News Roundup: DOGE’s Difficulties, Beware Tiny Stocks, Congressional Supertraders, Penny Stocks

Stocks go up

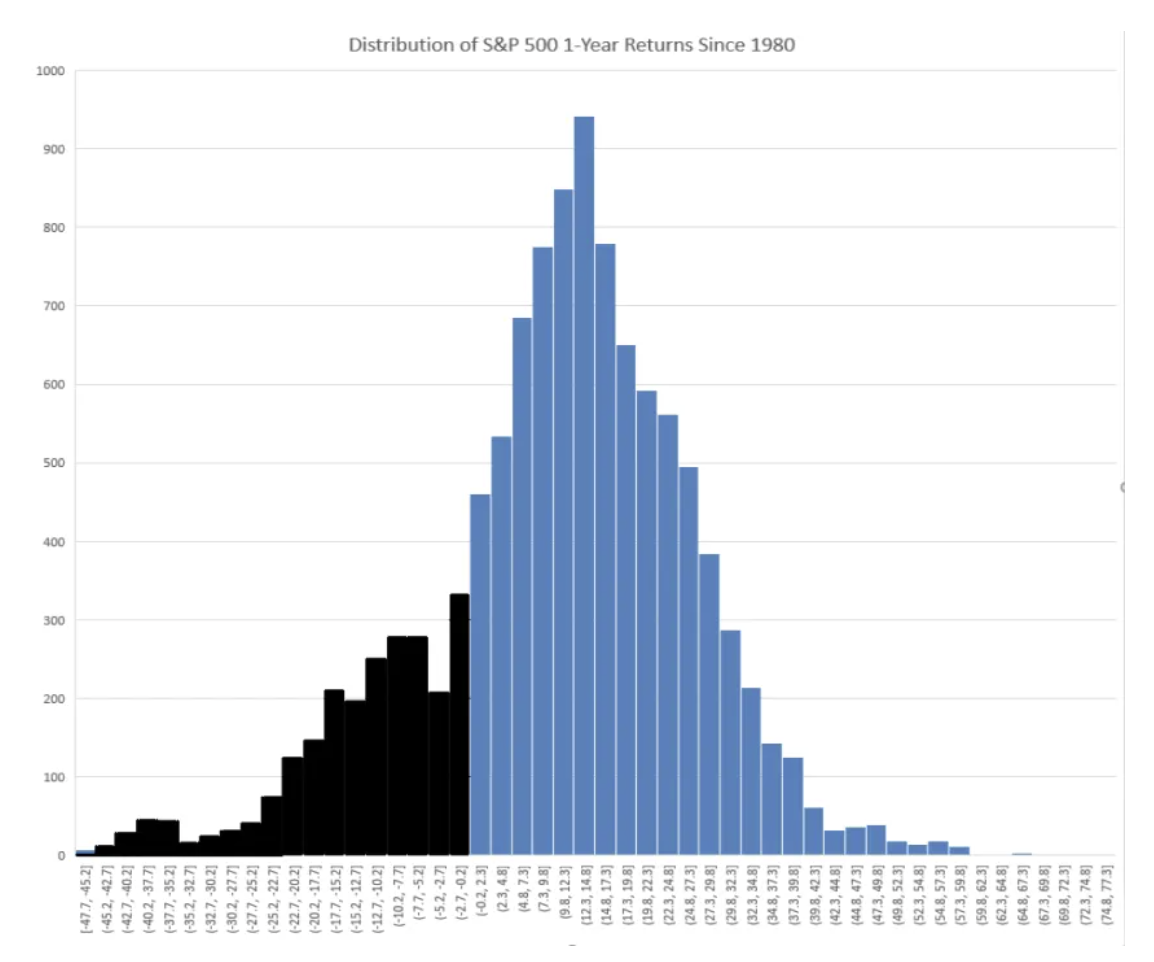

John Authers of Bloomberg has one of the simplest, yet one of the most important, visuals for US stock investors: the distribution of one-year returns from 1980. Blue means a positive return.

If we want to split hairs, we can say that this is just from 1980. But I’d imagine that we’d see a similar histogram with data extending back further. Stocks capture the long-term value addition of businesses to society, which tends to be positive. Long-term investing in the US stock market is, in my opinion, one of the biggest no-brainers in investing.

DOGE cuts coming – but from where?

Billionaires Elon Musk and Vivek Rashawarmsy are on a mission to cut costs from the US budget. Elon cut Twitter’s headcount by 75%, and the company didn’t implode, despite the doubters – including many ex-Twitter employees who were certain the company would fall apart.

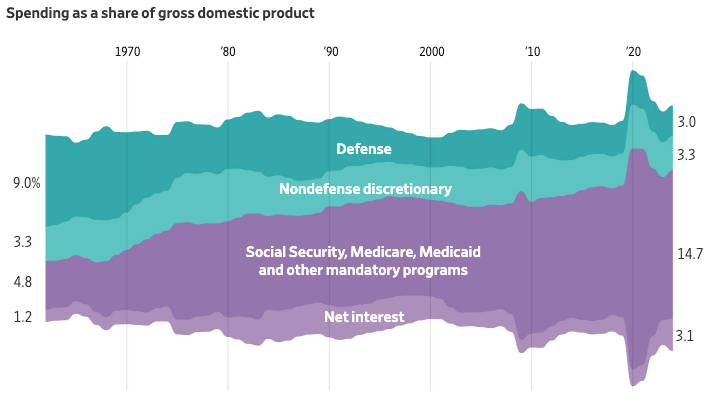

Can the US government survive similar treatment? The Wall Street Journal graphic below shows the proportion of US government spending compared to GDP.

It’s risen, but what’s glaring is the rise in entitlements, which are hard to cut because they represent payments to voters (many of whom are senior citizens represented by AARP, the most powerful lobbying group in the US). The Department of Governmental Efficiency is not a “real” agency in the sense of having executionary power – it can make recommendations to Congress – but assuming net interest and entitlements can’t be meaningfully cut, it basically means DOGE will need a Twitter-ish headcount reduction from both defense and civil service. And considering that defense is somewhat essential, DOGE’s cuts will likely come for really taking a hatchet to civil service.

Will Congress agree?

Stocks are mostly losers

I’ve mentioned Arizona State University professor Hank Bessembinder’s finding that over (roughly) the past 100 years, just 3.2% of US stocks have delivered all the returns; the rest just matched Treasuries. Roughly 40% of US stocks have gone to zero, and 60% have lost money for investors.

There are many rinky-dink stocks, and I’m guessing if we rule out micro caps, the ratios get a bit better, but the idea stands.

Now, those numbers are about equity returns, but equity returns move, roughly speaking, with corporate profitability. This makes sense because the economic purpose of a company is to charge more for a good or service than it costs to produce or provide; otherwise, the endeavor doesn’t make sense.

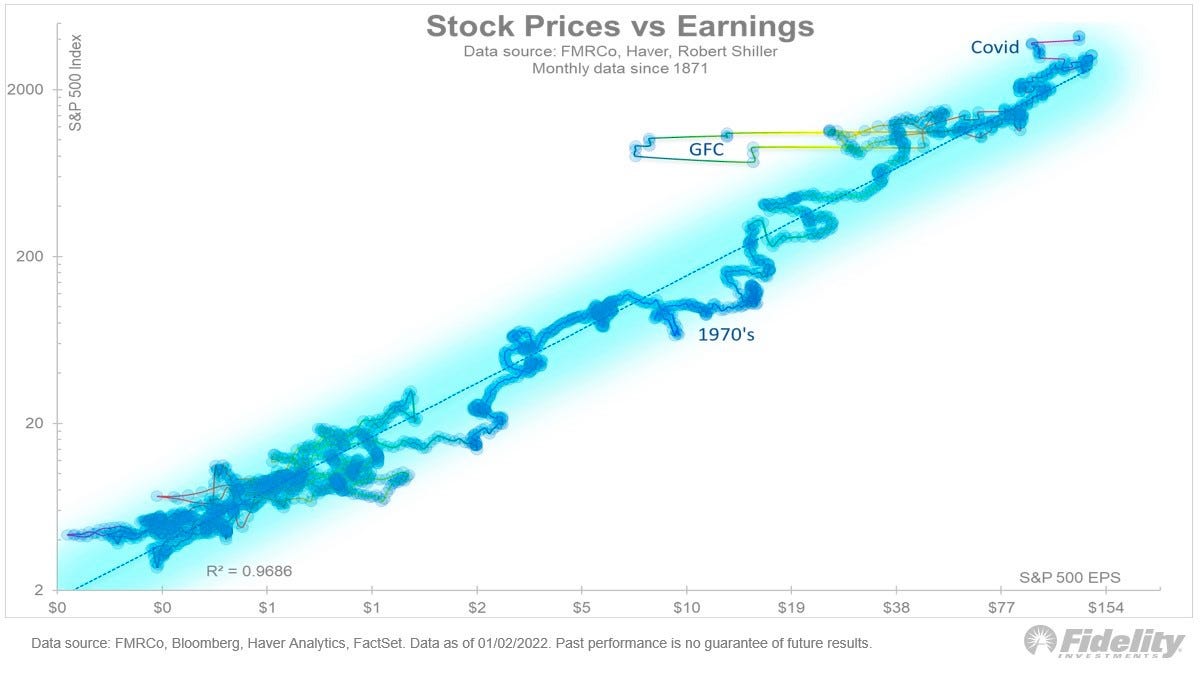

Sam Ro frequently cites this Fidelity graphic showing the general tethering of stock prices to earnings.

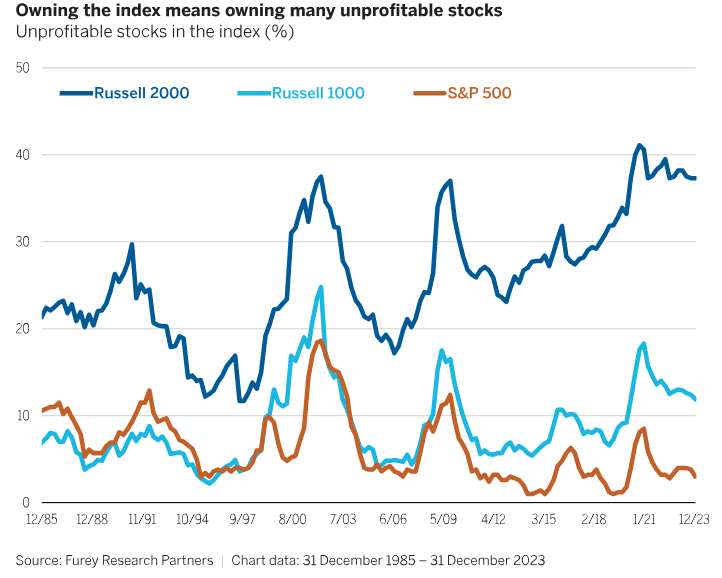

Anyway, you can see from Furey Partners data below that the smaller companies (represented by the Russell 2000) are much less profitable than their larger brethren.

Even the S&P 500 is predominantly a mid-cap index. So if you’re buying larger companies, you’re likely enjoying better odds.

Be careful buying penny stocks

But speaking of tiny, unprofitable companies…

Dr. Wes Gray of Alpha Architect is pretty awesome in my book. He’s been on the BBAE Podcast, and is humble to a fault, but a total butt-kicker in real life. One of his compatriots is Larry Swedroe, who recently wrote about the dangers of investing in “penny” stocks, which these days could be defined as stocks with share prices under $5, and generally with small market caps and low average daily trading volume.

Larry first reminds readers that investors exhibit an undue preference for “lottery-like” stocks – i.e., they pile into stocks that they perceive as having huge return potential, but failing to consider probabilities in the process. Spending $5 to buy a few lottery tickets that you know have just barely above no chance of winning is consumption. It’s not investing.

You could do the same thing by gambling, instead of investing, in the stock market. It’s not ideal, because mixing gambling money with investing money taints the investing money a bit because it adds volatility, and volatility reduces value.

Anyway, Larry mentioned a few studies (one here, and another; Larry’s piece has more) confirming that lottery-style thinking with stock investing is not a good idea.

From the abstract of the Georgetown paper: “Contrary to the theoretical principle that higher risk is compensated with higher expected return, the literature shows that low-risk stocks outperform high-risk stocks.” (Emphasis added.)

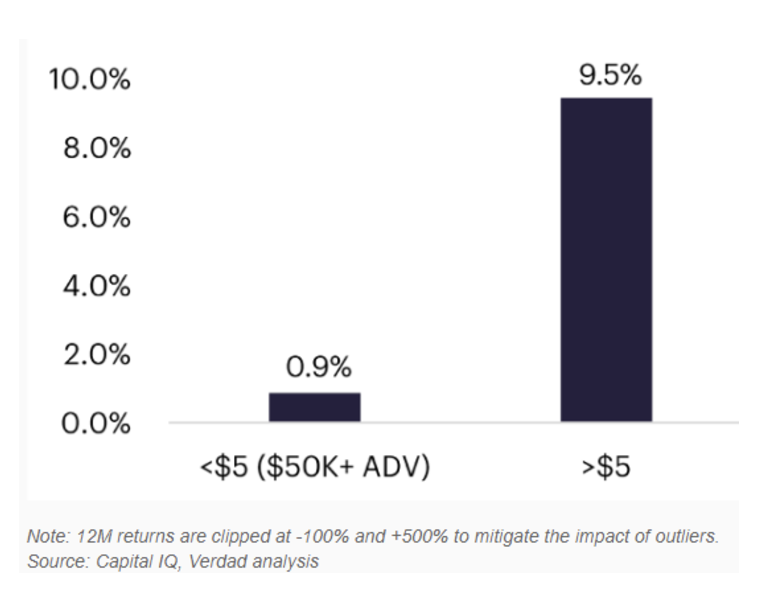

Investors looking for lottery-style returns in the stock market love penny stocks. Penny stock investors know that many penny stocks go to zero, while some take off. But mashing together the returns of the few big winners with the many losers, are the aggregate returns worth it? Another paper – Do Investors Overpay for Stocks with Lottery-Like Payoffs? An Examination of the Returns on OTC Stocks – says “no.”

Still not convinced? Larry points out that researchers at Verdad studied returns from 1996 to 2024 and – sorry, penny stockers – found that penny stocks massively underperformed non-penny stocks: 0.9% annualized versus 9.5% annualized. Worse, if the returns of the penny stocks gets weighted by market cap, the annualized number drops to -60%. Again, that’s negative 60%. Ouch.

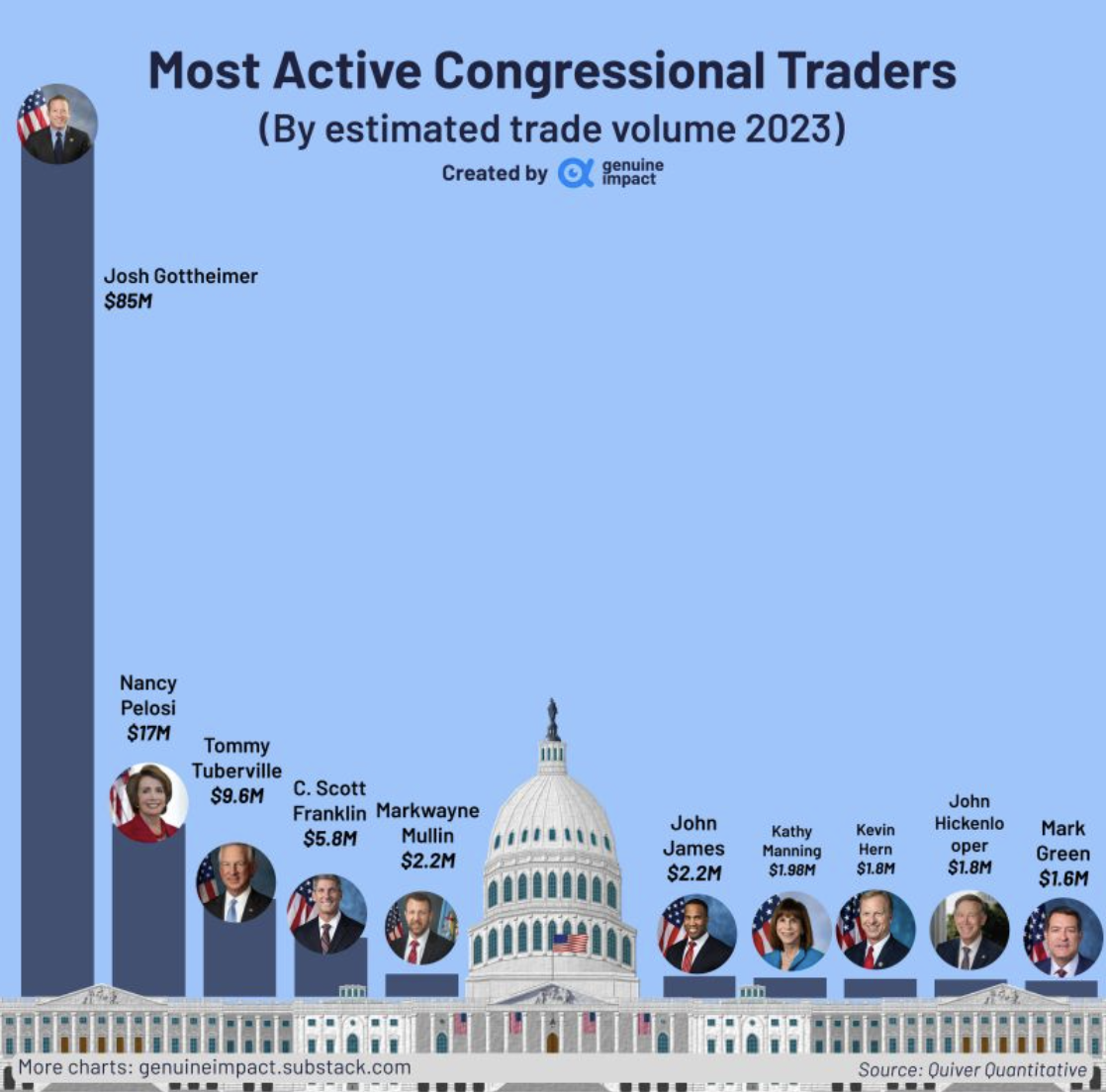

Who is Josh Gottheimer?

A dirty issue in US markets is Congressional trading. The average Democratic member of Congress gets 33% annualized returns, whereas the average Republican gets 18%. While the discrepancy itself is interesting, both numbers are far above both average investor returns and average US market returns.

Congressmen and Congresswomen don’t work for companies but they have the power to enact laws that will affect companies and, obviously, the knowledge of what’s either likely or potentially coming down the pike.

The challenge of getting Congress to pass a law stopping members of Congress from trading is that, well, members of Congress will have to pass the law.

For all the flak that Nancy Pelosi gets for her trading – including an ETF with an eponymous ticker called the Unusual Whales Democratic ETF (Nasdaq: $NANC) – Josh Gottheimer really takes the cake, as you can see from this Genuine Impact graphic.

Who is this broker’s dream?

Josh is a Democratic Representative from New Jersey; son of a preschool teacher and a small store owner. He’s a member of the House Financial Services Committee. His salary from the House is $174,000.

Josh started Congress in 2017 with a net worth of $5.6 million; much of this apparently came from Josh’s tenure at Microsoft, prior to politics. By 2022, thanks to lots of profitable and frequent trading, his net worth was $18.2 million. I don’t know what it is now – the $85 million in 2023 is a volume number – but if he’s trading $85 million a year, my rough guess is that it’s higher.

From a societal standpoint, there are only 535 members of Congress, and only a small portion appear to trade individual stocks with earnest; these folks scoring potentially unfair profits is the smaller issue; the much bigger one is whether their stock ownership may compromise their judgment, even subconsciously.

In the meantime, if Josh Gottheimer puts out an investment newsletter, there is a 100% chance I am buying it.

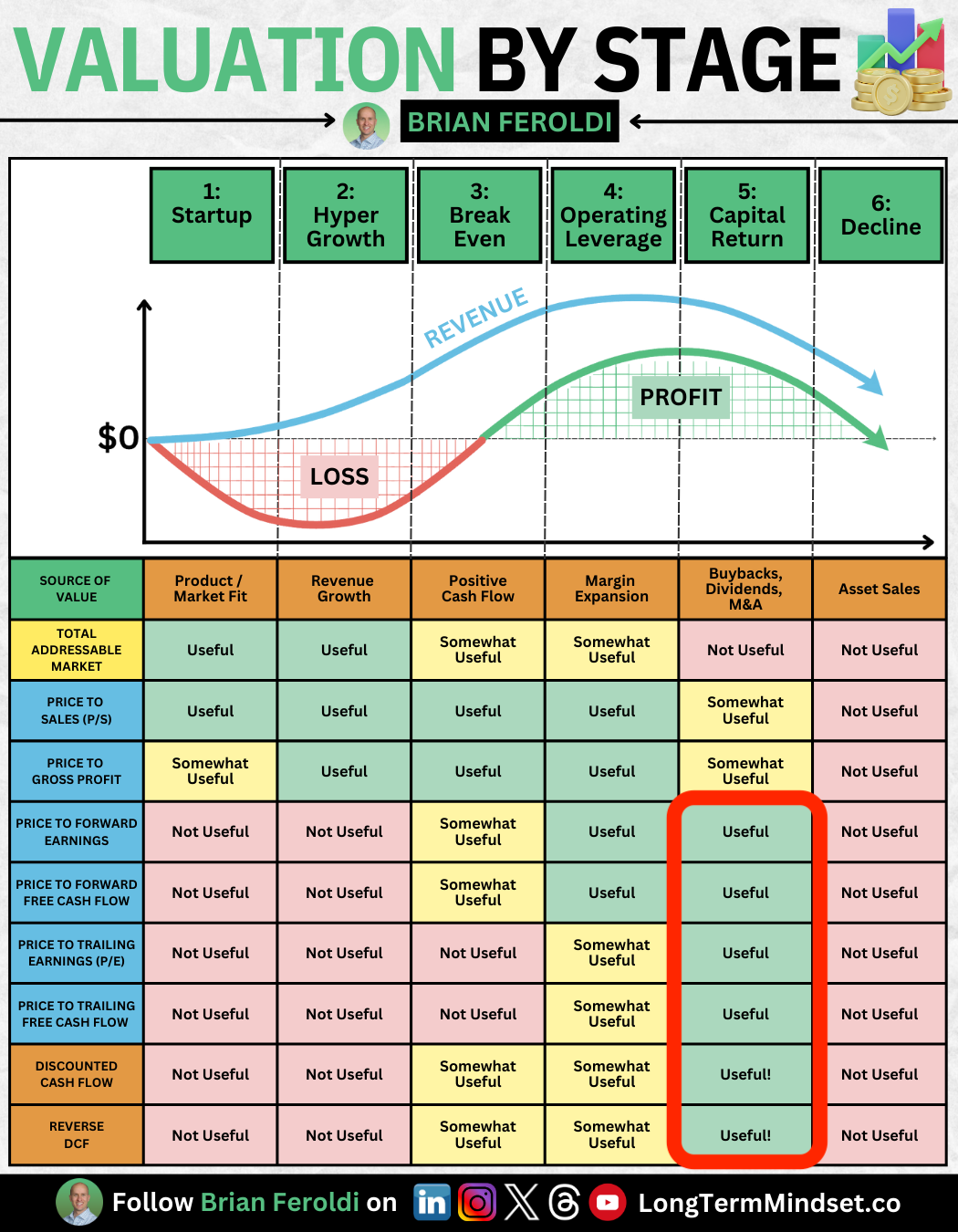

Valuation methods

If you do not do your own valuation, and have no interest in ever doing your own valuation, the below will be 100% irrelevant. But if you have any interest, Brian Feroldi, friend of BBAE, has assembled an infographic that explains which valuation methods best fit which stage in a company’s lifecycle.

This type of thinking is good, because traditionally, growth investors and value investors do a lot of talking over each other. It’s true that P/S is a “junk” metric for embedding quite little information – I’ve said this myself – but it’s relatively more excusable earlier in companies’ lifecycles (or in certain situations where accounting standards really mar statements’ ability to present an accurate picture).

I’m still less bullish on P/S than Brian’s chart is – I’m loath to call it “useful” – but the spirit of what he’s going after is incredibly well-targeted.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.