Building on our previous discussion about the revolutionary capabilities of BBAE’s MyMarket, we are now turning our attention to one of the most popular options strategies used by investors – Covered Options.

Understanding Covered Calls

A covered call is an options strategy where the investor sells, or “writes”, call options against shares of stock they already own. This strategy is typically employed to generate additional income from a stock portfolio.

How It Works

Let’s break it down step by step:

- Owning the Stock: To initiate a covered call, you must own the underlying stock. This is why it’s called “covered” – because you have the stock to cover the obligation if the call option is exercised.

- Selling the Call: Once you own the stock, you can then sell call options on it. When you sell a call option, you grant the buyer the right, but not the obligation, to purchase your stock at a predetermined price (strike price) within a certain timeframe.

- Collecting the Premium: As a seller of the call option, you receive a premium – this is the price the option buyer pays you for the right to potentially buy your stock later.

Advantages of Covered Calls

- Income Generation: Selling call options can provide additional income. This income is pocketed regardless of whether the option is exercised.

- Downside Protection: The premium received can also offer a small buffer against potential declines in the stock price.

Understanding Covered Puts

A covered put is an options strategy where an investor sells, or “writes”, put options while shorting the corresponding amount of the underlying stock. This strategy is typically employed to generate income from a bearish outlook on a stock or to protect a short position.

How It Works

Here’s a step-by-step breakdown:

- Shorting the Stock: To initiate a covered put, you must first short-sell the underlying stock. This is why it’s called “covered” – because you have the short position to cover the obligation if the put option is exercised.

- Selling the Put: Once you have shorted the stock, you can then sell put options on it. When you sell a put option, you grant the buyer the right, but not the obligation, to sell you the stock at a predetermined price (strike price) within a certain timeframe.

- Collecting the Premium: As with covered calls, selling the put option earns you a premium, which you receive upfront.

Advantages of Covered Puts

- Income Generation: By selling put options, you can generate additional income, which you retain regardless of whether the option is exercised.

- Profit from Bearish Outlook: If you believe that a stock’s price will decline, covered puts allow you to profit from this outlook while also earning a premium.

- Protection for Short Positions: The premium received can offer a buffer against potential rises in the stock price to some extent.

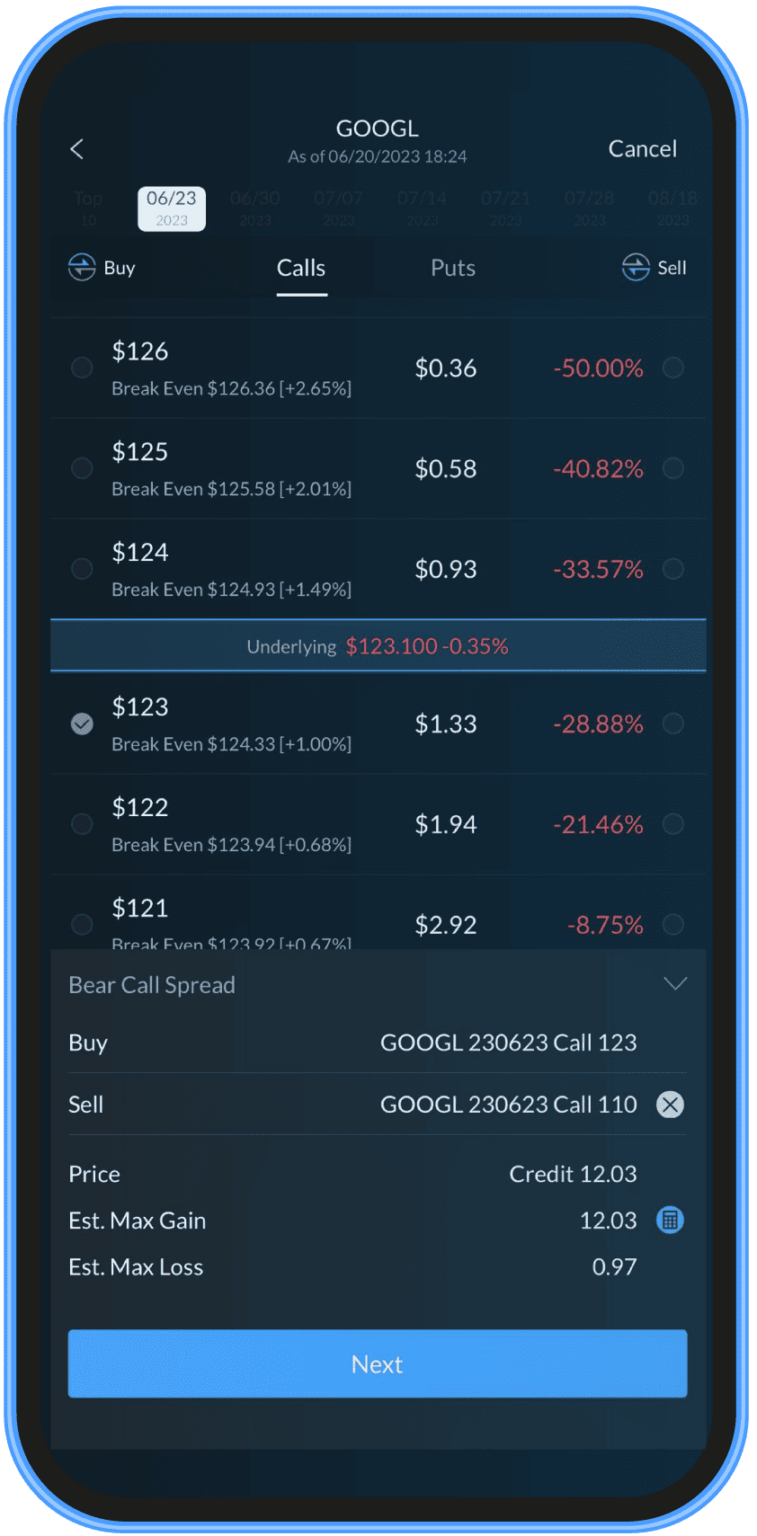

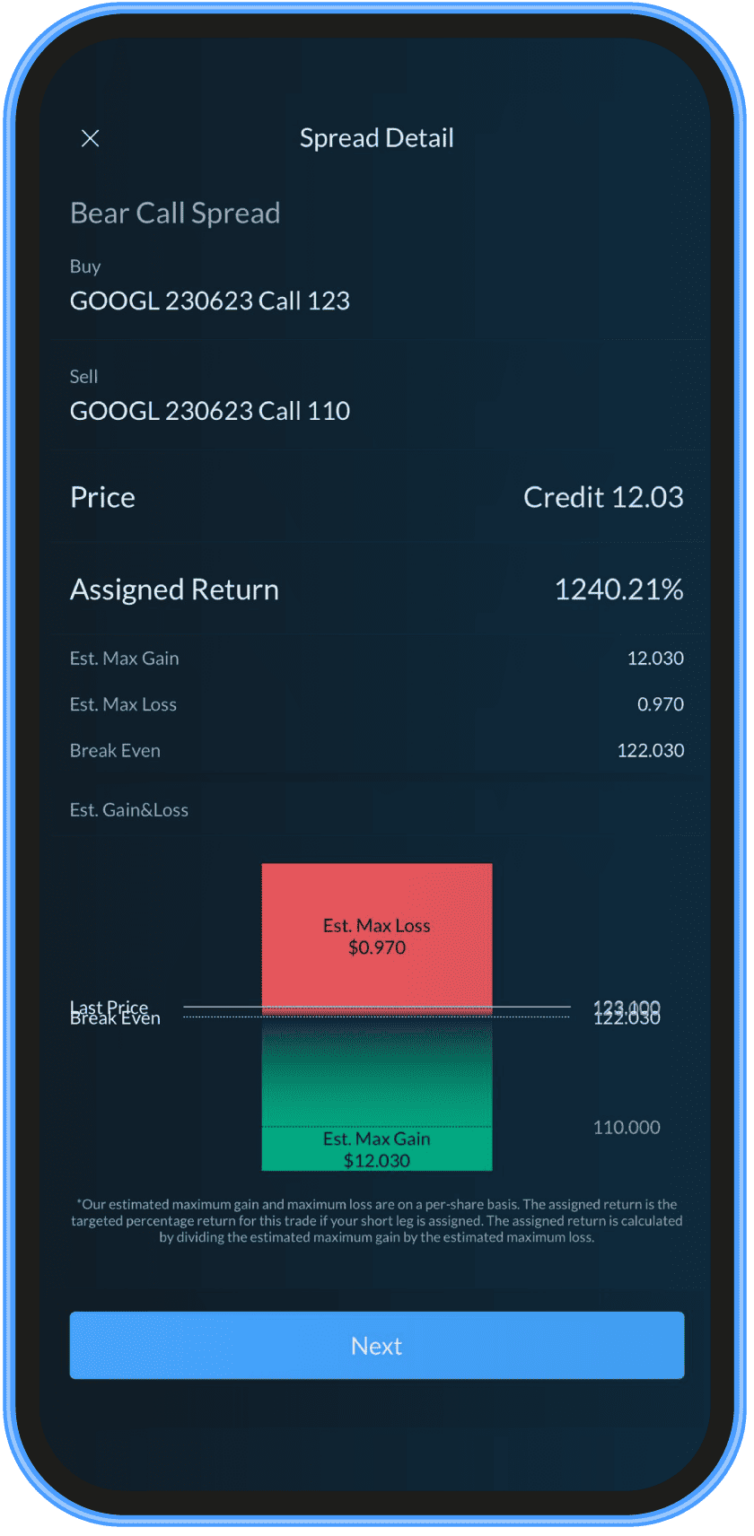

BBAE’s MyMarket and Covered Options

With the arbitrage-free theoretical pricing tool provided by BBAE’s MyMarket, determining the fair value of options to sell becomes a straightforward process. The tool’s real-time updates and computation of the Greeks can also help you decide on the optimal strike price and expiration date for the options you wish to sell.

Points to Remember – Covered Calls

- Limited Upside: When you sell a covered call, your profit potential is capped. If the stock’s price soars above the call’s strike price, you might have to sell your stock for less than its current market value.

- Obligation to Sell: If the stock’s price is above the call’s strike price at expiration, the call buyer might exercise their option. This would require you to sell your stock at the strike price.

- Not Full Downside Protection: While the premium can offer some protection against stock price declines, it won’t shield you from significant drops.

Points to Remember – Covered Puts

- Limited Downside: Just as covered calls cap your upside, with covered puts, your potential profit is limited to the difference between the stock’s initial price and the strike price, minus the premium.

- Obligation to Buy: If the stock’s price is below the put’s strike price at expiration, the put buyer might exercise their option, compelling you to buy the stock at the strike price.

- Risk of Significant Upswing: If the stock’s price rises substantially, your losses can be significant, as they are theoretically unlimited on a short sale.

Conclusion: Enhancing Portfolio Returns with Covered Options

Covered Calls can be an effective tool for generating additional income from a stock portfolio. Covered Puts provide a mechanism for investors to capitalize on bearish outlooks and protect short positions. However, like all investment strategies, it’s essential to understand the risks involved. BBAE’s MyMarket, with its cutting-edge technology, can be a valuable companion in this journey, ensuring that you make well-informed decisions and optimize returns.

Disclaimer: Nothing herein constitutes investment advice or a solicitation to buy or sell any security. All strategies and investments come with risk, and potential investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Remember, while covered options offer an opportunity to enhance returns, they also come with specific risks. Always ensure that you’re comfortable with these risks before employing this strategy.

Next up in our series, we’ll delve deeper into other advanced options strategies to further optimize portfolio performance. Stay tuned!