News Roundup: Trump Nominates Scott Bessent, Top 5 Stocks, Silly S&P Targets, Inflation, Active ETFs

Moderate Scott Bessent

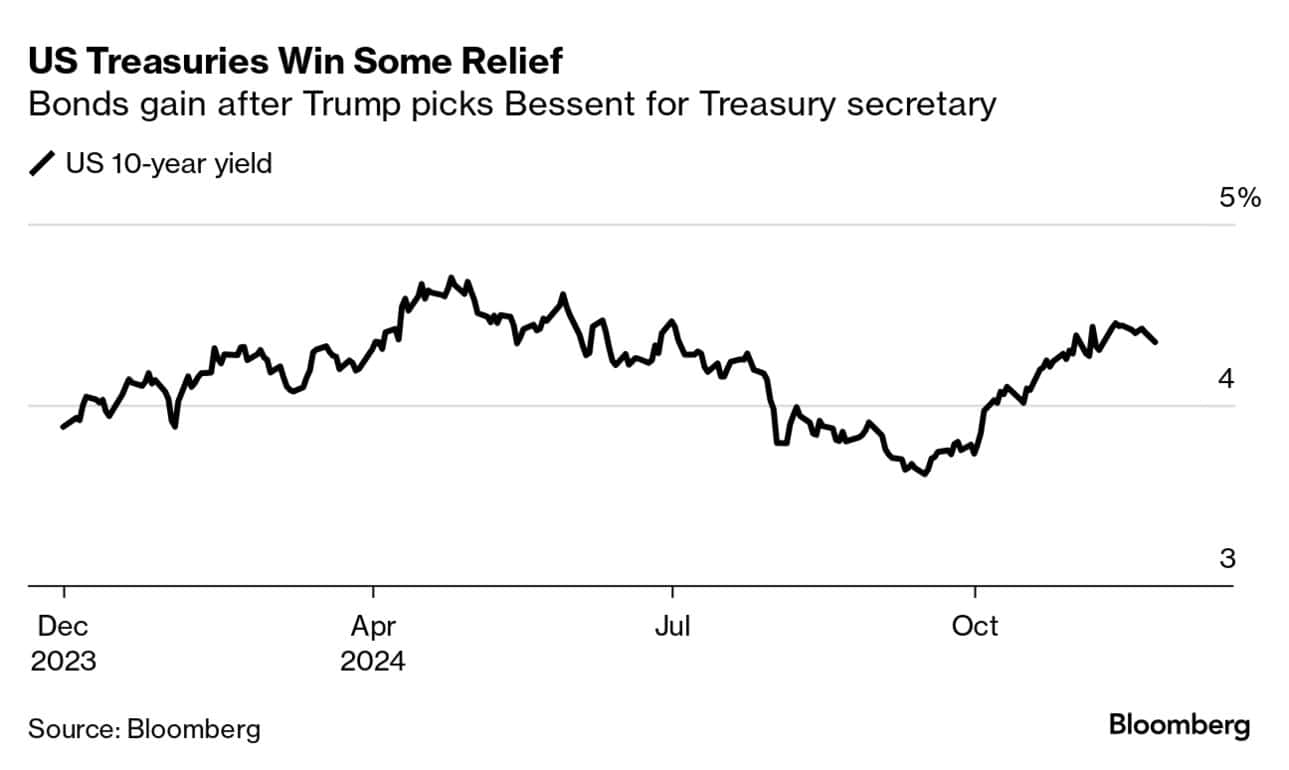

Incoming President Donald Trump may be getting heat for some of his Cabinet nominees, but moderates and bond investors alike seem pleased with Scott Bessent, Trump’s nominee for Treasury secretary.

Scott is a macro investor from the hedge fund industry; he worked for George Soros’ Soros Fund Management before setting up Key Square Group, his own fund. Scott has quirks, but it’s easy to see why he’s a crowd favorite.

Scott is a billionaire and donor to Trump (and former donor to Hillary Clinton). He worries about the US debt and deficit, which are wholesome, bipartisan concerns these days. He supports tariffs, but in a far more targeted way than Trump. One of his first, and largest, tasks will be to enact tax cuts (which, ironically, won’t help the deficit).

Less favorably, Scott has tossed out (and reportedly semi-retracted) the idea of a “Shadow Fed Chair” – a pre-inserted replacement to hover over Jerome Powell until he’s gone. While Trump, who’s no fan of Powell’s, would like this idea, it’s seen as extreme by most of Wall Street.

Elon Musk has described Scott as “business as usual guy,” which is not a compliment. Musk supported Cantor Fitzgerald CEO Howard Lutnick, who Trump has nominated for Commerce secretary instead.

But the bond market sees Scott Bessent as a level-headed fellow, and surprisingly moderate – and “moderate” tends to go well with things financial, especially on a regulatory level.

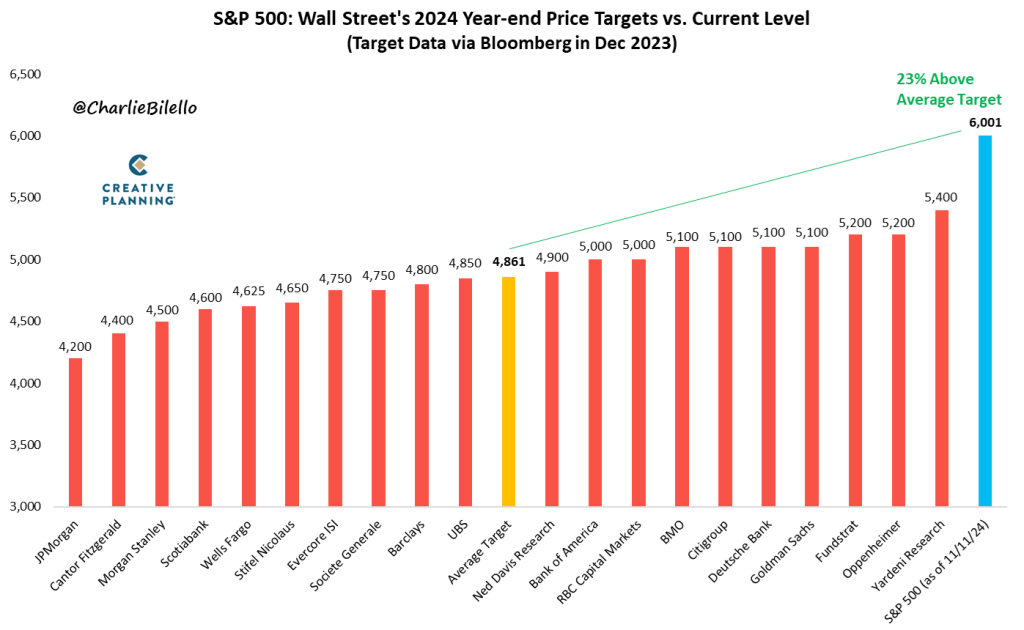

More S&P 500 price target inanity

We talked about this last week, but it’s the gift that keeps on giving.

With 2024 wrapping up, Wall Street analysts are busying their 2025 price targets – for the S&P 500, especially – and the best thing investors can do is to… ignore them.

“We’ve long felt the only value of stock forecasters is to make fortune tellers look good.”

-Warren Buffett

Buffett didn’t have Charlie Billelo’s graph at hand when he wrote that in 1992, but he would no doubt say it proves his point. People want specific forecasts – so, catering to demand, Wall Street prognosticators provide them. But that doesn’t mean that this exchange is a good idea, or that specific forecasts have any value. (Keep this point in mind when reading my story about the spate of new speculative ETFs below, too – what investors want and what’s good for investors are often two different things.)

Anyway, “everybody” underestimated 2024. I have no reason to believe they’ll be more accurate (for non-accidental reasons) for 2025.

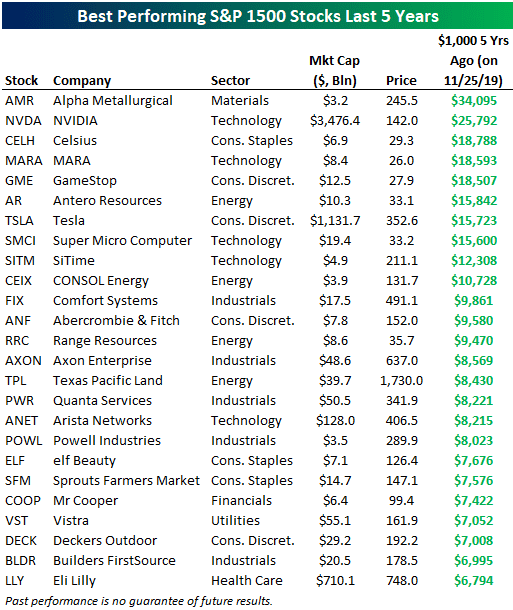

Top stocks of the past 5 years

This is a straightforward visual, courtesy of Bespoke Investment Group. Nvidia (Nasdaq: NVDA) was the second-best performing stock over the past five years. The best was coal company Alpha Metallurgical Resources (NYSE: AMR), which, though $3.2 billion in market cap now – a small cap – was apparently a teeny $94 million market cap firm before its run. Ironically, Apha Metallurgical was 63% more expensive in January of this year.

GameStop (NYSE: GME) is the fifth best performer, which is either ignominious or triumphant, depending on your perspective. Tesla (Nasdaq: TSLA), which seems to be owned by every Millennial investor I know, was seventh. Lower down, Vistra (NYSE: VST) is an independent power producer on a tear – and if you’re been following the BBAE YouTube channel, you know about the IPP boom (and the risks involved – we’ve presented voices on both sides).

This list leans toward energy, but not in an overly dominant way; I am pleasantly surprised by this list’s diversification.

What’s slightly funny is Bespoke’s italicised disclaimer: Past performance is no guarantee of future results.

That statement is true, and we see it on investment products being marketed, but this list is not an investment product of Bespoke. Do we live in a world where someone would actually think that because, say, Alpha Metallurgical Resources turned $1,000 into $34,000 over the past five years it’s guaranteed to do that over the next five? Hopefully it’s just Bespoke’s zealous counsel, because extrapolating, this would, in theory, mean that Yahoo! Finance and anyone else providing price data and charts based on price data would have to disclaim that past data does not equal future data, which starts to feel a little silly.

Inflation is service inflation, at least currently

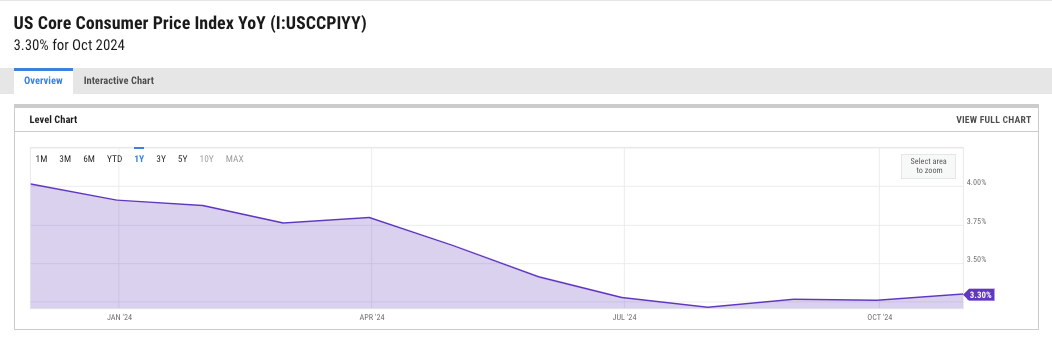

You may have heard that inflation dropped rapidly from 9.1% in 2022, but that it’s starting to plateau at a bit more than 3% – in fact, the latest core CPI reading was 3.3% for the 12 months ending in October, which was very slightly higher than the 12 month reading though the end of September. (Regular trailing-12-month CPI was 2.6% through October and 2.4% through September.)

This isn’t freak-out territory by any means, but it’s concerning that the trend of falling inflation is no more – or is at least taking a multi-month break.

Incoming President Donald Trump campaigned on the notion that Democrats had let inflation get too high, and has pledged to tackle inflation, but the general – and strongly held – belief among economists is that Trump’s tariffs (registration or subscription may be required) deportations, tax cuts, and just general tendency to spend will send inflation higher. The bond market thought that the day he won the election – money flowed out of Treasuries, presumably based on inflation fears.

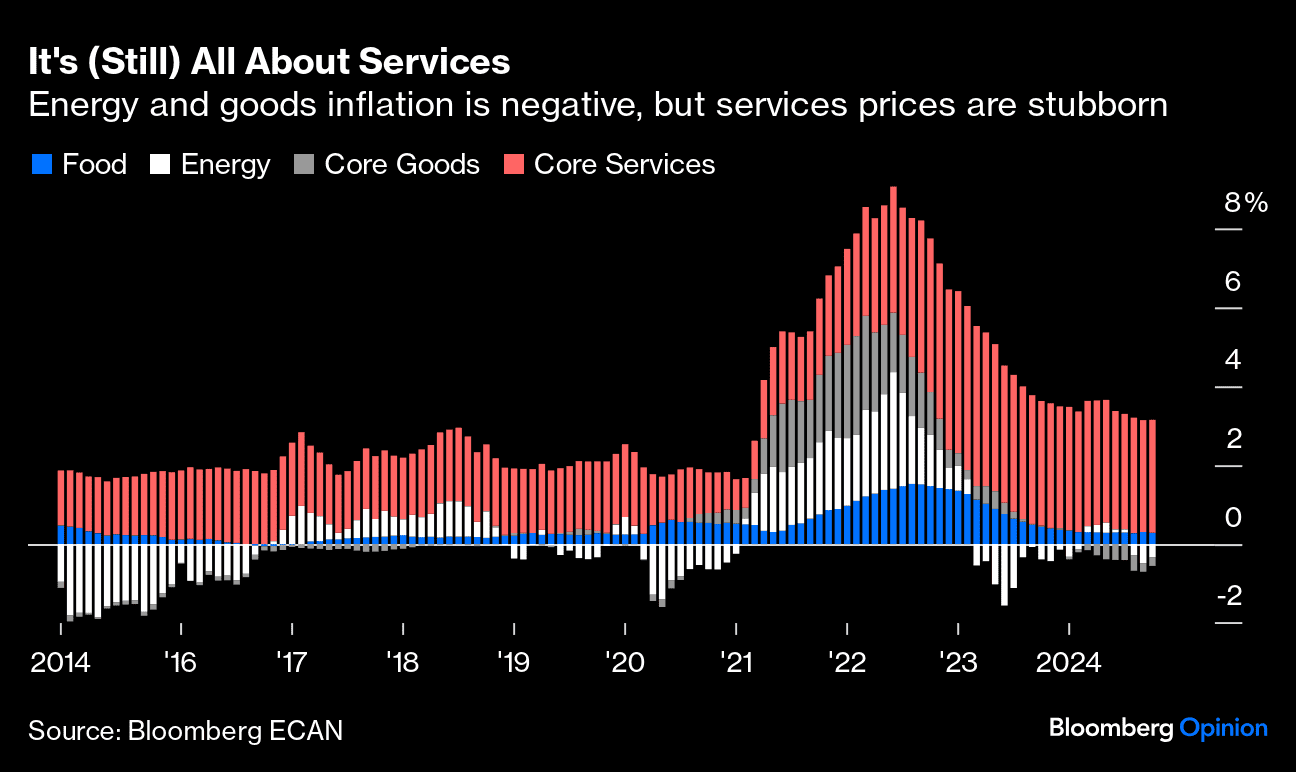

But what’s interesting is, per a chart from John Authers of Bloomberg, how much inflation is really about service costs. A teeny bit of inflation is from food, but energy has been deflationary, as have core goods.

To be circumspect, inflation is not the only national concern. But it’s not insignificant – it functions like a tax on spending power (though if you happen to be working in one of the careers contributing to service inflation, you’re presumably a net beneficiary – inflation may be bad for nearly all retirees but can easily be good for workers in sectors where salaries have disproportionately risen).

Either way, while the worst may be over, we seem to have a while to go before inflation concerns are in the rear view mirror.

Active ETFs for everything

If you took high school math, you may remember from factorials – indicated by an “!” symbol – that there are many more ways to arrange things than there are things.

If you have four people posing for a photo, you have 4!, or 4 x 3 x 2 x 1, or 24 ways to arrange them. If the people are teenagers, they may exhaust most of these permutations.

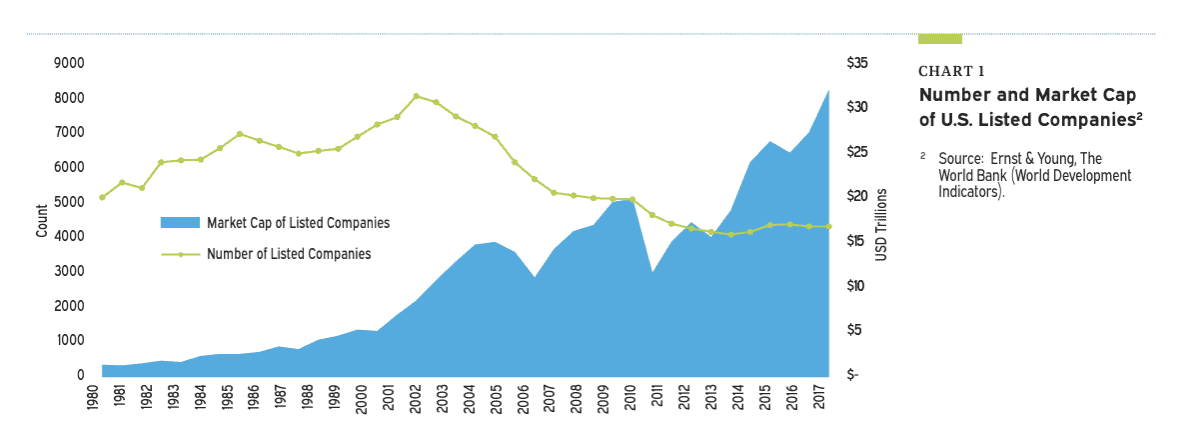

Anyway, there are 4,500 publicly traded stocks in the US (down from more than 8,000 in 2002), versus 3,500 ETFs. So we’re not quite “there” yet (and not all ETFs own stocks), but the number of US ETFs seems destined to eclipse the number of US stocks sooner or later.

(For some perspective, in 2000, there were 80 ETFs and roughly 7,000 stocks.)

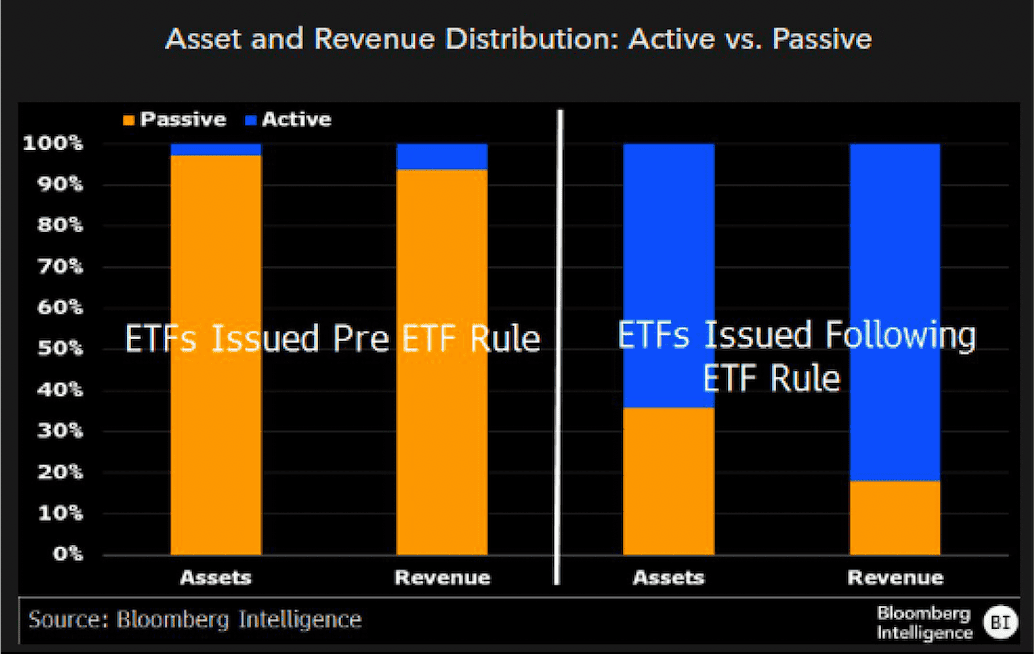

Of note is the rise in active ETFs, and specifically after the SEC’s adoption of Rule 6c-11 in 2019, which made bringing ETFs to market easier. See, ETFs are prima facie illegal under the Investment Company Act of 1940, but the SEC had, since 1992, been manually reviewing each ETF application and issuing something called an exemptive order, which provided exemptive relief from the 1940 Act. But it was a bottleneck-y, queue-based manual process that was holding up the financial innovation show. At least that’s how the SEC came to see it.

For whatever reason, it was holding up actively managed ETFs in particular (I’m guessing because active ETFs, being dicey, may have been less likely to be approved).

Now, the floodgates have been opened. From the Bloomberg graphic below, roughly ⅔ of ETFs created since Rule 6c-11 have been active, and – I’m just eyeballing the chart – roughly 85% of revenues from ETFs issued since then have gone into active ETFs.

How should we feel about this? Mixed. Logistically, financial innovation takes the path of least resistance, and we’re probably seeing active strategies that would have otherwise been mutual funds (or hedge funds, where it’s become very hard to be a startup) pop up as ETFs instead.

With the market for low-cost index ETFs well covered, and ditto for most geographies, new ETFs have to be creative in some way – and while some “buffed” ETFs offer extra downside protection, most new active ETFs are speculative in nature, like GraniteShares’ 3x daily Nvidia ETF.

We could gripe about whether or not these volatile ETFs are doing the market a disservice or not (they add liquidity, but they also add volatility, which detracts from value), but the reality is that they’re getting oxygen from a newer, younger, investor base that’s grown up in a raging market and seems to be OK with blurring the lines between investing and gambling.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.