The Best Reason to Buy Stocks in 2024

Happy New Year, BBAE Blog readers!

It’s been a tremendous year for us at BBAE, and we hope it’s been just as tremendous for you. Here’s a New Year kickoff post with a reminder of why the best time to invest in stocks is most frequently… now.

2023.

The death toll in the Russia-Ukraine war crossed 10,000 civilians.

The WHO declared an end to the COVID-19 pandemic.

The US saw its second- and third-largest banking collapses in history, with Silicon Valley Bank and First Republic bank failing.

A Chinese spy balloon crossed America.

The global average temperature reached 2 degrees celsius hotter than pre-industrial temperatures for the first time in history.

Hamas attacked Israel.

And the S&P 500 rose by nearly 25%.

That’s just the average.

Nvidia rose by 246%

Meta rose by 184%.

And Netflix rose by 191%.

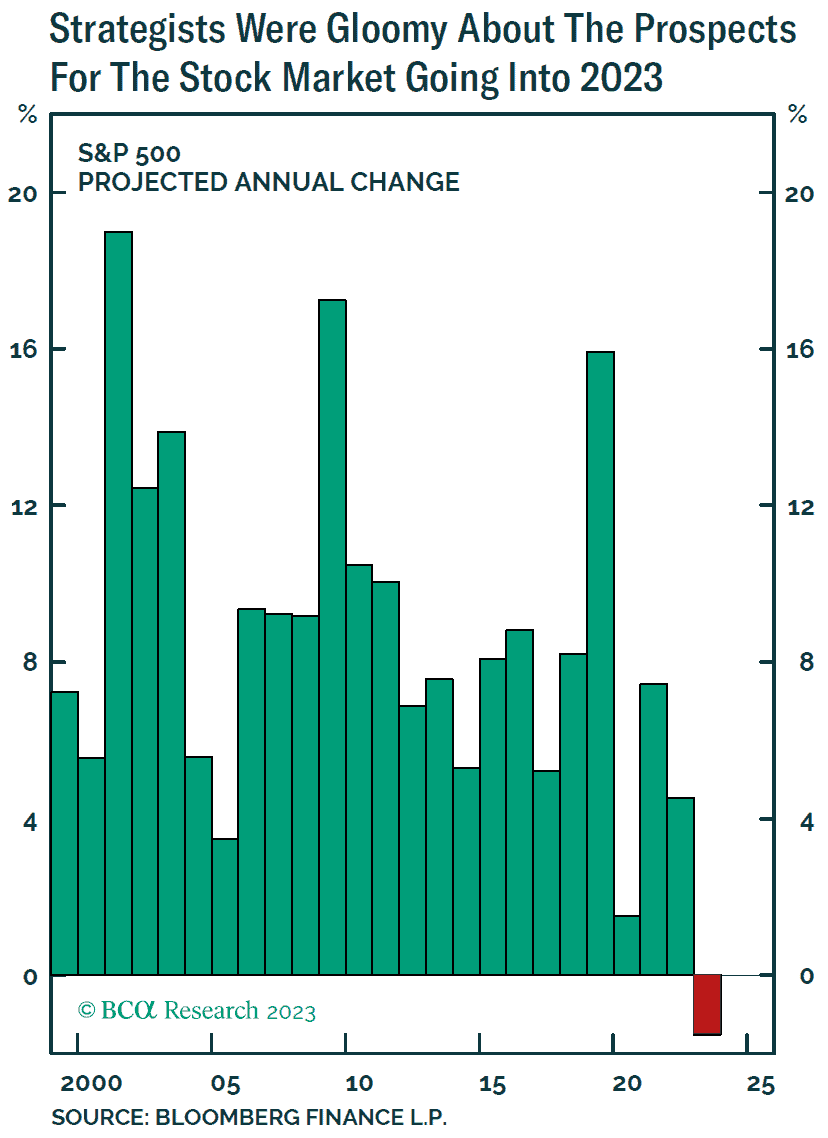

It wasn’t supposed to be this way. The S&P 500 was supposed to drop modestly in 2023, according to “experts.”

Source: BCA Research, using Bloomberg data

It’s easy to laugh at the experts in hindsight. But they had legitimate, smart-sounding reasons for their predictions.

Seven reasons 2023 was supposed to be a bad year for stocks:

- Overvaluation: The S&P 500 started 2023 with a P/E of 23, which is 53% higher than its median P/E ratio of 14.96

- The bull market was over: 2022 began the decline that “everyone” knew that stocks had coming after a 13-year bull run

- High interest rates: The Federal Funds rate went from nearly 0% to more than 5%

- Ukraine and Russia have been at war: The US has allocated $113 billion in aid to Ukraine (it’s sent more than $60 billion of that, according to usafacts.org), and direct costs aside, geopolitical conflicts give world markets the jitters

- Israel is at war against Hamas: The US gave Israel $3.8 billion in military aid as part of a 2016 agreement, and President Joe Biden is seeking $14 billion more

- The US’ national debt is approaching $34 trillion dollars: This compares to $4.2 trillion in annual federal tax receipts

- End of the dollar’s dominance? The BRIC countries, led by China, have been plotting to replace the US dollar as the world’s reserve and de facto trading currency

Somehow, the market didn’t get the memo.

The S&P 500 soared.

That’s the thing about stocks – they tend to go up.

The stock market is, essentially, a barometer of human progress. Yes, mankind faces setbacks, derailments, and cataclysms from time to time, but it marches on. In fact, it tends to accelerate parabolically.

We’ve arguably made more progress fighting cancer in the past 10 years than in the past 100. And perhaps more in the past 100 than in the past 100,000 (or 200,000, or 300,000, depending on your definition of “human”).

For that first 100 to 300 millennia of human existence, the big transportation advancements were horses, boats and wheels. Then, 198 years ago, trains were invented. In 1886, Karl Benz patented a three-wheeled gas-powered car. Now, cars are self-driving and mass-affluent people can go to near space.

The transportation progress made in the last 0.06% of human history dwarfs the progress in the preceding 99.94%.

Progress doesn’t happen all the time in all areas. Google searches are getting worse. The low-hanging fruit of scientific discovery may have largely been harvested, according to this paper in Nature (Park, Leahey, Funk, 2023).

But mostly, we move forward. And that value-creating momentum is what you tap into when you buy stocks.

Most investors are watching the wrong hockey puck

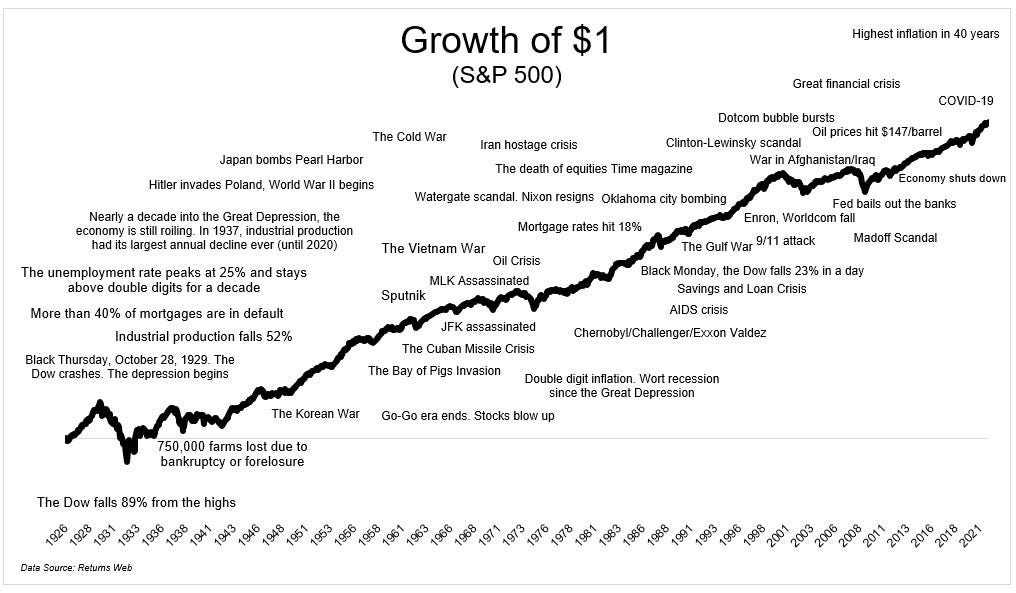

There are multiple versions of charts like the one below (from Michael Batnick) that show the same conclusion: The blow-by-blow news will frequently provide reasons not to invest in stocks, but those reasons have, at least so far, been no more than short-term derailments, at least from the lens of a hypothetical 50-year investing “career.”

This is because humans are just so good at marching forward, and over the long run, the stock market is far more tethered to ongoing human progress than to news.

We should be thankful for that.

You (almost) can’t lose money in stocks…

You definitely can, especially when dealing with individual stocks and shorter time periods, but it’s fair to say that you almost can’t lose if you hold enough US stocks for long enough, if history is a guide.

Here’s what I mean: If you buy and hold the S&P 500 for any 10-year period, your chance of a positive return is 94.6%. If you buy and hold for any 20-year period, your chance of a positive return is 99.8% (data from Ellevest).

Simply not losing money is not a high bar – you can stuff money in a piggy bank and not lose it. What investors want is the propensity to not lose money coupled with a propensity to make money.

The S&P 500 has provided about 10% returns over the long run so, coupled with the probabilities of not losing money above, it’s provided exactly what investors need.

Yet Dalbar Research found that over the past 30 years, the average mutual fund investor got just 4% annual returns.

Research (in particular by Brad Barber and Terrance Odean, but also others) shows that individual investors focus on blow-by-blow anecdotes, like in the chart above, instead of on the steadily progressing line. This causes them to jump in at peaks – after good news – and sell in troughs – after bad news.

What will the stock market do in 2024?

Being the Chief Investment Officer of an investment platform, I am probably supposed to offer some prediction. The Wall Street banks and research houses certainly have.

Morgan Stanley predicts the S&P 500 will go down 12%.

Goldman Sachs predicts it will stay roughly flat from current levels.

Capital Economics, apparently a bastion of bulls, forecasts a 15% rise. Morgan Stanley, Bank of America, Deutsche Bank, Oppenheimer, and others are in the middle.

But a year is an arbitrary time for investors.

Investors don’t need yearly predictions. Yearly predictions are relatives of blow-by-blow news – more likely to throw investors off the right path than to keep them on it.

We should be thankful for this, too.

It’s easy to find doomsayers, but I don’t see an economy that’s doing badly. I don’t see a country or a way of life or a world that’s falling apart, for that matter, either.

Maybe I will be wrong. But people have been saying the world will fall apart since there were people, and it hasn’t happened yet.

To whet your prediction appetite, I’ll share some graphics in turn shared by Sam Ro, who runs tker.co, one of the premier macroeconomic research services on substack. I’m a paying subscriber to Sam’s service and have met him (at Yahoo! Finance’s wonderful conference last month), although neither I nor BBAE have any affiliation with Sam beyond liking his content.

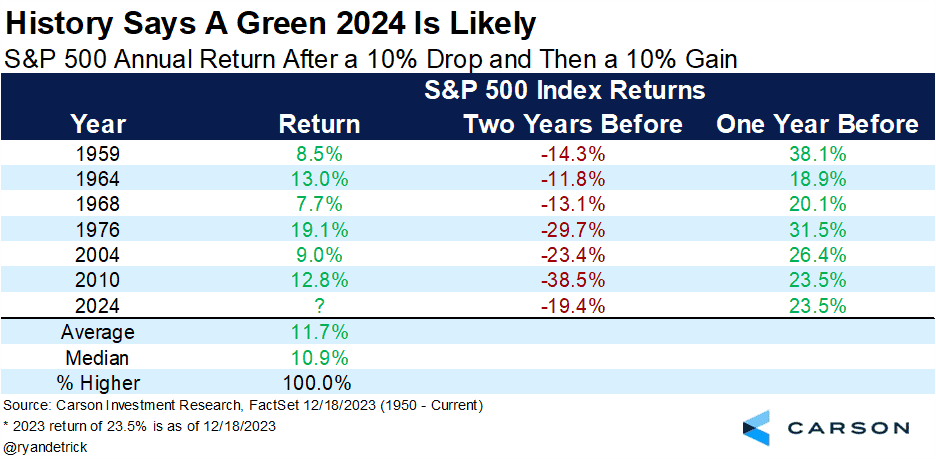

When in doubt, predict a bull market

Sam reminds readers that since 1950, the US has been in a bull market 83% of the time.

The first chart Sam shares is from the Carson Group:

It’s self-explanatory, but indicates good news for US stocks.

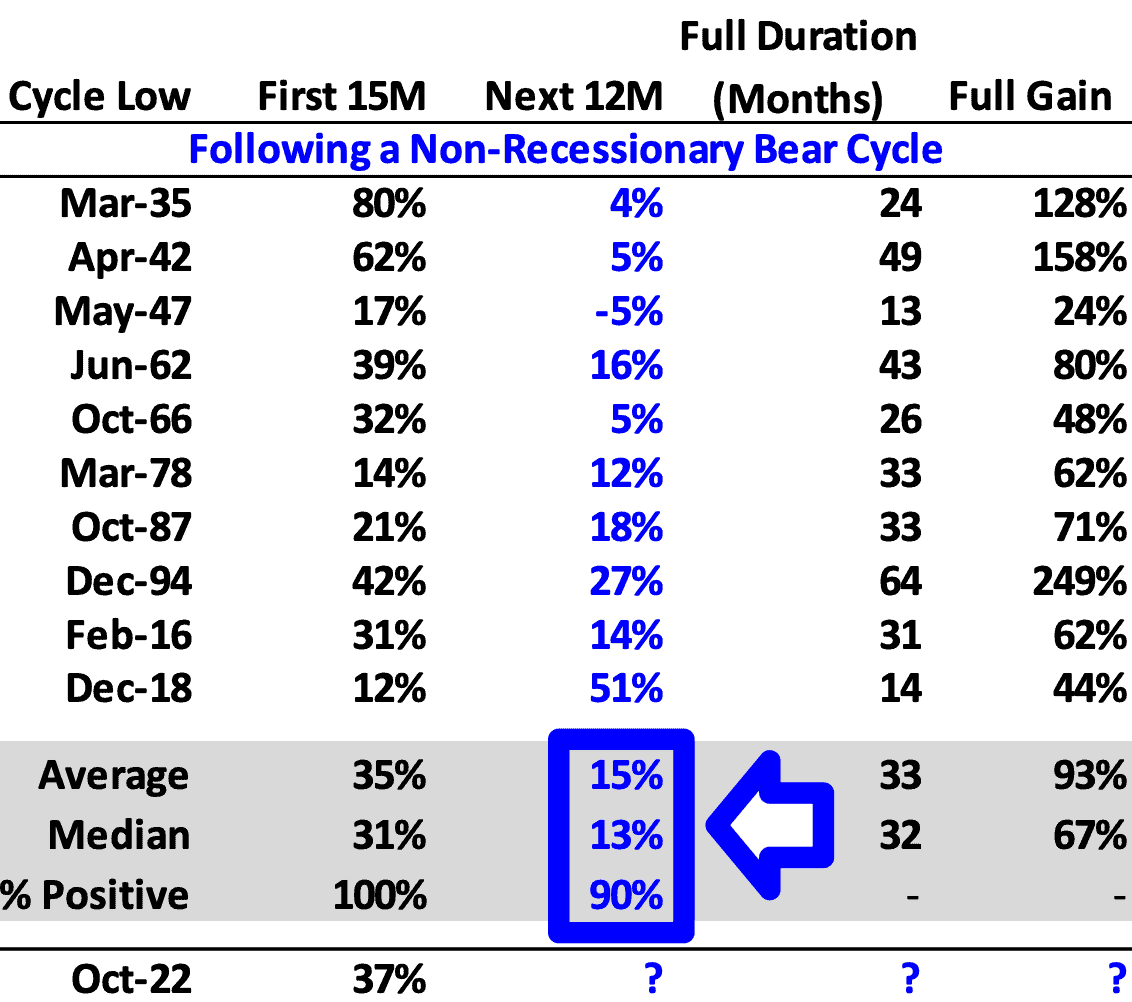

The second table Sam shared is from Ari Ward of Oppenheimer. It’s more wonky. I’m leery of wonky things in investing, because I know how easy it is to commit chart or data crime. But this table could explain 2023’s strong performance after the 2022 (non-recessionary) bear market – while signaling more green pastures ahead.

As Sam said, bull markets happen 83% of the time, or at least have. His conclusions about 2024 from the data he shared are probably right.

But the wonderful thing is that investors don’t have to worry about this. We can just buy the market via an index fund – BBAE has some absolutely wonderful index portfolio products powered by MarketGrader – and if we’re sporting, add some high-potential companies on top of that.

Looking at the Michael Batnick chart from earlier, we can see that it’s almost always a good time to invest if our time horizon is 10 years or more.

That’s something we should be very, very thankful for.

James

p.s. As we step into 2024, know that I’m very, very thankful for every one of you reading this BBAE Blog. We launched this effort in 2023 and look forward to many years ahead. Please don’t be shy about letting me know in the comments what you’d like to hear about – I’d love to hear from you!

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions.