Welcome back to our five-part blog series, ” BBAE’s Guide to Dividend Investing.” In our first installment, we introduced you to the world of dividend investing and the BBAE app, a powerful tool designed to help you navigate this investment strategy. We covered the basics of dividends, the power of dividend reinvestment, and how dividend investing can provide stability during market volatility.

In this second blog post, we will delve deeper into the mechanics of dividend investing. We’ll explore the key components of this strategy, including the dividend payout ratio, dividend yield, and dividend growth rate. We’ll also discuss the appeal of dividend investing and how it differs from other investment strategies. So, let’s dive in!

The Basics of Dividend Investing

Dividend investing is a strategy that focuses on purchasing shares in companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. This approach offers a dual-income potential: the potential for capital appreciation (the increase in the stock’s price over time) and the regular income from dividends.

The appeal of dividend investing lies in its simplicity and the steady income it can provide. Unlike other investment strategies that rely heavily on market timing and short-term price fluctuations, dividend investing is a long-term strategy. It’s about buying shares in solid companies and holding onto them for the long haul, reaping the benefits of regular dividend payments and potential price appreciation.

But dividend investing is not just about picking any company that pays a dividend. It’s about choosing companies that have a history of paying consistent and increasing dividends. This is where the difference between dividend yield and dividend growth comes into play.

Dividend yield is the annual dividend payment divided by the stock’s current market price. It’s a snapshot of how much cash flow you’re getting for each dollar invested in the stock. However, a high dividend yield isn’t always a good thing. It could be a sign that the company is in trouble and the stock’s price has fallen.

On the other hand, dividend growth focuses on the rate at which a company’s annual dividend payments have increased over time. Companies with a strong history of dividend growth are often well-managed, with stable earnings and good prospects for future growth.

Key Components of Dividend Investing

Now that we’ve covered the basics of dividend investing, let’s delve into its key components. Understanding these metrics can help you select the right dividend stocks for your portfolio.

Dividend Payout Ratio

The dividend payout ratio is a financial metric that indicates the percentage of earnings a company pays out to its shareholders in the form of dividends. It’s calculated by dividing the annual dividends per share by the earnings per share. This ratio can give you an idea of how well a company’s earnings support the dividend payments.

A lower payout ratio could mean that the company has room to increase its dividends in the future. However, a payout ratio that’s too low might indicate that the company is not making the best use of its earnings to reward shareholders. Conversely, a high payout ratio could signal that the company is returning a large portion of its earnings to shareholders, but it might also mean that the company has little left for reinvestment or that the dividends are not sustainable in the long run.

Dividend Yield

Dividend yield is another crucial metric for dividend investors. It is calculated by dividing the annual dividend payment by the stock’s current price. The result, expressed as a percentage, gives you an idea of the return you can expect from the dividend alone, not considering any potential capital appreciation.

For example, if a company pays an annual dividend of $1 per share and the stock’s current price is $20, the dividend yield would be 5%. This means that for every dollar you invest in the stock, you can expect to receive 5 cents in dividends.

While a high dividend yield can be attractive, it’s important to remember that it’s not the only factor to consider. A high yield could be a result of a falling stock price, which might indicate that the company is in trouble. Therefore, it’s essential to look at the dividend yield in conjunction with other financial metrics and the overall health of the company.

Dividend Growth Rate

The dividend growth rate is a measure of how much a company’s dividend payment has grown over a specific period. This is an important metric for dividend investors because it can indicate the company’s future growth potential.

Companies with a strong history of dividend growth are often well-managed, with stable earnings and good prospects for future growth. These companies are likely to continue increasing their dividends, providing an increasing income stream for investors.

The dividend growth rate can be calculated in different ways, but one common method is to look at the average percentage increase in dividends over a certain number of years. For example, if a company increased its dividend from $1.00 to $1.10 over a year, the dividend growth rate would be 10%.

Conclusion

In this second installment of our four-part blog series, we’ve delved deeper into the mechanics of dividend investing. We’ve explored the key components of this strategy, including the dividend payout ratio, dividend yield, and dividend growth rate. We’ve also discussed the appeal of dividend investing and how it differs from other investment strategies.

Dividend investing is a powerful strategy that can provide a steady income stream and potential capital appreciation. By understanding the key components of this strategy, you can make informed decisions about which dividend stocks to add to your portfolio.

In our next blog post, we will explore different dividend investing strategies, including the high dividend yield strategy and the dividend growth strategy. We’ll also discuss the potential risks of dividend investing and factors to consider when choosing dividend stocks.

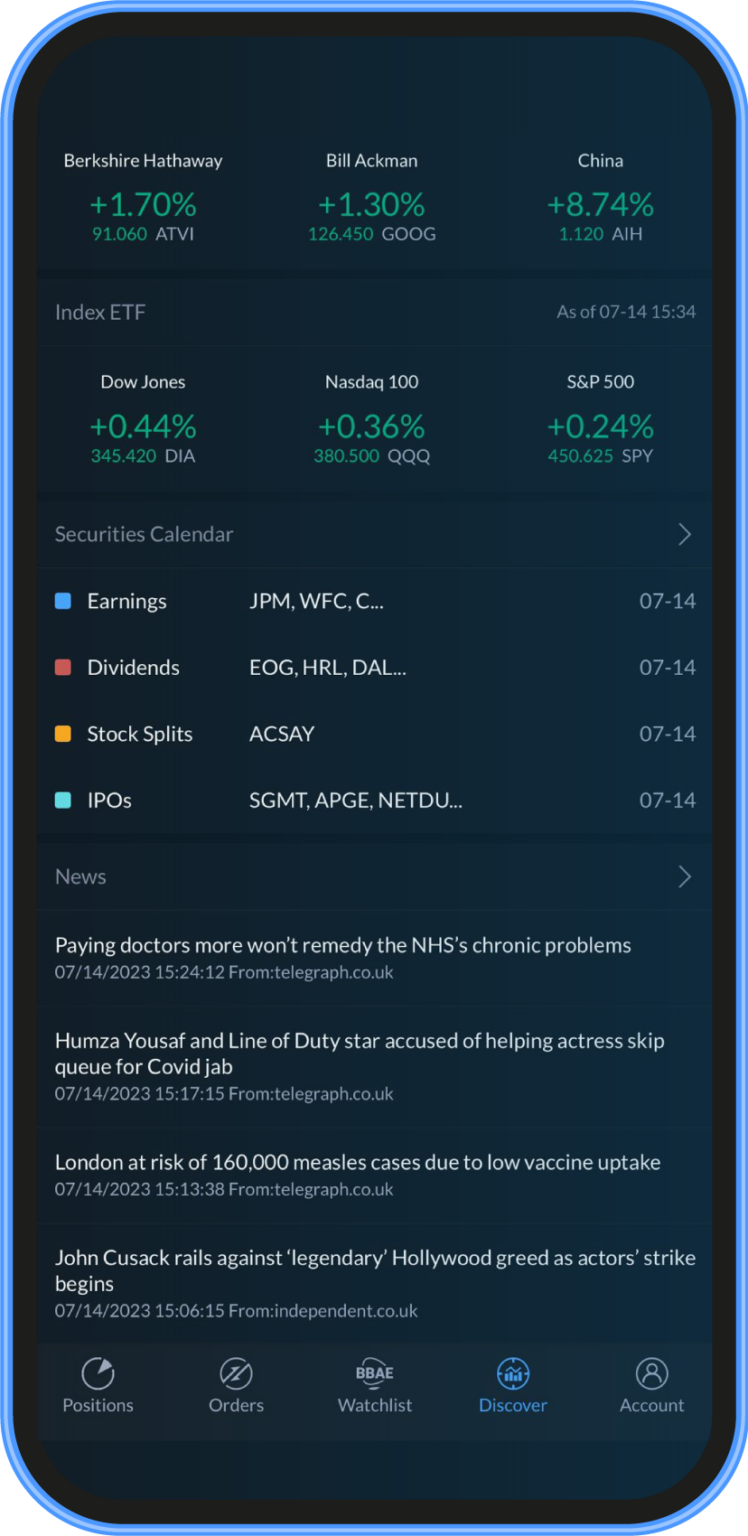

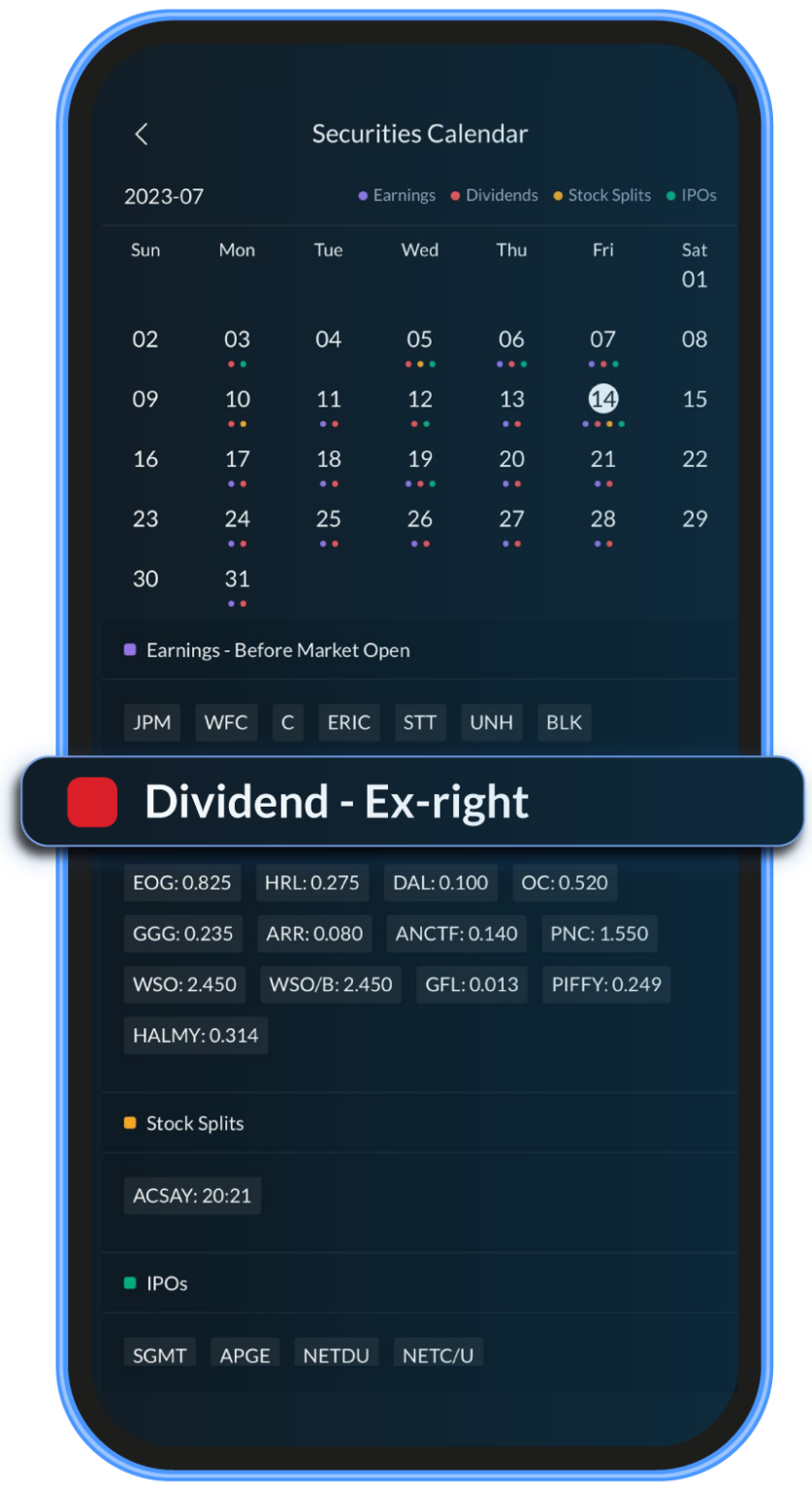

Download the BBAE MyMarket App now and start making smarter, more informed investing decisions.

Subscribe to BBAE’s Blog and stay ahead in the world of investing!

Whether you’re just starting out or looking to refine your strategy, this series will equip you with the knowledge and tools you need to succeed.

Stay tuned!