Spoiler alert: I wrote a recent article for Forbes about investing in a high interest rate environment. You can read it here (and remember, if you haven’t already, please take a moment to subscribe to this blog and/or follow BBAE on Forbes – just click on the button next to the title on Forbes).

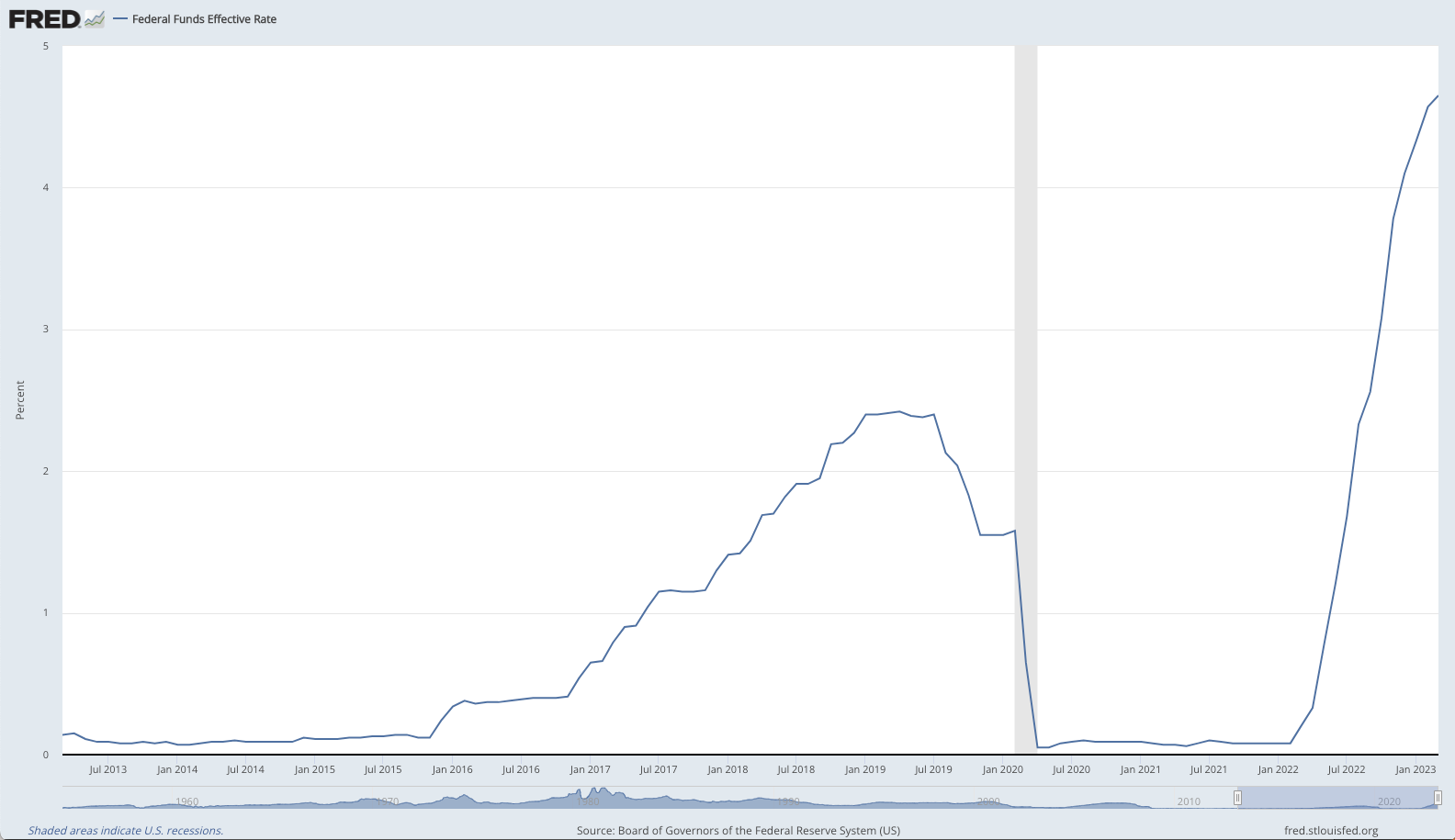

But the punchline wasn’t really about investing in high rates. I mean, it was in a way – I showed how Fed Funds have risen:

And then I talked about how prices of old bonds get killed when new bonds pay more – and vice versa (the US has had roughly a 40-year run of old bonds benefitting from this phenomenon):

But there was more.

Stocks are a different beast. Generally, over a period of time, they mostly get dinged by higher rates, as some academic evidence I cite shows.

But the near-term results are a mixed bag. This may be because the market has already anticipated rising rates, because the rising rates come when economies are hot, and that hotness trumps the rate-hike effect, because the Fed Funds rate (the rate that’s actually hiked) doesn’t map to other rates as tightly as expected sometimes, or for some other reason.

Anyway, I walked through the conventional wisdom regarding “good” and “bad” sectors during rising rates.

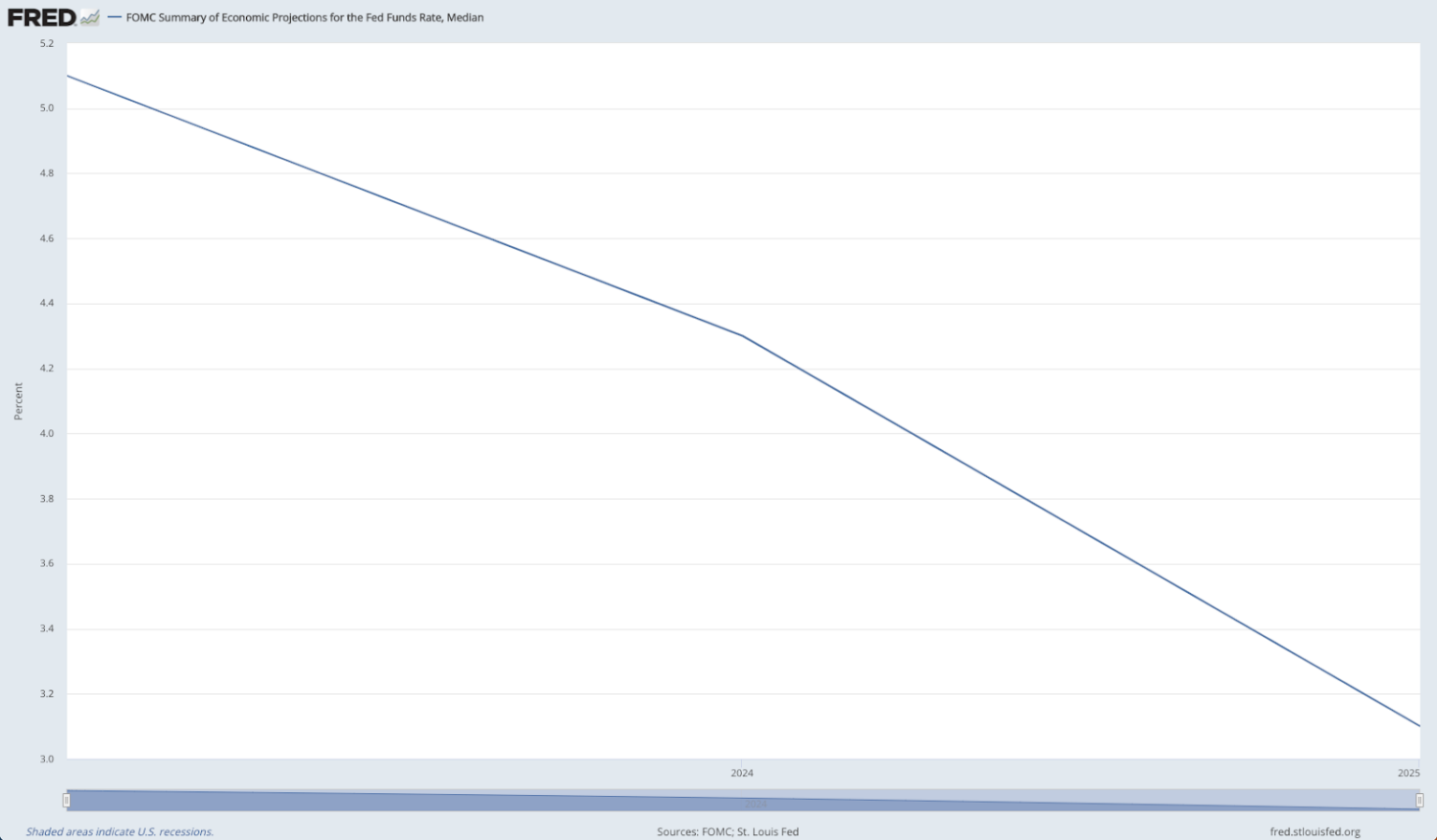

But the real question is this: Should investors be readying for rising rates now, now that Fed Funds may have peaked, or should they be looking to the FOMC’s own Fed Funds forecast – which anticipates declining rates starting next year – and be preparing to invest in a falling interest rate environment, versus a just plain “high” one?

James

p.s. Whether you’re investing for high rates, falling rates – or if you don’t even care about interest rates when you invest – we’re confident that you’ll find BBAE’s butter-smooth app (did I mention it was smooth as butter?), helpful-but-not-cluttered tools and resources, and commission-free trading a true asset. Click here to explore an account.