Michael Burry – Portfolio Update – Q3 2024

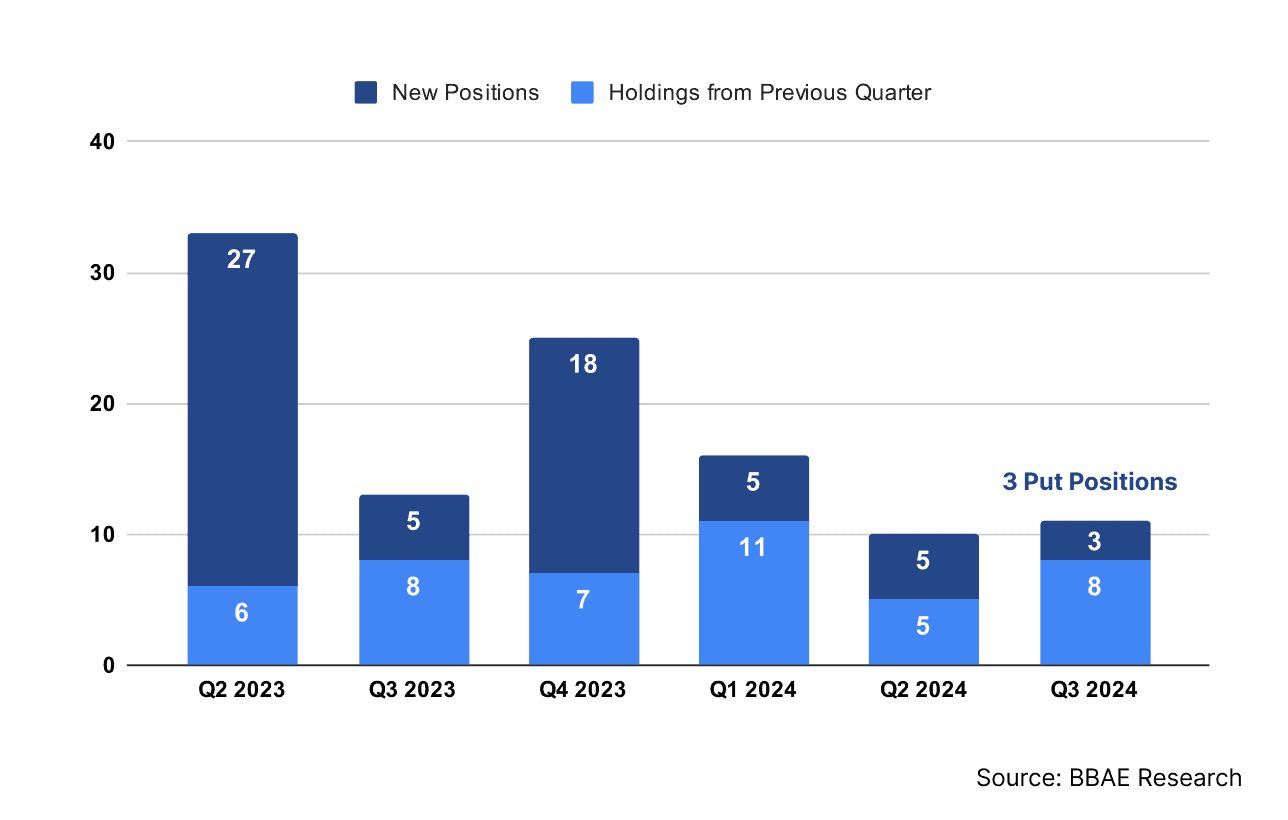

In a quarter marked by strategic repositioning, Michael Burry, the legendary investor known for predicting the 2008 financial crisis, has revealed a notably concentrated portfolio in his latest 13F filing. The Scion Capital manager, departing from his typically high-turnover approach, has focused on fine-tuning existing positions rather than initiating major new investments.

Burry opened three new positions and closed two. Notably, all three new positions are put options on companies where he already holds long positions, suggesting a hedging strategy rather than new directional bets. This approach marks a shift toward portfolio refinement rather than major new investments.

Source: SEC Filings

Strategic Hedging of Chinese Tech Stocks?

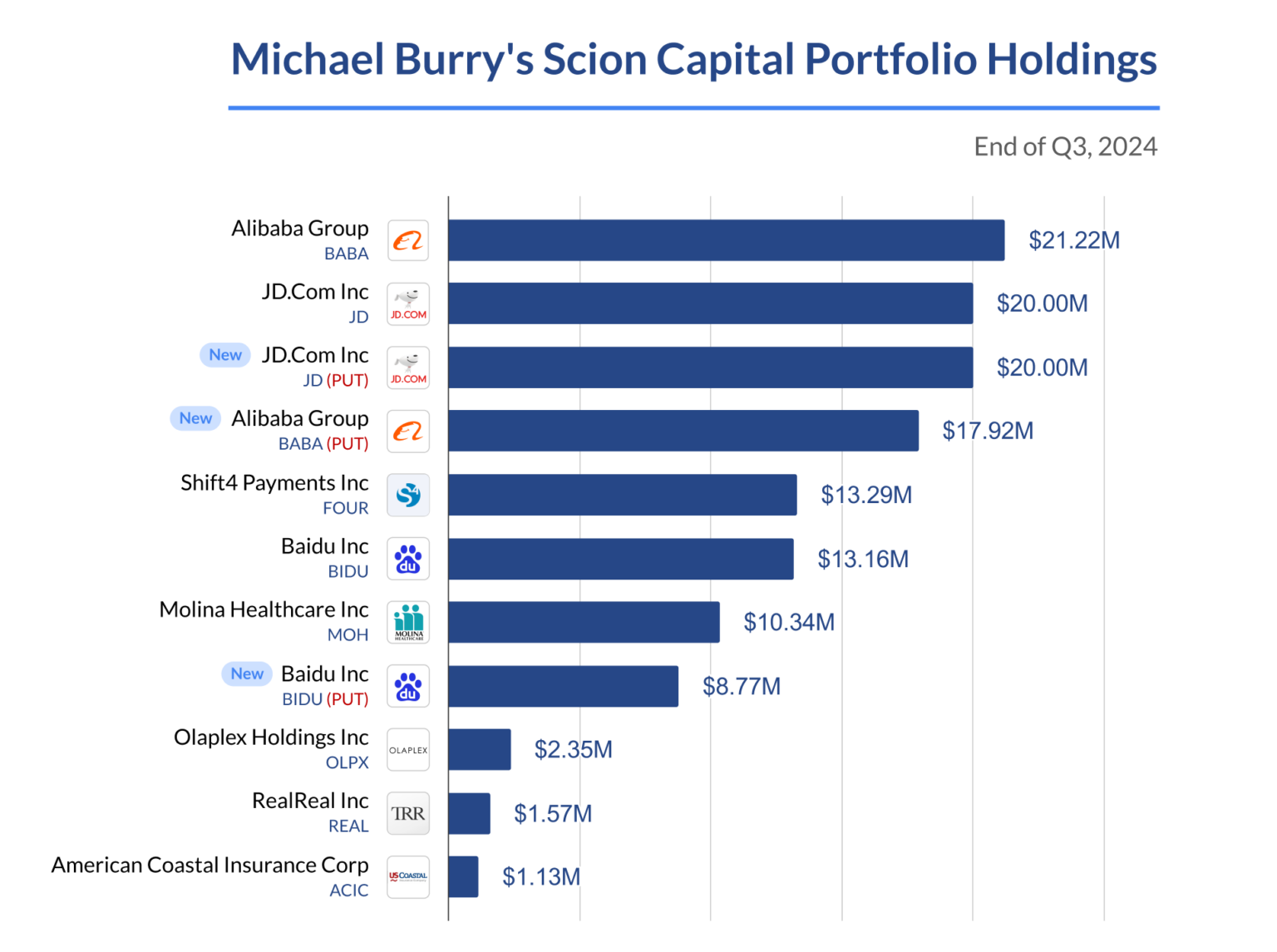

Michael Burry has been actively reshaping his Chinese tech stock portfolio since late 2023. Starting with investments in Alibaba ($BABA) and JD.com ($JD) in Q3 2023, he has steadily increased his stakes in these companies over multiple quarters. In his latest portfolio update, Burry increased his holdings in Chinese stocks, including Alibaba ($BABA), Baidu ($BIDU), and JD.com ($JD), while also initiating multi-million-dollar put options as a hedge against these positions.

Notably, Burry’s $JD position appears fully hedged, with $20 million worth of shares matched by $20 million in put options. Meanwhile, $BABA and $BIDU are only partially hedged. It remains unclear from the filing when exactly these put options were added, but they may be linked to the Chinese stock rally at the end of the previous quarter, fueled by Beijing’s announcement of economic stimulus measures. The next quarter’s filings will reveal whether this hedging strategy was a temporary move to guard against a potential market pullback following the strong rally in September.

Increased Stakes in Shift4 Payments ($FOUR) and Molina Healthcare ($MOH)

In the latest quarter, Michael Burry significantly increased his holdings in Shift4 Payments, Inc. ($FOUR) and Molina Healthcare, Inc. ($MOH), boosting his stakes by 50% and 67%, respectively. These positions were first initiated in Q2 2024. Considering the hedging effect of his put options, which effectively neutralize large long positions in Chinese stocks, these two names now emerge as the most significant long positions in Burry’s portfolio.

Shift4 Payments is a technology company specializing in payment processing solutions for industries like hospitality and e-commerce. Molina Healthcare, on the other hand, provides health insurance through government-sponsored programs such as Medicaid and Medicare, playing a crucial role in improving healthcare access for low-income individuals and families.

Michael Burry’s Scion Capital Portfolio Holdings, Q3 2024

Source: SEC Filings

Portfolio Reductions and Exits

According to the latest filing, Michael Burry reduced his stakes in two positions and completely exited two others.

The reduced positions include RealReal Inc ($REAL), an online marketplace for consigned luxury goods, and American Coastal Insurance Corp ($ACIC), a property and casualty insurance holding company. Burry trimmed these holdings by 50% and 60%, respectively.

The closed positions are Hudson Pacific Properties Inc ($HPP), a real estate investment trust specializing in office and studio properties, and BioAtla Inc ($BCAB), a clinical-stage biopharmaceutical company focused on developing selective antibody-based therapeutics for treating solid tumor cancers.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. BBAE has no position in any investment mentioned.