1. You don’t know when the market will go up.

The phrase “Timing is everything” – penned by William Shakespeare – applies to investing, but in a counterintuitive way.

The way it does not apply, at least according to research, is to time the market. Buying low and selling high makes intuitive sense as a thing you’d want to do, but – in the same way you’d want to win the lottery or want to hit a hole in one – it’s almost impossible to actually do.

“Time in the market beats timing the market”

-Ken Fisher

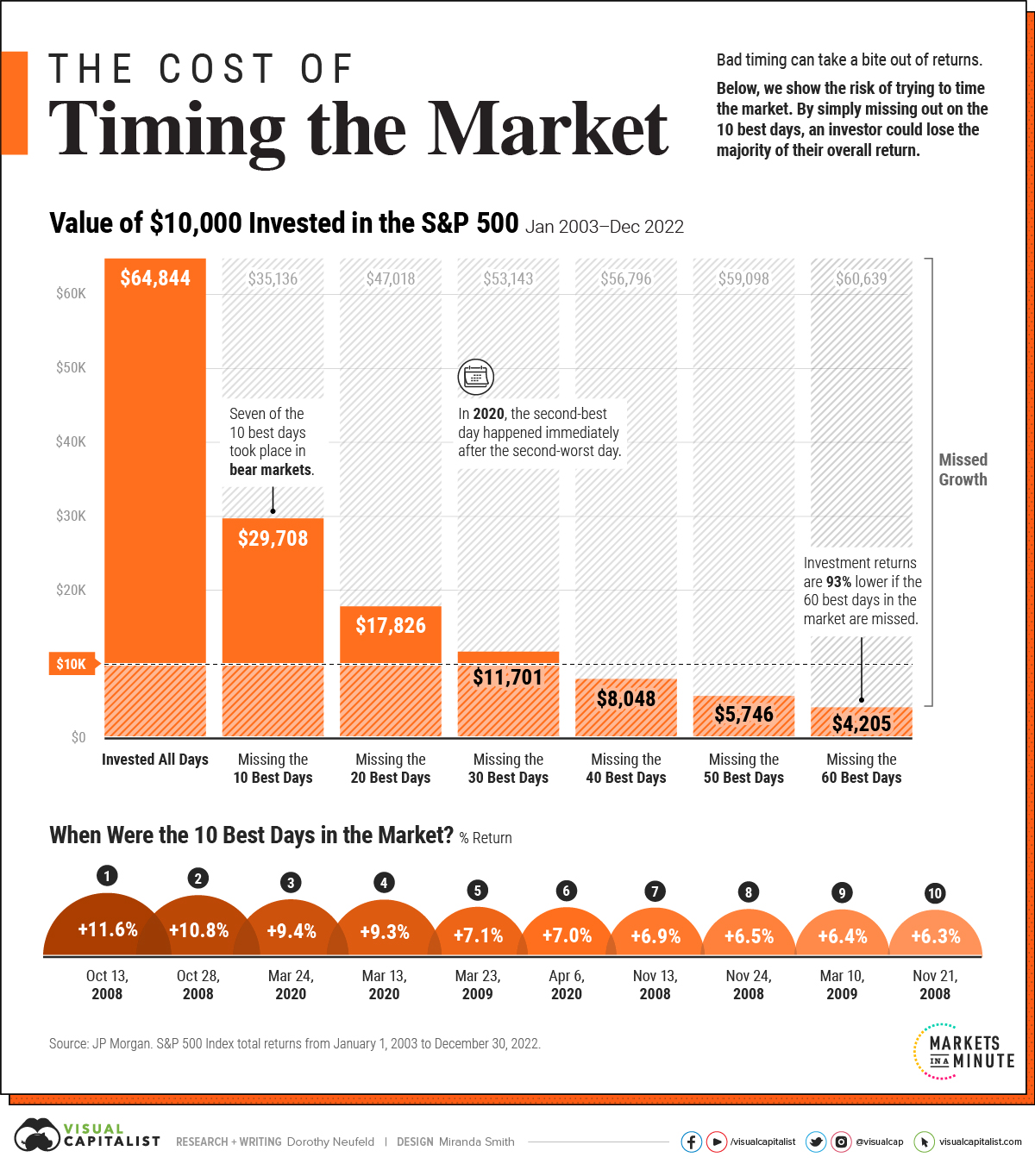

Ken’s right. As the below infographic from Visual Capitalist shows, even missing the best 10 trading days out of 20 years cuts your returns by nearly 55%. That’s right: for every $100 a fully invested investor ended up with, you’d have just $45.

Let’s slow down to take that in. Each year has about 252 trading days, so 20 years will have 5,040 of them.

Ten out of 5,040 is 0.0019, or 0.19% – less than a fifth of a single percentage point. You’d never notice if you were 0.19% taller, or if you become 0.19% more attractive to the opposite sex, or if a recipe had 0.19% more salt than normal. But in stock investing, 0.19% is enough to chop your returns by more than half.

Missing the best 60 days – slightly less than 1.2% of trading days – would have made your returns 93% lower than those of someone fully invested.

Almost everyone (myself included) thinks of the market in terms of trends. But this data shows that a better analogy may be a soccer game: goals determine the outcome, but as a fraction of game time, goal-scoring plays barely register.

Soccer is not a perfect analogy, as there’s no compounding, but imagine planning to turn on the TV “just to see the goals.” You couldn’t. You might get lucky sometimes, but the only way to see all the goals is to watch all the game.

Same in investing.

By the way, if you really want to time something that data indicates may be persistent, take a look at after-hours vs. market hours returns in an S&P 500 ETF, as noted by Bespoke Investment Group. (Similar data from Bespoke here, too.)

| Strategy | Return (1993-2018) |

| Buy and hold index ETF | 541% |

| Buy at close price, sell at open price daily | 571% |

| Buy at open price, sell at close price daily | -4.4% |

The worst thing for trading appears to be… trading.

2. You don’t know when the market will go down

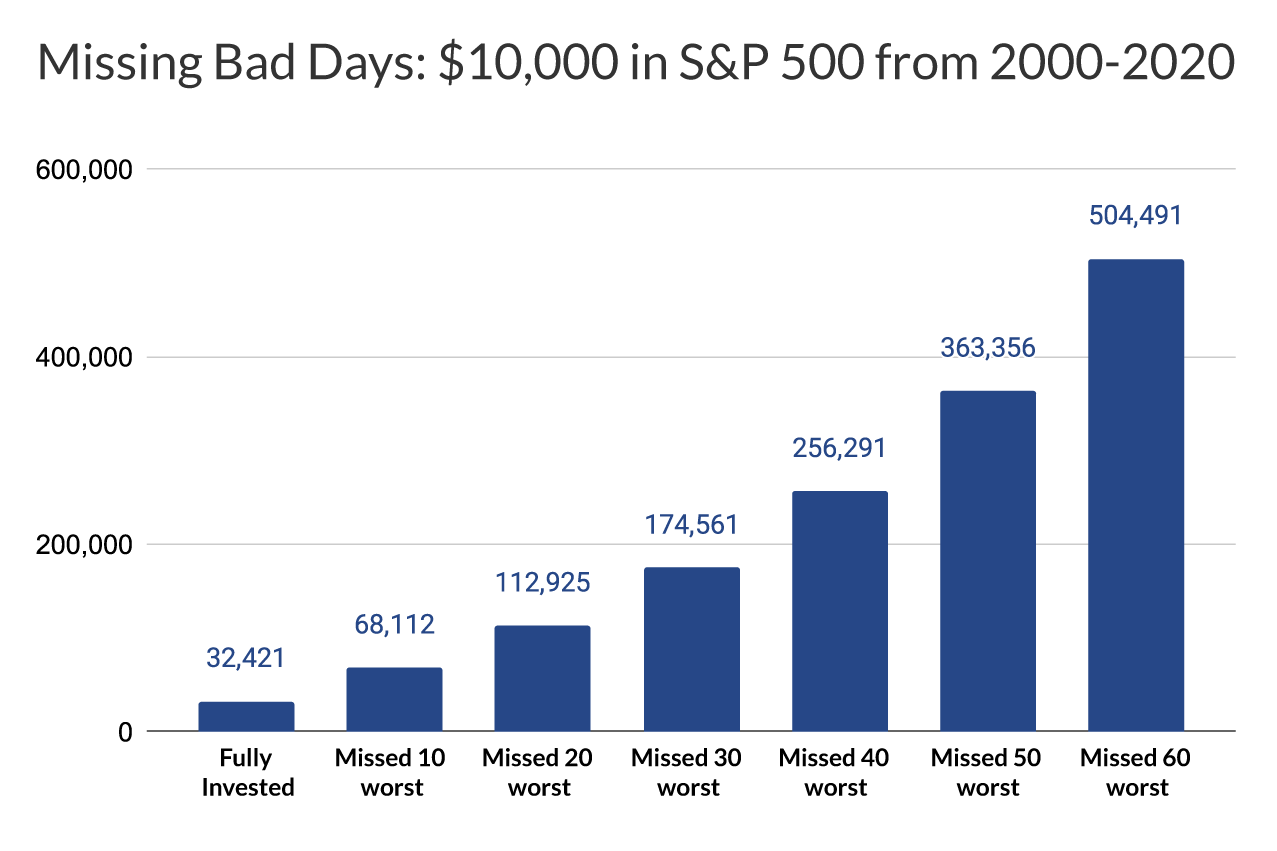

While the Visual Capitalist graph above makes you feel like an idiot for even thinking of not being fully invested all the time, a graph showing the “rewards” of missing the worst trading days is basically a mirror image:

The time periods are overlapping, but not quite the same (the “worst days” sample period includes the dot.com crash). Being a good sport and staying parked in the S&P would have turned $10,000 into $32,421. Missing the worst 60 days would get you $504,491.

(Interestingly, missing the best 60 days would leave you with about 7% of what you’d have if you’d been fully invested, whereas staying invested also leaves you with about 7% of what you’d have had you missed the worst 60 days.)

No magic. Just math.

And both graphs exaggerate real life: real people attempting to time the market – for either purpose – will invariably catch both abnormally good and abnormally bad days in their nets.

I’ll admit: it’s incredibly frustrating to think that if I somehow sidestep the worst 1.9% of trading days, I could have $500,000 instead of $30,000, but the relevant point is that… I can’t.

I can, however – and very easily – park my money in the market and let it sit there, ensuring that I capture the best 1.9% of trading days (I just have to endure the worst days, too).

3. Compounding is a magic show over the long run.

And your ticket to that show is simply getting invested.

I perpetually steal the example given by my first finance professor:

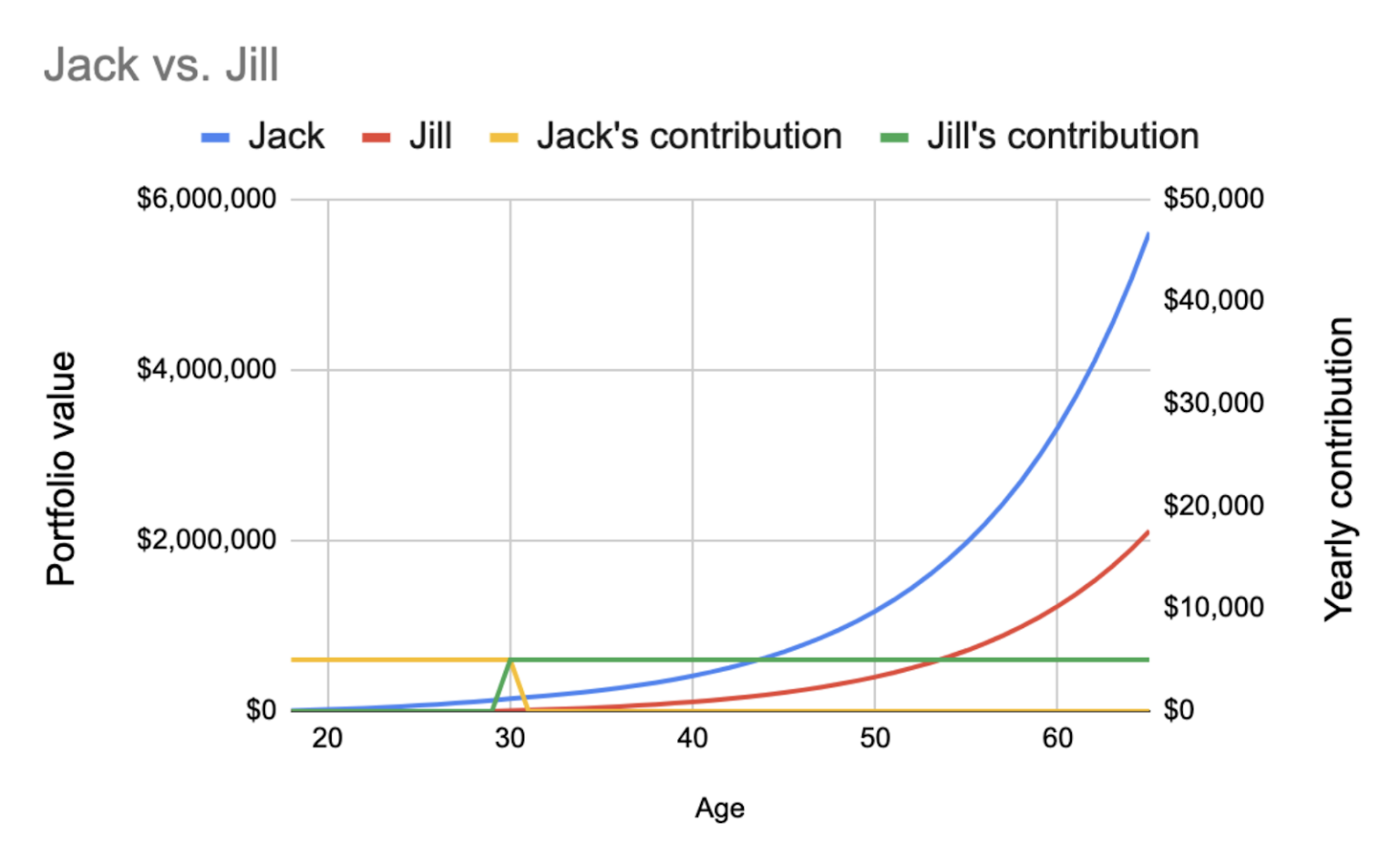

Jack and Jill are twins. Jack starts working out of high school at age 18 as a mechanic and saves $5,000 every year until he’s 30. Then he stops.

Jill finishes medical school at age 30, and saves $5,000 per year until she’s 65.

Let’s be slightly generous and assume their investments earn them 11% per year.

By the time the twins retire at 65, Jill will have $2.1 million. Jack will have $5.6 million.

Let’s recap:

- You can’t know when the best trading days are coming, so just stay in the market.

- You can’t know when the worst trading days are coming, so just stay in the market.

- Compounding is awesome and the sooner you start, the better, so just get in the market.

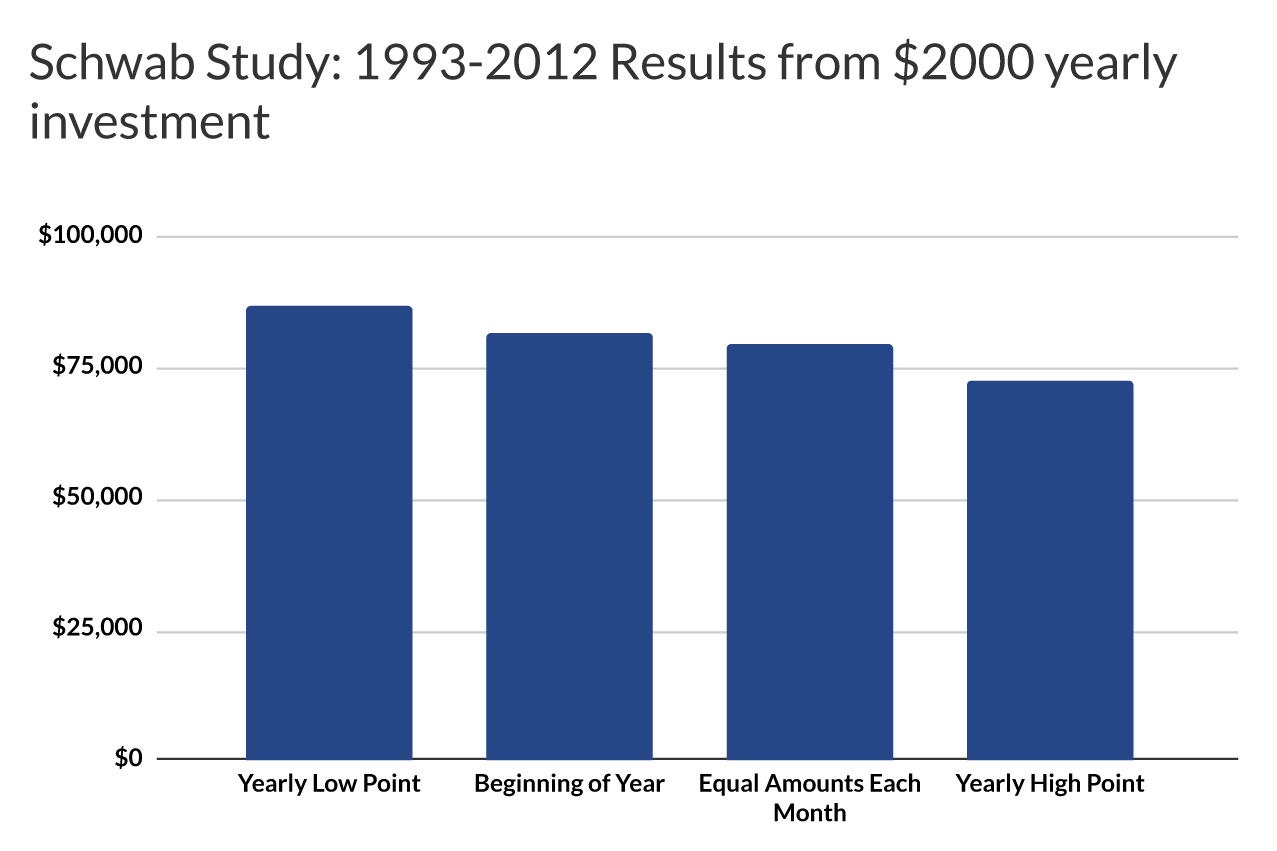

Even the timing of your yearly contributions doesn’t make a big difference, according to a Charles Schwab study:

4. Buying and holding good businesses fuels capitalism.

Many readers won’t care about this. But if you want to do something good for society, now’s your chance.

There’s an argument that business is the primary accelerant of human progress – at least progress in standard of living. And mundane as it sounds, securitization – the idea of chopping up companies into tradeable little pieces so that investors don’t have to be super rich to buy and sell them – may be one of mankind’s highest-impact innovations.

Securitization massively expanded the roster of who could invest in companies. But it came with a side effect: inviting non-long-term owners into markets.

Barely noticeable at first, frequent trading by folks with no care for the long-term well-being of the companies they invest in has grown into a perversion of grand proportions. The quick traders will say they offer liquidity to markets. Which they do. But the value-reducing volatility they introduce likely makes them a net negative to market valuations.

Anyway, when you invest – in a long-term way that aims to both fuel and capitalize on commerce’s ability to add value to humanity – you fuel a virtuous societal circle.

5. BBAE will give you up to $400 for opening an account.

I don’t mean to sidetrack this article, but I’m also speaking the truth: BBAE will match a portion of your initial deposit to make it that much easier to get into the market. This bonus is automatic for all new users, so go ahead and download the app or check out our offer here.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.