News Roundup: Fed Cuts Rates but Scares Markets, Forecasts Remain a Fool’s Errand, Argentina

Fed: US economy too good for its own good (+ we fear Trump inflation)

The Fed’s interest rate moves work like a combined gas and brake pedal on the economy: Higher rates slow things down and lower rates speed things up.

At least that’s the prevailing view, which is oversimplified. The Fed technically just suggests changes to the Federal Funds rate, an overnight lending rate between banks who keep money on deposit at the Fed (very strictly speaking, they don’t even have to follow the Fed’s suggestions, but they do).

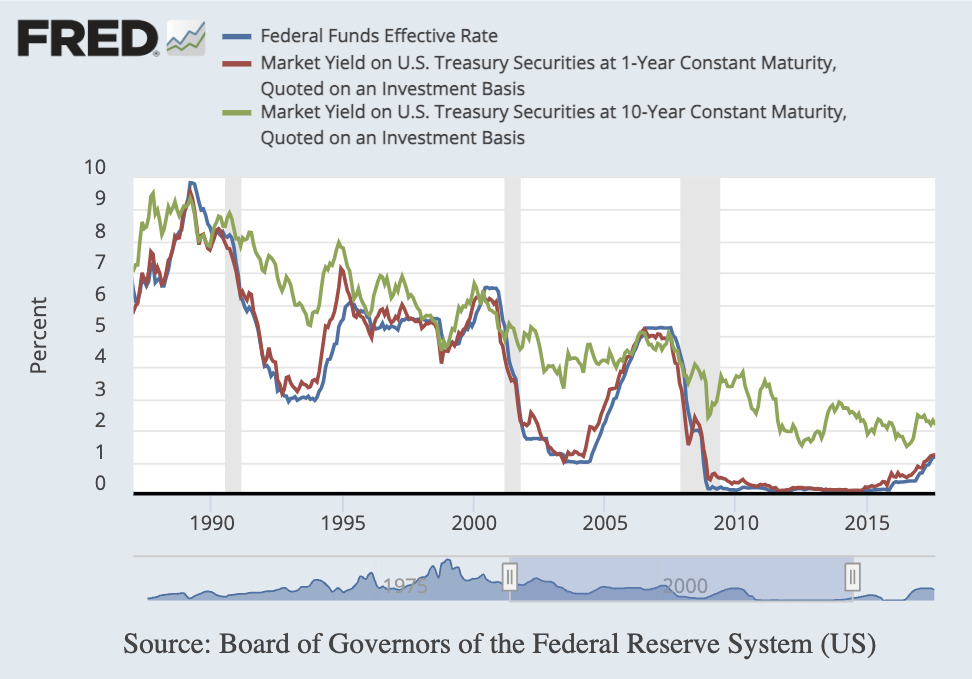

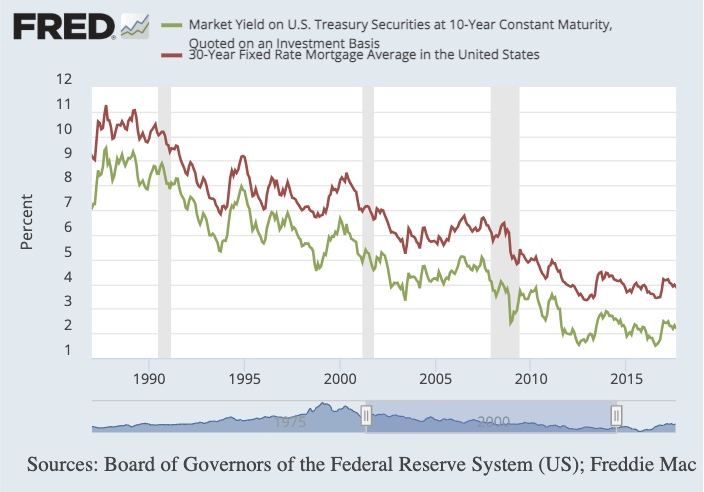

Fernando Martin from the St. Louis Federal Reserve Bank looked at how tethered (or not) Fed Fund changes are to a few other rates. Turns out Fed Funds rates (in blue below) are extremely correlated to 1-year Treasuries (in red), but much more loosely connected to 10-year Treasuries (green).

It’s 10-year rates that are most closely correlated with mortgage rates, for instance.

I digress, but while the Fed’s quarter-point cut this past Wednesday was itself a positive for stocks, the stock market did not take kindly to the Fed’s prediction that it may only need two 25-point cuts next year, instead of four. (The stock market is forward looking, if you’re new to stocks, so even though the current 25-point cut was good for stocks, it was already expected and therefore nearly entirely priced in by forward-looking investors of yore.)

The cut didn’t surprise markets, but the hawkish forecast did. John Authers from Bloomberg showed some reactions (to be clear, these charts are “zoomed in” both in date range and scale, which makes the movements look more extreme than they really are).

Truth is, with inflation already starting to tick back up, the December rate cut was a close call. If the Fed hadn’t telegraphed the cut so much already, I doubt they’d have felt the need to cut with inflation rising again.

It’s not easy being the Fed, having to pivot on a dime and then pivot again. But then again, what else should they do? Is it better to not pivot?

Trump likes a hot economy, and nearly all economists expect his policies to create inflation, so it’s not impossible that we’re talking about rate hikes in 2025. Jim Cramer thinks the Fed should have taken a wait-and-see approach instead of continuing to signal future rate cuts, and I agree with him.

For investors – many of whom had been prepping for a falling rate environment – the lesson should be clear: It’s hard to bet on short-term catalysts like rate cuts.

Saving and investing? Start now

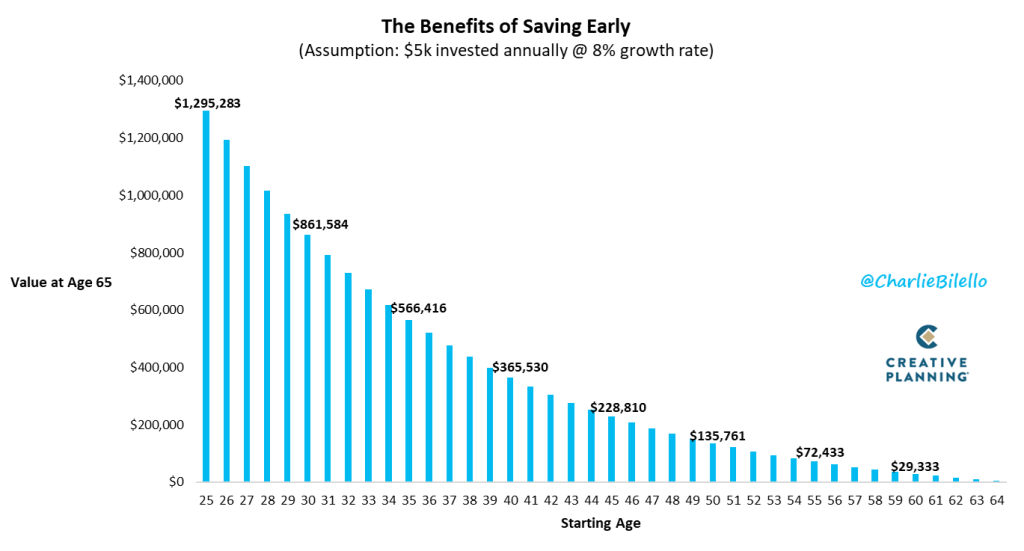

This is why we’re all here at BBAE, in a graph.

Charlie Bilello of Creative Planning shows the power of starting early. In this graph below, he’s assuming a $5,000 annual investment starting at various ages and an 8% compounding rate – a little lower than the S&P 500’s historical annual growth, but about what you might expect from a “mostly equities” portfolio that blends in some cash and bonds.

The $5k doesn’t matter; the shape of the graph does. At age 65 – Charlie’s stopping point – $5k invested yearly from age 25 will be worth roughly $1.3 million, whereas somebody starting at age 55 would just have $72,000.

The problem? Most 25-year-olds’ minds are on other things than getting ahead in the savings game. More technically, I do believe awareness helps, but it’s not everything: Young people are often challenged by prefrontal cortex maturity (I know I did), entry-level salaries, and student debt. Freaks of nature like Warren Buffett can both resist temptation to spend and “see” the future of compounding in a way that most people can’t – they take joy in foregoring expenses now, knowing that the $20 or $30 extra dinner out might cost you becomes hundreds of dollars way down the road.

For the rest of us, I wonder – full acknowledging that his is the sort of idea that would likely never happen – if government run or at least government-sanctioned paid summer “educational work” camps for teens where their earnings go tax-free into retirement plans would save the Social Security system massive costs down the road, thanks to the power of early compounding.

Best time to buy the S&P 500? At 4pm

Ever told somebody – or been told yourself – that the best thing you can say in a situation is nothing?

The stock market is a bit like that. Yes, we all know that passively buying and holding is good, for reasons of low fees and less propensity of overtrading. But I’m talking about literally the market’s being open in this case.

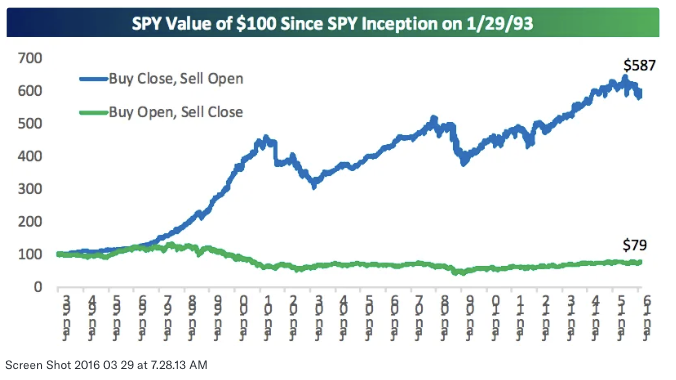

The market’s best performance is actually when it’s not open.

Long ago, I showed data from Bespoke Investment Group showing that you’d have gotten the best returns if you’d bought at the daily close and sold at the daily open:

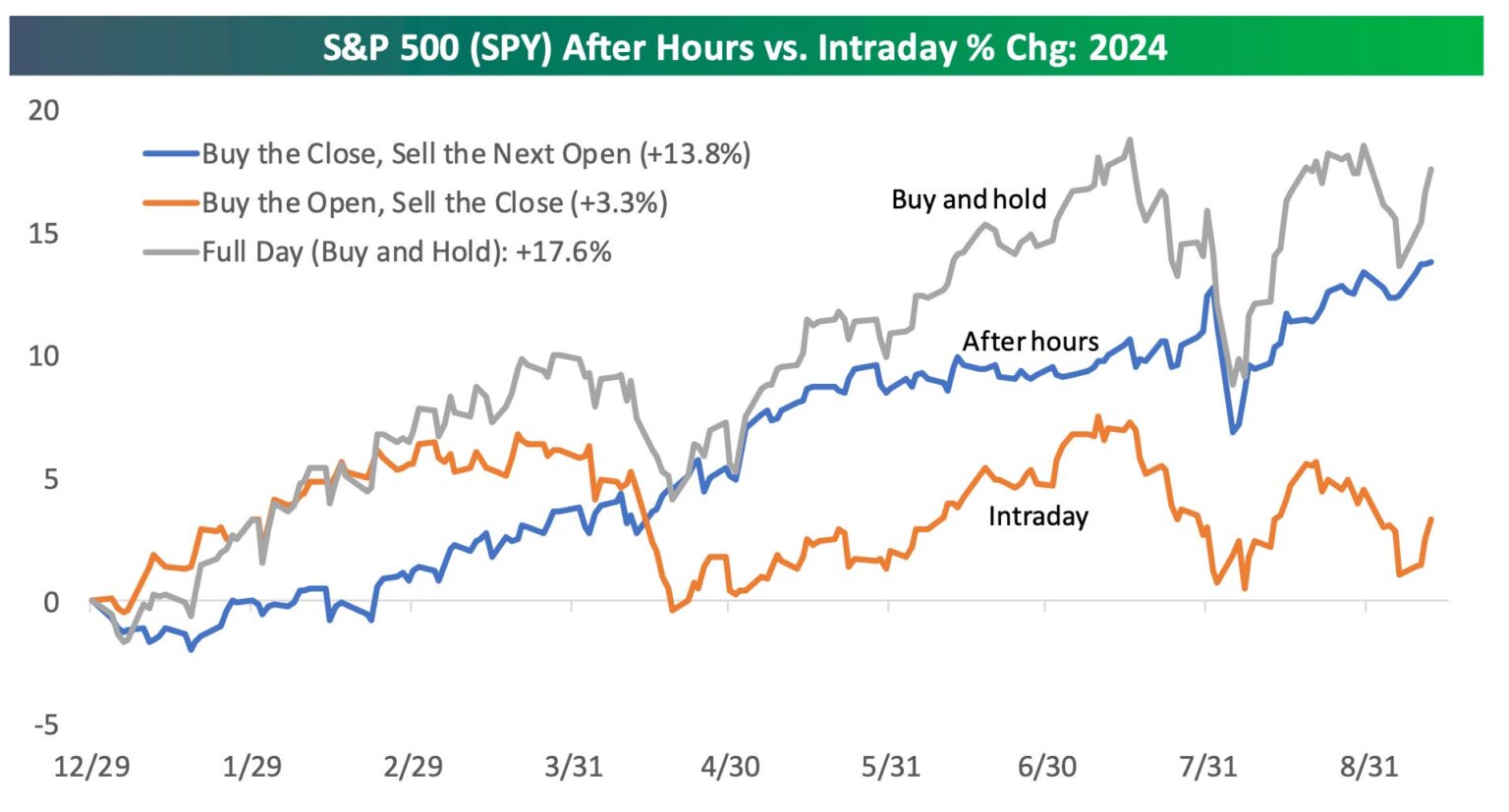

Well, good news for lazy buy-and-holders: At least for 2024, buy and hold investing has mostly beaten “just after hours” investing:

I don’t think “just after hours” investing is a practical or serious consideration for most investors. So it’s good to feel that at least in 2024, we’re not missing out by not doing it.

Rather, the more interesting angle for me is that the general admonition for retail investors – that increased trading decreases returns – might loosely appear to be true for the collective act of trading in general.

Running with this, you’d conclude that 24-hour markets are a bad idea, and that perhaps, conversely, once-a-day trade clearing is the better format.

Everyone who makes a living in the 9:30 to 4pm capital markets would hate this idea, for personal reasons, and would concoct all sorts of broad, societal explanations about why it could never work, but I think it could. I view constant liquidity as a bug, not a feature. I predict we’d have higher values and a wealthier society with shorter trading windows. Sometimes, with liquidity, less is more.

Just remember: Forecasters have no idea

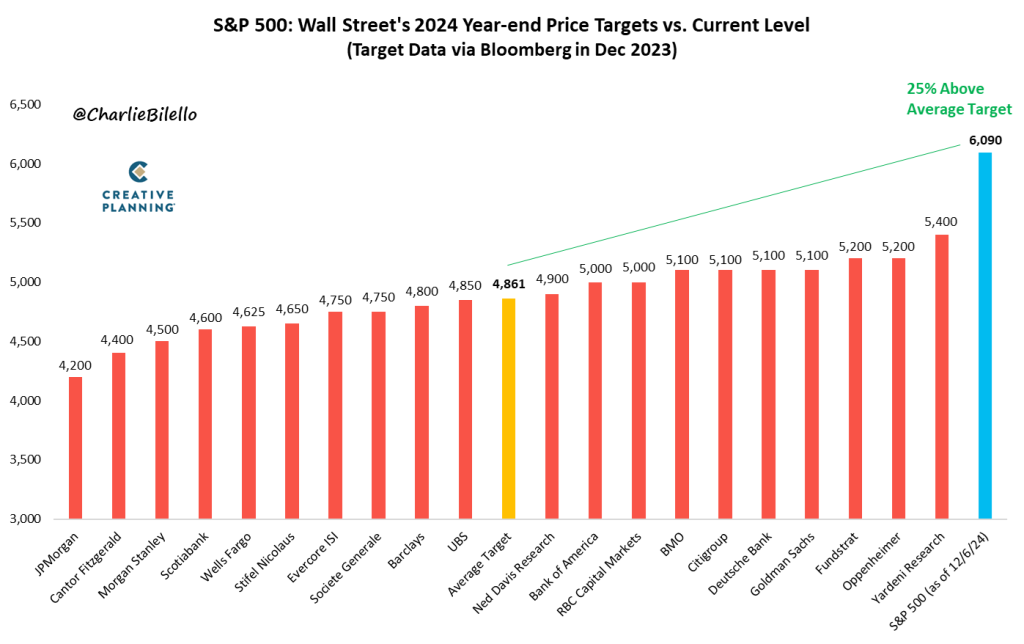

I’ve hit this nail a few times recently, so I won’t go long on this, but the below chart shows just how off forecasters (well-paid, highly trained, and amply resourced forecasters) were in predicting the stock market for 2024. If you’re new to this blog, they were off in 2023, too.

I’m not saying all year-ahead market forecasters are always going to be off – people get lucky sometimes – but I am saying that forecasters’ repeated inaccuracy exposes the near-futility of trying to predict the near-term results of a social science.

Useless or not, humans want forecasts – very much – so we get them.

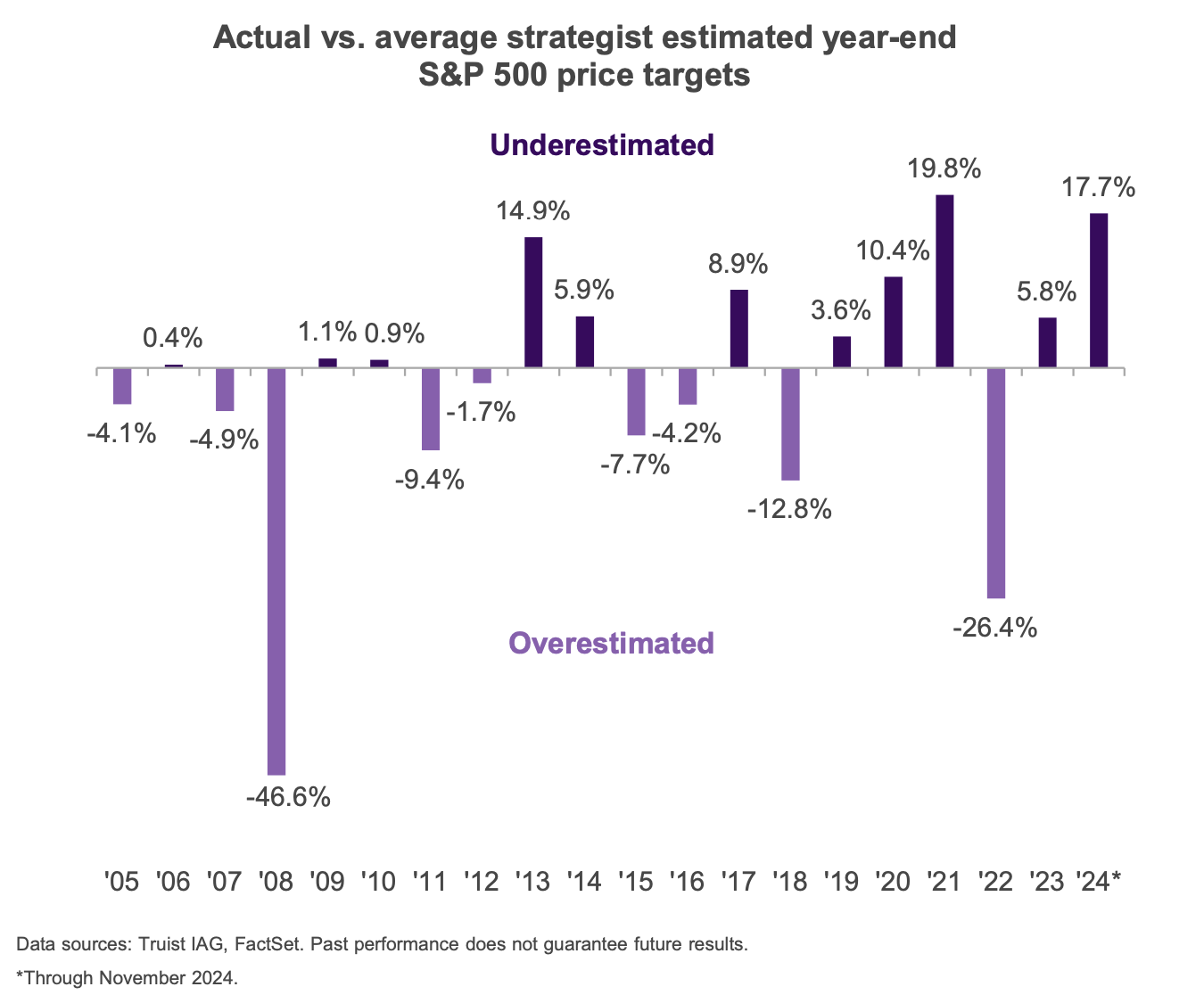

To be fair, forecasts are off in both directions. The chart below, shared by Sam Ro of Tker.co (original source unknown) shows the direction and degree of off-ness of average Wall Street S&P 500 year-ahead forecasts (the same thing from Charlie’s graph above) over the past 20 years. Sometimes the consensus is off a lot, and sometimes it’s off a little. But on balance, are S&P 500 forecasts accurate enough to be useful? I tend to doubt it.

Argentine dream

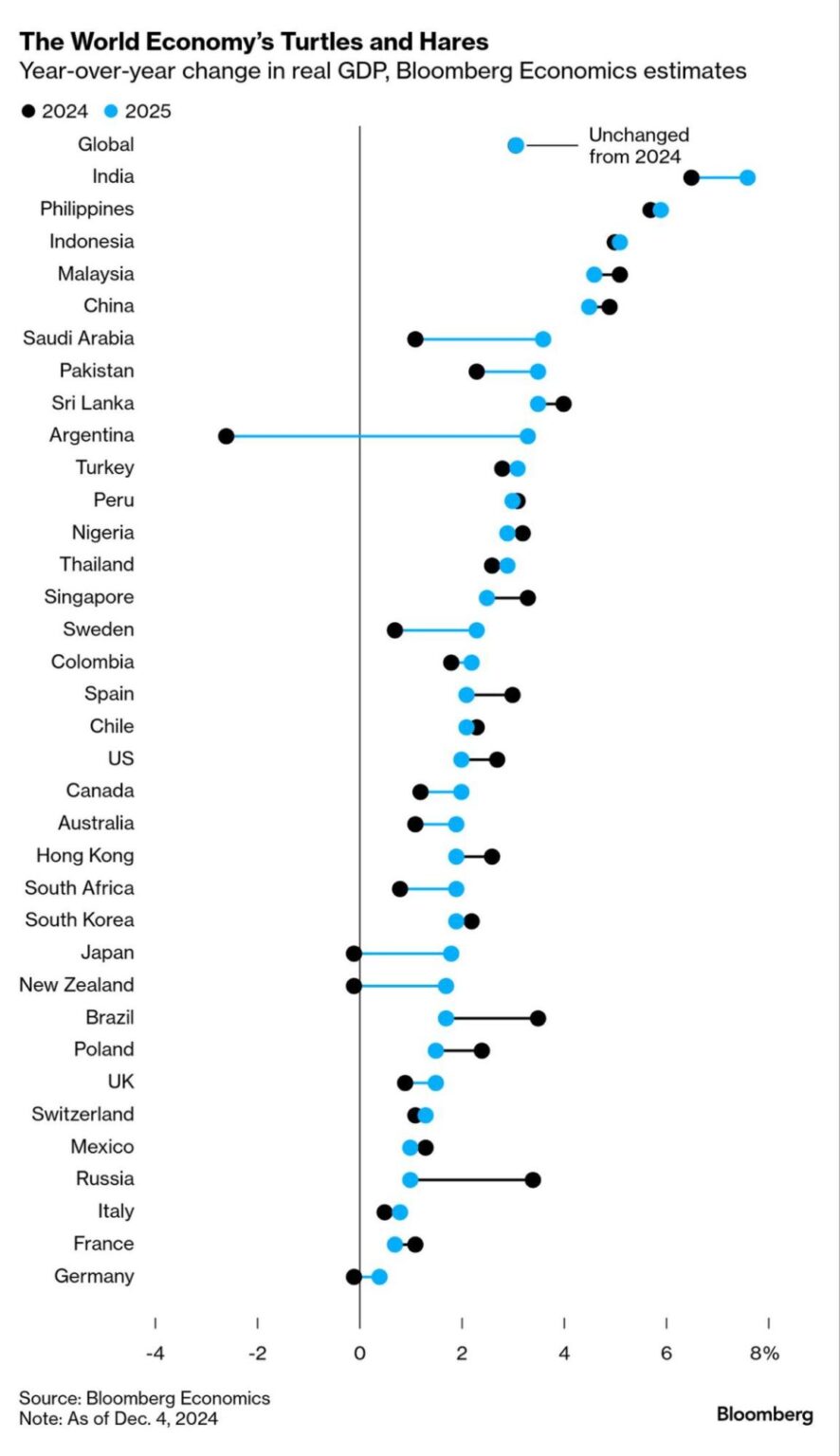

This is really worth its own article but Javier Milei is making waves south of the equator. By getting tough on money printing and government waste, the flamboyant libertarian economist (and leader of Argentina) has killed inflation and given Argentia the fastest GDP growth in the world.

True, unemployment has spiked, and poverty has risen, as Milei foretold, but in his plan these are temporary sufferings – in fact, manifestations of pain that was already in the system; just artificially hidden – to be endured en route to a better future.

If you follow the Argentine story, you know that a little more than a century ago, it was the sixth wealthiest nation in the world. But through cycles of mismanagement, corruption, and debt dependence, it burned its credibility (and roster of willing lenders) and economic potential. Until now, Milei might say.

I’m not particularly political and have no ideological dog in this fight, but you’ve got to give credit where credit is due: It likely takes someone like Milei – who, frankly, many thought was bonkers – to fix the level of mess Argentina has been in. If he succeeds, expect a trend of smaller governments and freer market where governments will allow.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares in SPY and VOO. BBAE has no position in any investment mentioned.