Michael Burry – Portfolio Update – Q2 2024

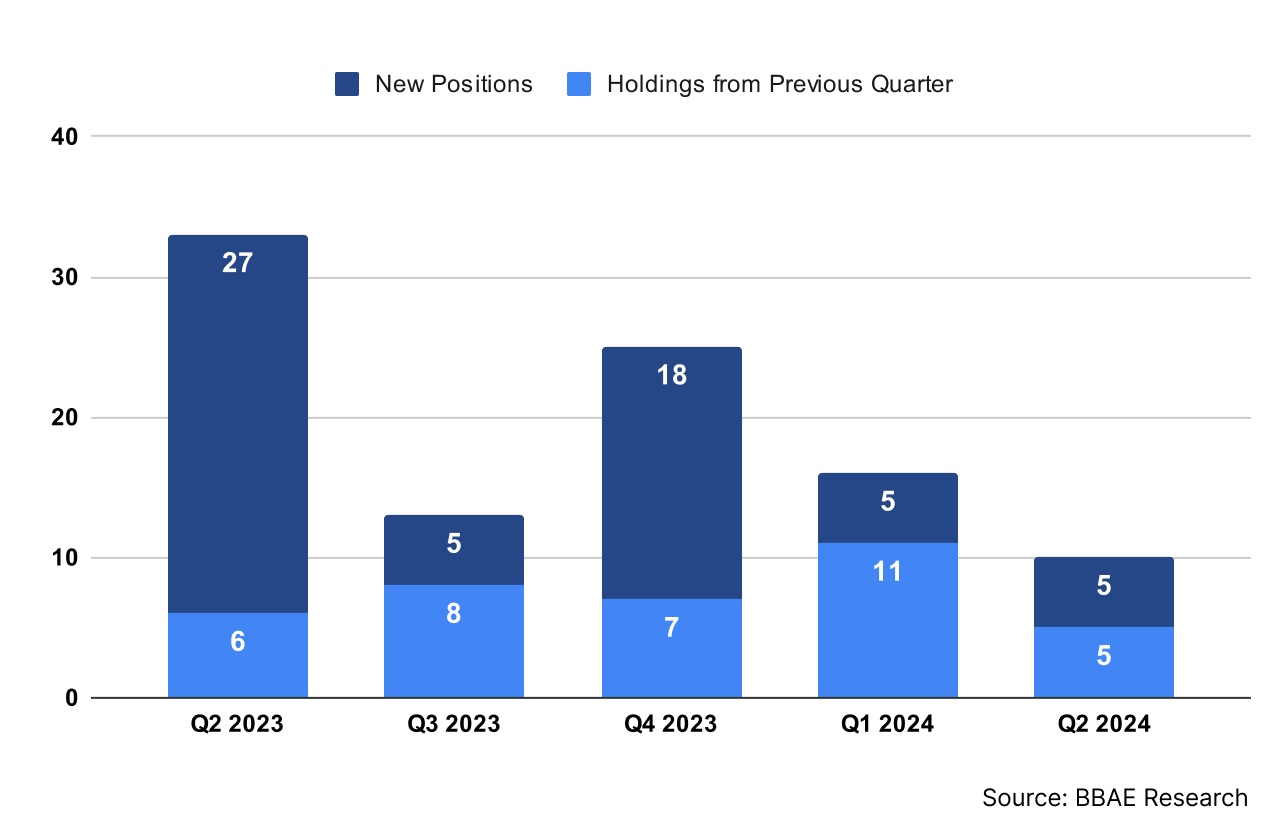

Michael Burry, the famous hedge fund manager behind Scion Capital and renowned for his prediction of the 2008 financial crisis, has disclosed his portfolio holdings for Q2 2024. Continuing his trend of high portfolio turnover, Burry opened 5 new positions while closing 11 others. He is persisting with the strategic shift he initiated in the previous quarter, focusing on reducing the total number of holdings. This approach involves divesting from multiple positions and reallocating funds into a smaller selection of high-conviction stocks. As of the fourth quarter of 2024, Burry’s portfolio consists of just 10 stocks, marking the lowest number of holdings since Q4 2022.

Michael Burry’s Portfolio Holdings and New Positions by Quarter

Chinese Tech Stocks: A Mixed Approach

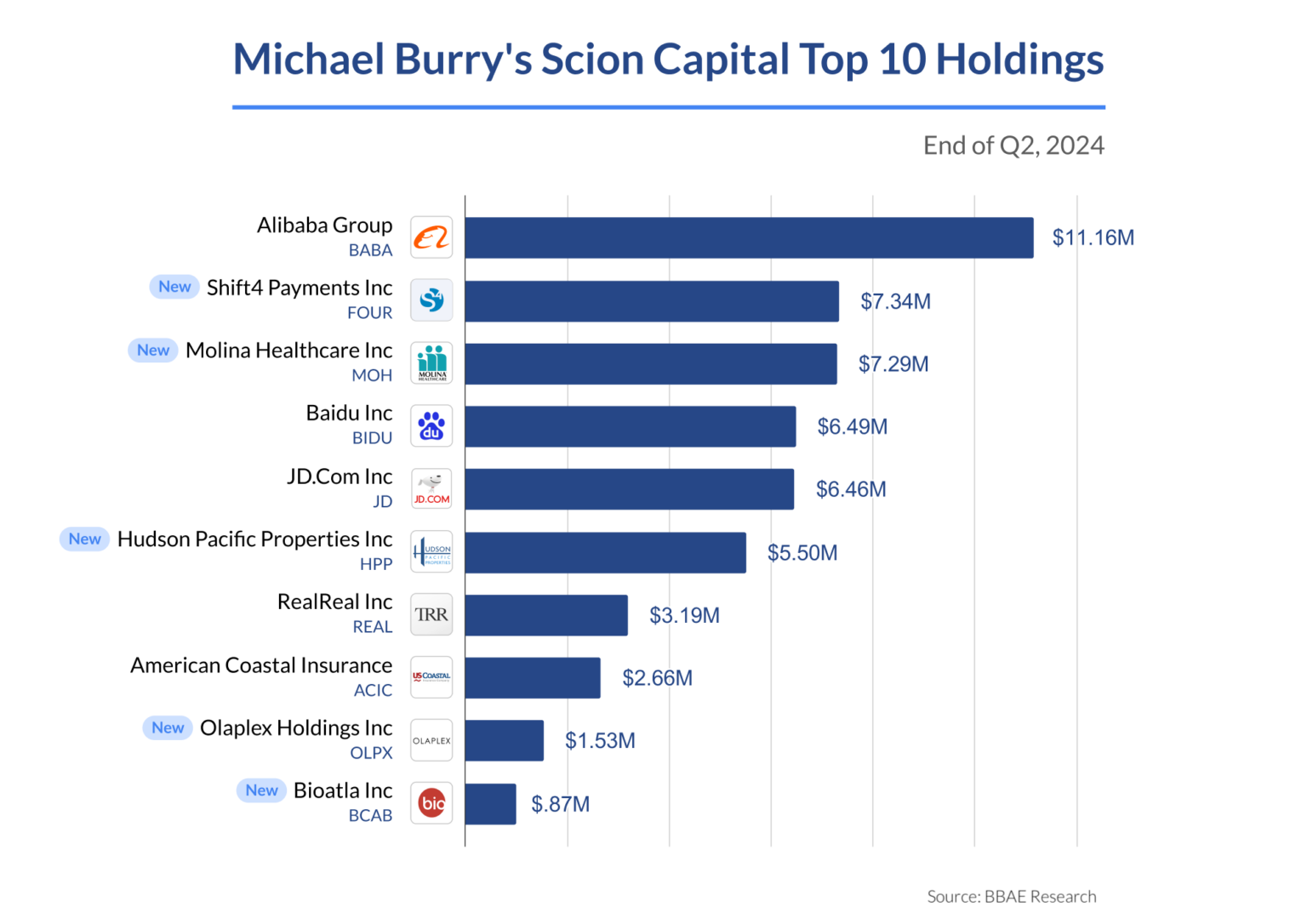

Burry has been actively adjusting his Chinese tech stock holdings since late 2023. Initially investing in Alibaba and JD.com in the third quarter of 2023, Burry expanded these positions through the first quarter of 2024. He further diversified by adding Baidu to his portfolio in early 2024.

In the most recent quarter, Burry significantly increased his stakes in Alibaba and Baidu. He acquired an additional 30,000 Alibaba shares, boosting his position by 24%, and grew his Baidu holding by 87.50% with 35,000 new shares. However, Burry’s enthusiasm wasn’t uniform across Chinese tech stocks. In a notable move, he reduced his JD.com position by 30%, selling 110,000 shares.

Shift4 Payments and Molina Healthcare Now Among Top Holdings

This quarter, Burry made significant moves in his portfolio by initiating two large positions that now rank among his top three holdings. Shift4 Payments, Inc. (NYSE: FOUR) and Molina Healthcare, Inc. (NYSE: MOH) have become the second and third largest holdings in his portfolio, respectively. Shift4 Payments is a payment processing technology company serving industries like hospitality and e-commerce, while Molina Healthcare provides health insurance plans primarily through government-sponsored programs such as Medicaid and Medicare. Molina focuses on serving low-income individuals and families, playing a crucial role in expanding healthcare access.

Source: SEC Filings

Closed Positions:

In the second quarter of 2024, Burry exited several positions, most notably HCA Healthcare Inc. ($HCA), which was his third-largest holding in the previous quarter. Alongside HCA, he also closed positions in the following companies:

- Sprott Physical Gold Trust ($PHYS)

- Block Inc. ($SQ)

- Vital Energy Inc. ($VTLE)

- Citigroup Inc. ($C)

- Safe Bulkers Inc. ($SB)

- Cigna Group ($CI)

- First Solar Inc. ($FSLR)

- Star Bulk Carriers Corp. ($SBLK)

- Advance Auto Parts, Inc. ($AAP)

- BP plc ($BP)

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. BBAE has no position in any investment mentioned.