The IPO Market: The 2023 Story and 2024 Expectations

2021 was a record year for U.S. IPOs, with over 1,000 companies going public, including SPACs. However, in 2022, the U.S. IPO market experienced a significant slowdown due to various challenging market conditions, such as high inflation, rising interest rates, and geopolitical instability. This downtrend continued into 2023, which saw only a handful of notable IPOs. In this piece, I will delve into the performance of the 2023 IPO market and explore the prospects for 2024.

The US IPO Landscape in 2023

In 2023, 124 companies went public via the traditional IPO route (excluding SPACs). The year started slowly, but the second half saw a surge in notable IPOs. ARM, a British semiconductor company, made its public debut in September, becoming the year’s largest IPO. Arm successfully raised $4.9 billion U.S. dollars and soared nearly 25% in its market debut, closing at $63.4 per share. In addition to Arm.

Other notable IPOs included Instacart, a grocery delivery platform, which went public with a valuation significantly lower than its peak during the pandemic.

Klaviyo, a tech company specializing in AI-integrated marketing automation, also made a significant entry with a valuation of $9.2 billion.

Birkenstock, the iconic German shoemaker, entered the market with a valuation of $9.3 billion, marking a significant transition from a family-owned business to being backed by private equity firms and notable investors.

Kenvue, formerly the consumer healthcare division of Johnson & Johnson, also completed its IPO in May 2023.

Summary of the 5 Largest IPOs of 2023

| Symbol | Company Name | IPO Proceeds | IPO Price | Current Price | Return |

| ARM | Arm Holdings | 4.9B | $51.00 | $72.20 | 39.61% |

| KVUE | Kenvue Inc | 3.8B | $22.00 | $21.22 | -3.55% |

| BIRK | Birkenstock Holding | 1.48B | $46.00 | $46.80 | 1.74% |

| KVYO | Klaviyo Inc | 576M | $30.00 | $28.59 | -4.70% |

| CART | Maplebear Inc | 660M | $30.00 | $23.39 | -22.03% |

Performance figures as of the market close on December 21, 2023

The 5 Top-Performing IPOs of 2023, (with market cap exceeding $1 billion)

| Symbol | Company Name | Return Since IPO |

| SKWD | Skyward Specialty Insurance Group | 126.80% |

| GPCR | Structure Therapeutics | 120.00% |

| NXT | Nextracker Inc. | 105.75% |

| CAVA | CAVA Group Inc | 94.36% |

| RYZB | RayzeBio Inc | 55.28% |

Performance figures as of the market close on December 21, 2023

Out of the 124 IPOs in 2023, only 30 are trading above their IPO prices, delivering positive returns to investors.

2023 also saw a resurgence in direct listings, following a brief pause in 2022 when only one company chose this method to go public. This trend, initially popularized by Spotify in 2017, has been gaining momentum annually. This year, the following companies went public via direct listing: Surf Air Mobility (SRFM), Courtside Group (PODC), and reAlpha Tech (AIRE).

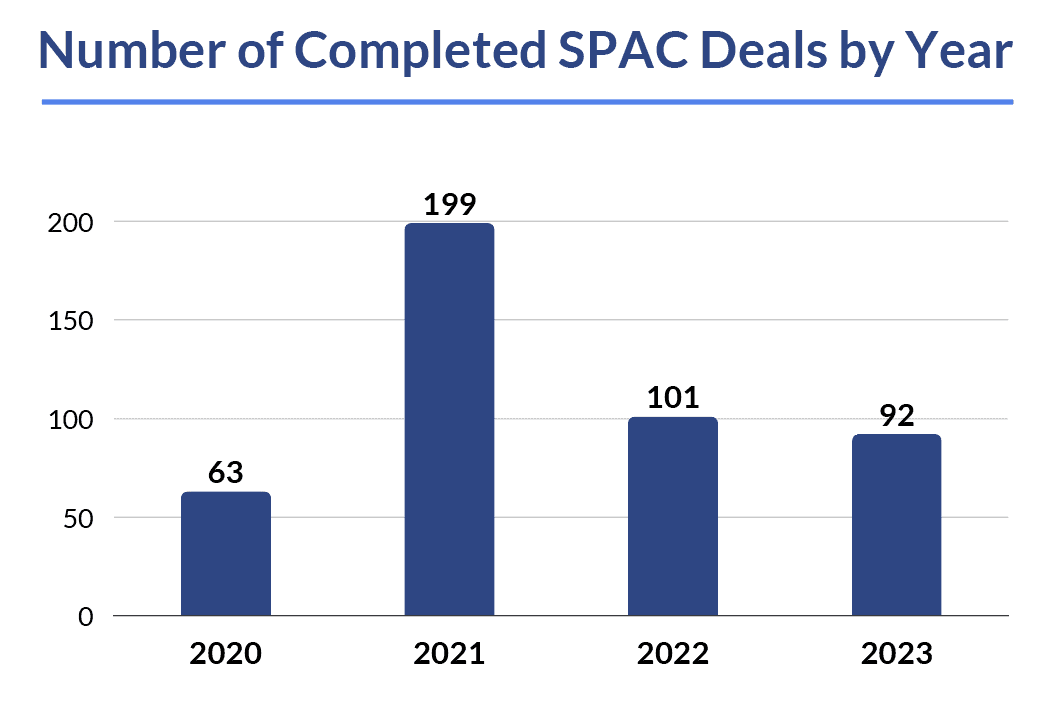

On the side of SPACs, 92 companies successfully completed mergers and were listed on public markets, a drop from the 199 and 101 completed deals in 2021 and 2022, respectively. The year was characterized by a large number of pending SPAC deals unable to finalize transactions and numerous SPAC deal terminations.

The largest completed SPAC transactions were VinFast, a Vietnamese electric vehicle company that was listed on the U.S. market at a valuation of $23 billion and experienced significant volatility in its stock price post-merger, and Better, a digital mortgage lender that went public at a valuation of $7 billion and saw its stock price plummet by 93% on its first day of trading.

Over 90% of companies that went public via SPACs in 2023 are currently trading below their IPO prices.

Overall, the U.S. IPO market in 2023 demonstrated a mix of cautious optimism and challenges, with a diverse range of companies entering the public market amidst varying degrees of success and market reception.

Rebound in Sight: Promising Outlook for 2024

Based on recent trends and market indicators, there is a strong possibility that 2024 could witness a resurgence of initial public offerings in the U.S. stock market, surpassing the relatively muted activity seen in the past two years. These several factors contribute to this optimistic outlook:

- Improving Market Conditions: Despite recent challenges, the overall stock market has demonstrated remarkable resilience and stability, with major indices posting impressive positive returns. In December, the S&P 500 reached a new all-time high, driven by a remarkable 240% year-to-date return from Nvidia, and the robust performance of other major tech giants like Meta, Tesla, Apple, and Amazon. This improvement in market sentiment is likely to encourage more companies to consider going public, particularly those that have been waiting for better conditions.

- Buoyant Investor Confidence: Despite economic headwinds, investor confidence in the long-term trajectory of the U.S. economy remains relatively high. This positive outlook translates into increased appetite for new investment opportunities, including IPOs, as investors seek to diversify their portfolios and capitalize on growth prospects.

- Potential for Rate Cuts: The Federal Reserve has suggested the possibility of pausing interest rate hikes and even initiating cuts in 2024. Stabilized interest rates would create a favorable environment for IPOs by lowering the cost of capital.

Potential IPOs to watch in 2024

As The IPO market is expected to pick up steam in 2024 after a slow year in 2023. Several high-profile companies are rumored to be considering going public next year, and investors are eager to get in on the action.

Here are a few of the potential IPOs to watch in 2024:

- Shein, a Chinese fast-fashion company that has become one of the most popular retailers in the world. The company was valued at $66 billion after rising $2 billion in the first half of 2023, Reuters reported in November that the company had confidentially filed to go public in the United States. Shein IPO is expected to occur sometime in 2024.

- Reddit, the popular social media platform, is also reportedly considering an initial public offering (IPO) in the near future. While an official date for the IPO has not been announced, it is widely expected to take place sometime in early 2024.

- Skims, Kim Kardashian’s iconic shapewear brand is also reportedly exploring an IPO sometime in 2024. This year, company raised $270 million in a funding round, valuing it at $4 billion.

On the SPAC side, some announced mergers are expected to close in 2024:

- Trump Media & Technology Group (TMTG), a social media platform founded by former U.S. President Donald Trump, has signed a deal to go public with a special purpose acquisition company, Digital World Acquisition Corp. (Nasdaq: DWAC). This move has captured the attention of investors and the media. This deal is currently the oldest active SPAC deal. The definitive agreement was announced in October 2021, but the company faced several challenges, leading to its inability to close the transaction successfully. Despite the challenges, investors are still betting on a successful deal completion, giving DWAC’s share prices a 70% premium over its NAV.

- Oklo, a U.S.-based advanced nuclear technology company, has a deal with AltC Acquisition Corp (NYSE: ALCC), a SPAC co-founded and led by OpenAI’s Sam Altman. If you want to learn more about this deal, you can check my deep dive into the transaction by clicking here.

- Lotus Tech, a global luxury electric vehicle maker, announced its SPAC merger agreement at the beginning of 2023 with L Catterton Asia Acquisition Corp, a SPAC listed on Nasdaq (NASDAQ: LCAA). The deal values the company at $5.4 billion. The company recently announced that it secured US$870 million of private investment in public equity (“PIPE”) for the transaction, the merger is expected to close in 2024.

The 2023 US IPO market was a mixed bag, characterized by both challenges and opportunities. While the overall performance was mixed, the surge of notable IPOs in the second half of the year coupled with the promising outlook for 2024 suggests that the market may be on the verge of a rebound. Investors and companies alike are eagerly anticipating a stronger year for the IPO market in 2024, with the potential for a resurgence in activity driven by improved market conditions, growing investor confidence, and the potential for interest rate cuts.