Michael Burry – Portfolio Update – Q1 2024

Michael Burry, the renowned hedge fund manager behind Scion Capital, disclosed his portfolio holdings for Q1 2024. In 2023, Burry initiated and quickly closed substantial short positions after just one quarter. He also opened 18 new positions in the last quarter of the year. However, his most recent filing indicates a shift in his approach. He has reduced the number of his portfolio holdings, divesting from numerous positions, reallocating funds to existing ones, and taking only five new positions. Here are the key takeaways from his latest filing:

Chinese Tech Giants Remain a Core Holding

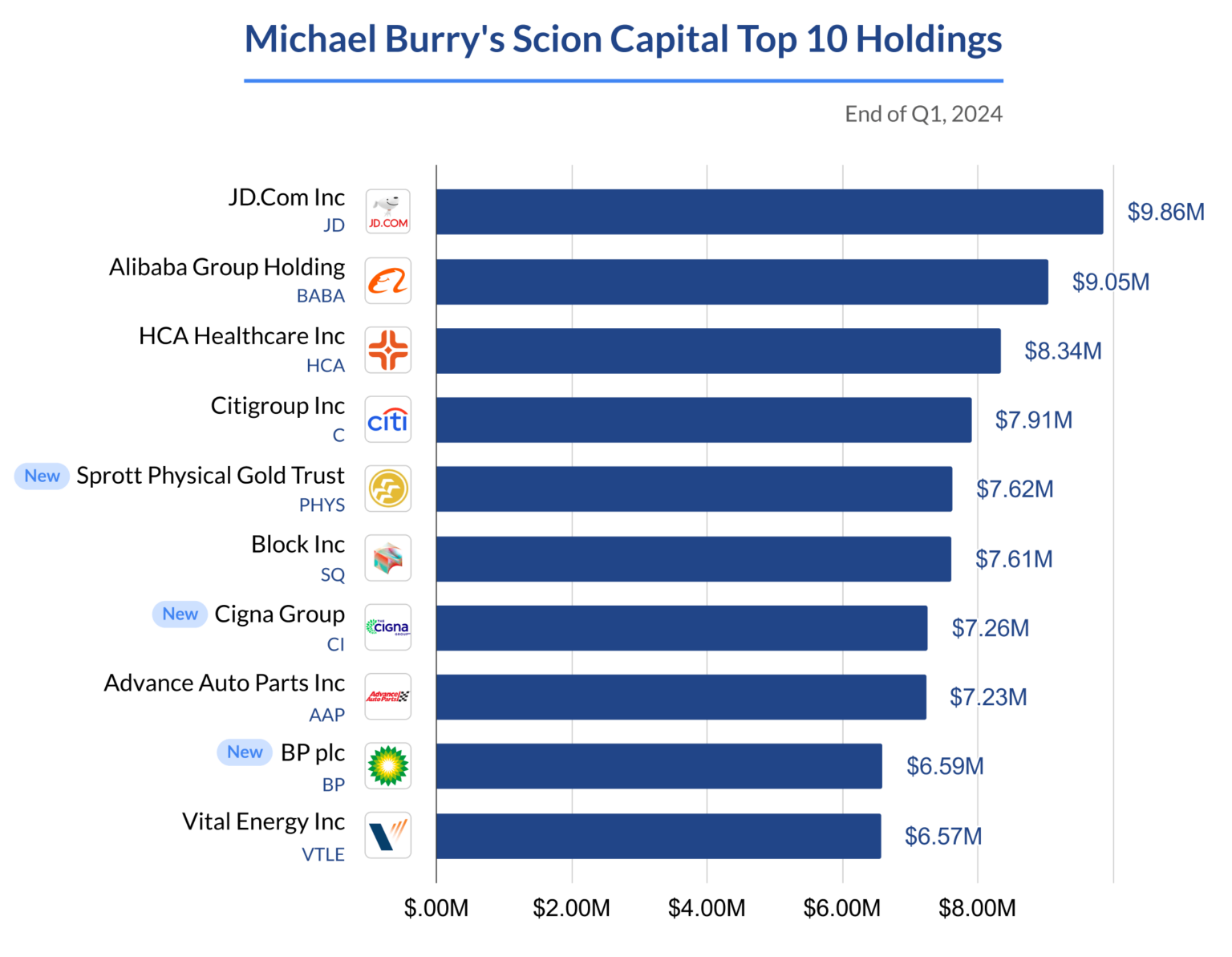

Burry first opened his positions in Alibaba and JD.com in Q3 2023, and he expanded both holdings significantly in Q4, making them his top two holdings. This quarter, Burry doubled down on the Chinese tech market again, increasing his stakes in Alibaba and JD.com by 67% and 80%, respectively. These two companies remain his largest portfolio holdings as of this filing.

In addition to reinforcing his positions in Alibaba and JD.com, Burry also initiated a new position in another Chinese internet giant, Baidu. He purchased 40,000 shares worth $4.21 million, making Baidu the 14th largest holding in his portfolio.

Gold as a Potential Hedge

One of the most notable new additions to Burry’s portfolio is the Sprott Physical Gold Trust (PHYS), with a sizable $7.62 million investment. This move can be interpreted as a hedge against market uncertainty, inflation concerns, or potential economic turbulence. Historically, precious metals like gold have been viewed as safe-haven assets during times of market volatility or economic downturns.

Energy Investments

Burry has also acquired two new energy stocks. He purchased 175,000 shares of energy giant BP, valued at $6.59 million. Additionally, he invested $5.06 million in First Solar Inc (FSLR), acquiring 30,000 shares in the solar energy company.

Michael Burry’s Top 10 Portfolio Holdings

Here are Burry’s top 10 holdings as of Q1 2024:

Source: SEC Filings

Closed Positions:

Burry exited several positions during the first quarter, including:

- Toast Inc (TOST)

- Oracle Corp (ORCL)

- GEN Restaurant Group Inc (GENK)

- Mettler-Toledo International Inc (MTD)

- Bruker Corp (BRKR)

- Nexstar Media Group Inc (NXST)

- Booking Holdings Inc (BKNG)

- Alphabet Inc (GOOGL)

- Warner Bros Discovery Inc (WBD)

Michael Burry’s Q1 2024 portfolio update showcases a continued focus on Chinese tech giants, which have seen a downturn in recent years. By concentrating his investments on a smaller number of high-conviction bets, Burry’s portfolio has become more streamlined, decreasing from 25 stocks in the previous quarter to 16 in the current filing.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. BBAE has no position in any investment mentioned.