anchors of the power generation system. They’re expensive to start and stop, so best to just keep them running.

Costs of energy – and especially, “levelized” costs of energy that aim to account for all-in full-lifecycle energy costs – are complicated and contested (see EIA slideshow here), but historically, coal and nuclear have tended to be among the cheaper forms of power, although that’s changed in recent years.

Renewables like wind and solar certainly feel the best out of all ways to generate electricity, and after decades of subsidies, are generating low-cost electricity on a unit basis. That said – and please take everything I say as a generalization; certain ideological camps have more particular views and probably quibble with mainstream generalizations – renewables have at least two Achilles’ heels:

- The best areas for renewable power generation (hydro, wind, solar, geothermal) are often far from the population centers where the power is used. This means long transmission lines, which means loss of power and added cost.

- Wind and solar are intermittent. Grid-level electricity, for the most part, can’t be stored very well. Maybe someone who works for some startup grid battery company will write in to tell me that his or her company has solved this problem, but while many are trying, there’s no widespread solution. (Plus, batteries tend to involve digging up all kinds of rare earths in places not known for strict environmental or child labor standards.) Some interesting low-tech solutions involve using renewables to either lift weights or twist corkscrew-type things using power during low-demand periods (i.e., if the wind happens to blow during the middle of the night), and then dropping the weights or untwisting the coiled springs during the day to release power when needed.

Many worry that clean as renewables are, they’re just not close to offering enough capacity to be a serious source of electric power in the US. We can’t, in other words, just go all-renewable, because (a) there aren’t enough metals to make all the solar panels and windmills and (b) at present, we couldn’t tap enough renewable power to make a real dent in our power needs.

Natural gas: Natural gas used to be considered a “peaking” energy source, which complemented baseload power like coal and nuclear. Gas plants are easy to turn off and on, making them ideal to use on especially hot (or cold) days when power demand spikes above normal.

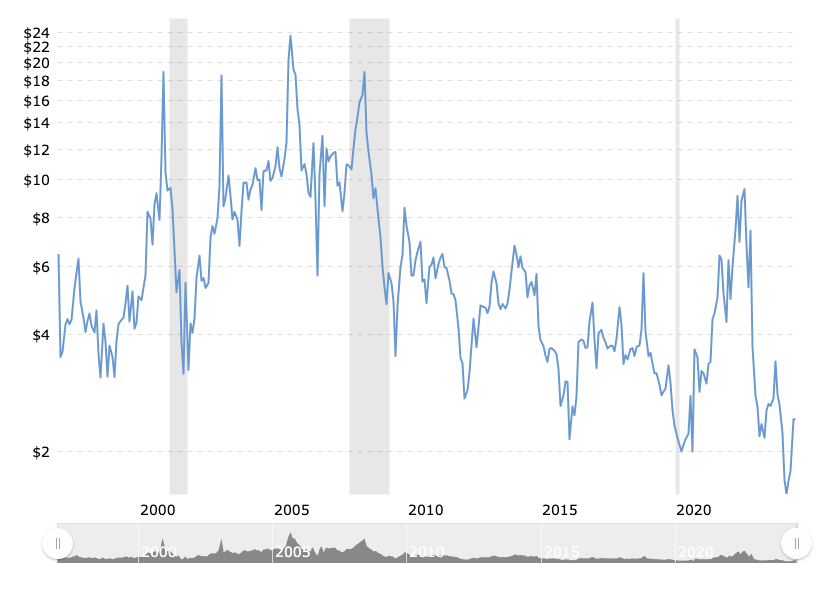

The US produces the most natural gas in the world (Russia is #2), and prices have been trending down over the decades.

Burning gas pollutes, but less than coal. But gas requires infrastructure, and not everywhere has it: Natural gas often bubbles up as a by-product of oil extraction, but in many locations lacking pipelines to take the gas to terminal facilities (“natural gas” is a broad term for several gasses that are typically isolated at a refinery, “cracked” to make plastics, or cooled into liquids to be transported), the gas is just “flared,” or burned at the surface. Everyone agrees that flaring is wasteful and bad for the environment, but it’s safer than not flaring in the absence of infrastructure.

Natural gas has grown as a portion of the US electric power mix, because it’s the most “workable” of the electricity sources on the scale the US needs, and because it’s on the cheaper end of the scale.

Electric Utilities

Now, we’ve just talked about power generation. Technically, there’s an entire chain to supplying power, at least for fossil fuels: Companies that explore/mine/extract the fossil fuel, that refine or process it, that transport it, and that deliver it to end users. Companies may participate in more than one part of this chain, and regulation broadly increases the closer the process gets to the end user (i.e., local distribution utilities are, as natural monopolies, very heavily regulated, whereas “wildcatters” that dig for fossil fuels are less so, apart from environmental restrictions).

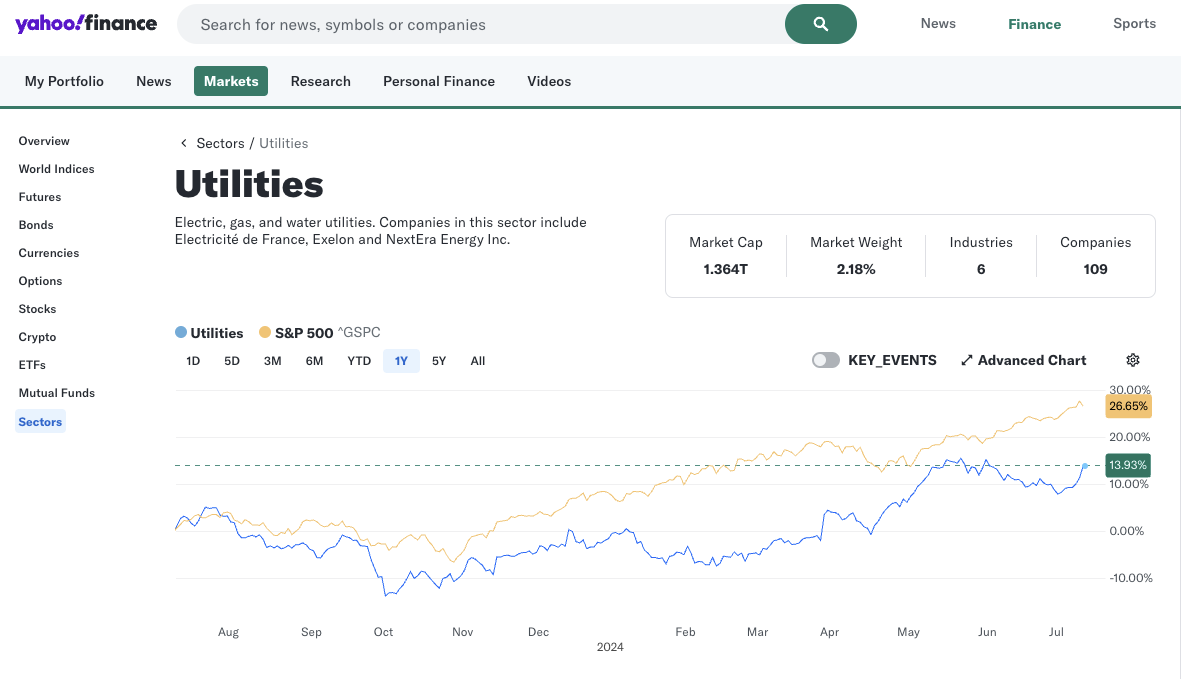

Returning to the AI theme, some might deduce that utilities – perhaps like Dominion (NYSE: $D), Duke Energy (NYSE: $DUK), and Southern Company (NYSE: $SO) – will see more demand, and thus will “do better” for stock investors. But the speculators are not betting on this: Over the past year, per Yahoo! Finance, the utility sector is up 13.9%, versus 26.6% for the S&P 500. (The chart lines below are tiny, but utilities are the lower (blue) line.)

In aggregate, utilities have only done half as well as the market over the past year. (The Yahoo! index may include some water utilities, too, but most are likely electric.)

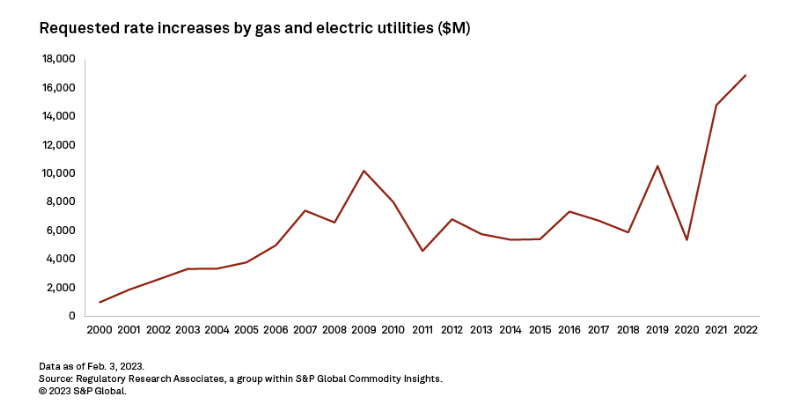

The problem? Utilities are so regulated that they’re not quick beneficiaries of incremental power demand. They’re mostly in the business of keeping the lights on. If they reap outsized profits, ratepayers get angry, which means regulators get angry. Plus, utilities are subject to periodic ratemaking every so often (say, five years or so); it generally takes a long time for them to pass through anything new, though utilities have recently gotten more aggressive about asking for a review for higher rates:

In other words, utilities are not the ideal way to play AI-driven power demand.

Independent Power Producers are cleaning up

There is another group of electric generation companies, however, that have risen by nearly 200% in the past year – massively outperforming the S&P 500. These independent power producers (IPPs) are a bit like mercenary generators for hire: they’re not utilities, but rather independent power plants that either sell power to utilities (who often need extra power, either sometimes or always), or sell it directly to end users – especially institutional buyers like data centers and factories.

IPPs are way up because they’re likely to be the beneficiaries of incremental power demand from AI-enabling data centers.

What are some publicly traded IPPs?

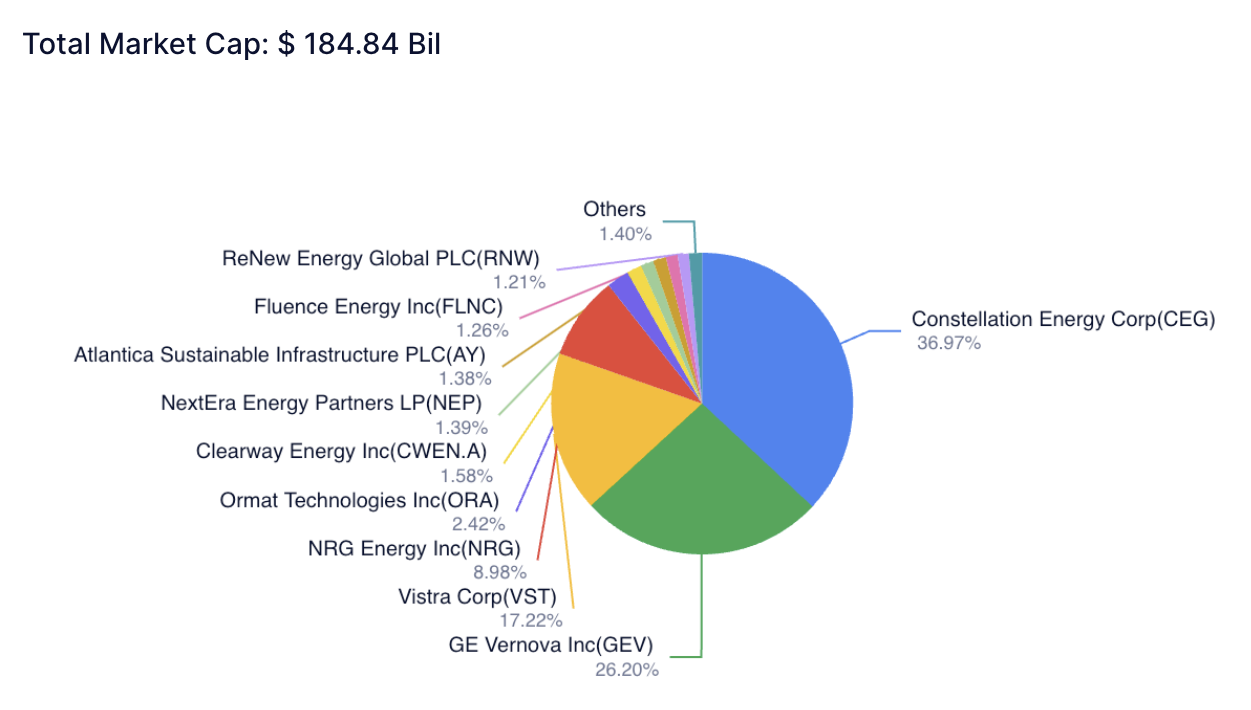

This chart from BBAE friend GuruFocus shows some of the major IPPs. Constellation Energy (NYSE: $CEG) stands out as the biggest, but Vistra (NYSE: $VST), GE Vernova (NYSE: $GEV) and NRG (NYSE: $NRG) are the other heavyweights.

Constellation is a particular darling of the market for checking several boxes:

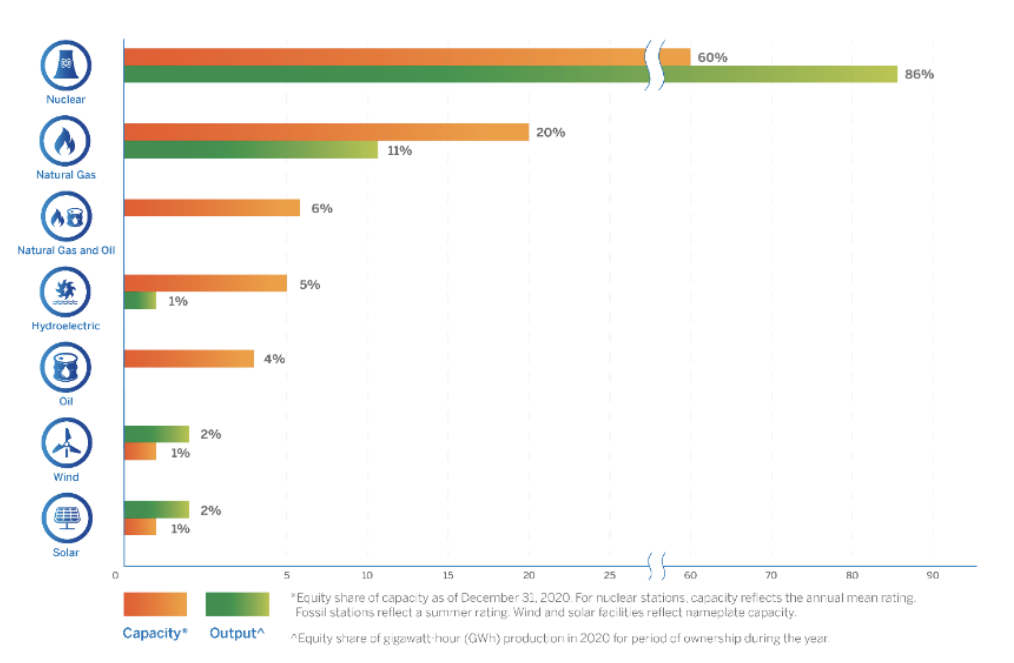

- Its generation mix is very clean on average (90% carbon-free, and Constellation generates more clean energy than any other US company).

- It has a lot of generation in Virginia, which has more data centers than anywhere in the US (and second only to Beijing worldwide).

- It has some nuclear plants near data centers, and always-on nuclear plants make a great match for always-on data centers.

It’s expanding, too: Constellation is braving the regulatory environment in hopes of building more nukes as the linked-to article explains.

Should you buy into the IPP updraft, or do current prices already embed anticipated growth?

To return to a point I often make here, one of the cardinal rules of investing is that investors must balance circumstances and price.

This sounds obvious, but it’s probably the most overlooked thing in investing, especially by novice investors.

A company with a bright future can be a lousy investment if the price is too high.

A company with a bleak future can be a great investment if the price is low enough.

We are not exploiting absolute performance in investing. Instead, we are exploiting differences in performance relative to expectations.

This may be the correct framework, but it doesn’t answer the question about what’s priced into IPPs. My guess is that it comes down to exactly how big AI will get. If you’re of the mind that AI will exceed current expectations, then IPP stocks may be a reasonable way to express your belief. As a bonus, they’re likely to be less volatile than Nvidia and the other chip stocks, and probably have a bit more downside protection, too. Conversely, if you’re of the belief that everything under the AI rubric is in some degree of bubble, you’d probably want to steer clear of IPPs, too.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.