InsiderEdge™️ Highlights: August 2024’s Top Insider Trades

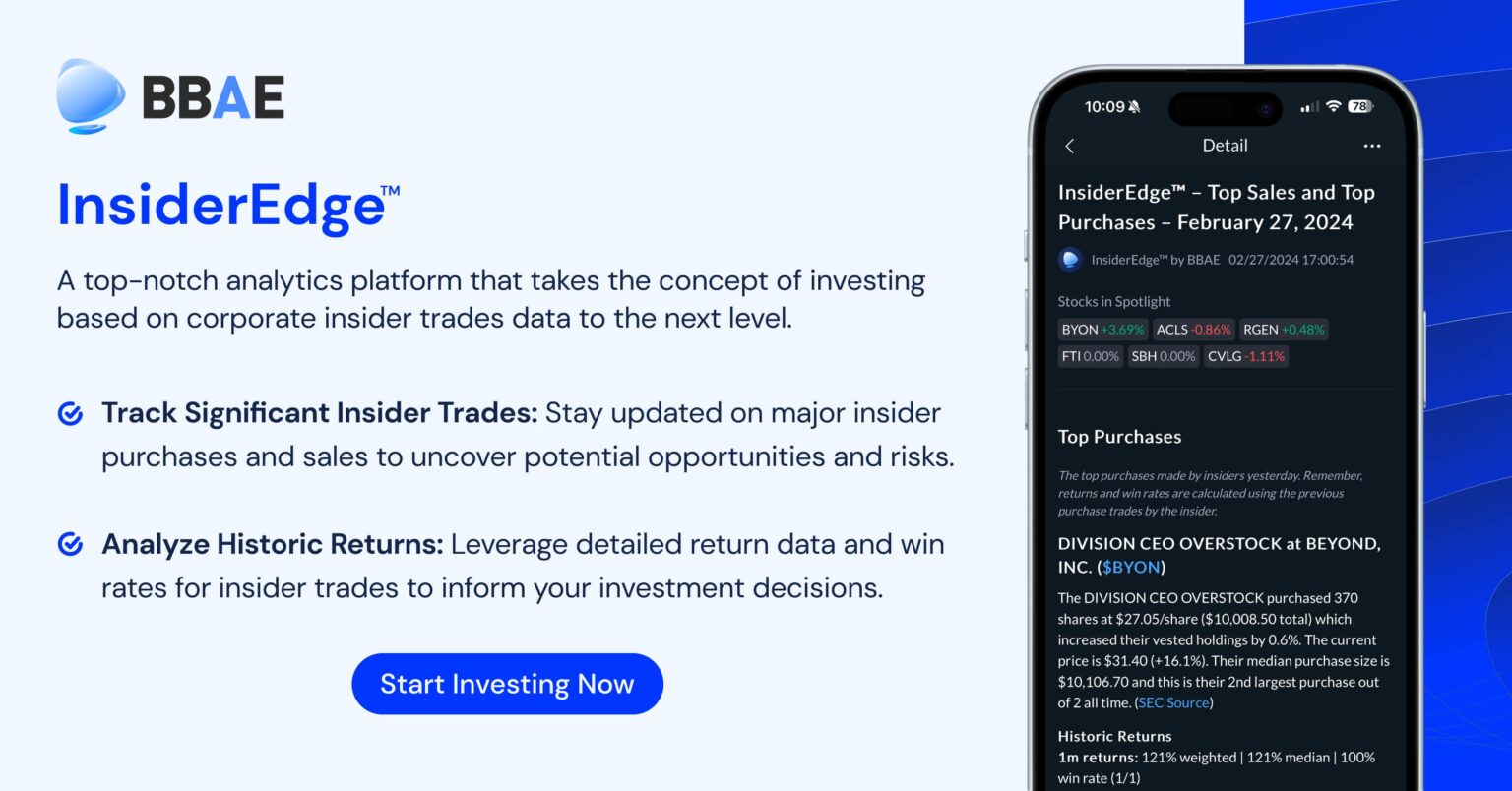

Throughout August, InsiderEdge™️ by BBAE, our premier analytics tool for corporate insider trading, diligently analyzed the month’s SEC reporting data to bring you the highlights of corporate insider trading activity. As always, these are published daily within the BBAE app. With its AI-driven capabilities, InsiderEdge™️ deciphers complex signals from the corporate insider trading world, translating SEC filings into a curated list of top investing signals. These insights offer a window into the confidence levels of those who know their companies best—corporate insiders.

August has proven to be another significant month for InsiderEdge. Let’s dive into the highlights.

Telos Corp ($TLS)

- Trade Spotlight: On August 15th, a Director purchased 1,000 shares at $2.42/share, investing a total of $2,420. This acquisition increased their vested holdings by 0.7%.

- Stock Price Activity: The stock price surged to $3.38, marking an impressive 53.64% rise since the publication of the InsiderEdge report.

- Implications of the Trade: The insider shows strong performance across various time frames, with win rates of 60% for 1-month and 3-month periods, 75% for 6 months, and 100% for 1 year. This was their 6th largest purchase out of 6 all-time trades. Notably, 3 other insiders also purchased stock, indicating collective confidence.

Heritage Insurance Holdings, Inc. ($HRTG)

- Trade Spotlight: On August 13th, the Chief Executive Officer acquired 5,000 shares at $8.59/share, investing $42,950. This buy increased their vested holdings by 0.5%.

- Stock Price Activity: The stock appreciated to $16.27, a 51.21% gain since the InsiderEdge signal.

- Implications of the Trade: The insider has shown consistent performance over time, with impressive win rates: 86% over 1 month, 73% over 3 months, 81% over 6 months, and 75% over 1 year. This was their 4th largest purchase out of 23 all-time trades, signaling strong confidence.

Trinseo PLC ($TSE)

- Trade Spotlight: On August 15th, the CEO AND PRESIDENT purchased 40,000 shares at $2.57/share, investing $103K. This acquisition increased their vested holdings by 9.5%.

- Stock Price Activity: The stock climbed to $3.59, representing a 32.96% gain from the InsiderEdge report price.

- Implications of the Trade: The insider boasts a perfect 100% win rate across 1-month, 3-month, and 6-month periods, with a 67% win rate over 1 year. This was their 4th largest purchase out of 5 all-time trades. Two other insiders also purchased stock, further bolstering confidence.

- Leslie’s, Inc. ($LESL)

- Trade Spotlight: On August 30th, the Interim CEO acquired 120,000 shares at $2.53/share, investing $304K. This purchase increased their vested holdings by 135.3%.

- Stock Price Activity: The stock rose to $3.25, a solid 30.00% increase from the InsiderEdge report price.

- Implications of the Trade: The insider shows a perfect 100% win rate across all time periods, with impressive returns ranging from 15% over 1 month to 219% over 1 year. This was their largest purchase out of 2 all-time trades, and another insider also bought shares, indicating strong collective confidence.

- Source

FIDELITY D & D BANCORP INC ($FDBC)

- Trade Spotlight: On August 8th, a Director purchased 5,000 shares at $42.95/share, investing $215K. This buy increased their vested holdings by 3.3%.

- Stock Price Activity: The stock price remained at $42.95, showing a 20.54% gain since the InsiderEdge signal.

- Implications of the Trade: The insider demonstrates strong long-term performance, with a 100% win rate over 3 months, 6 months, and 1 year. This was their 2nd largest purchase out of 6 all-time trades, signaling confidence in the company’s future.

Deciphering The Signals

Looking at insider trades can give investors potential insights into a company’s future. An insider buying stock suggests they believe the stock will rise, indicating potential growth or undervaluation. However, it’s crucial to understand that insider trading is just one piece of the puzzle. Investors should always look at the bigger picture, including market conditions, company performance, industry health, and economic indicators, before making investment decisions.

InsiderEdge™️ serves as a valuable tool for investors who wish to incorporate insider trading data into their analysis. By spotlighting significant insider trades, it enables investors to potentially align their strategies with those who have the deepest insights into their companies — the corporate insiders.

Disclaimer: The content provided by InsiderEdge™ is for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. The historical performance noted in this post is not indicative of future results. Investing involves risk, including the potential loss of principal. Use the platform at your own risk and consult a financial advisor before making any investment decisions. In partnership with Yellowbrick Investing Inc.