This Investment Underdog Had an Awesome 2023

Americans love stories of underdogs. Stories of unexpected triumph. Stories that evoke the US’ own underdog-beats-the-powers-that-be origins.

I have one for you today.

Let me set the stage first.

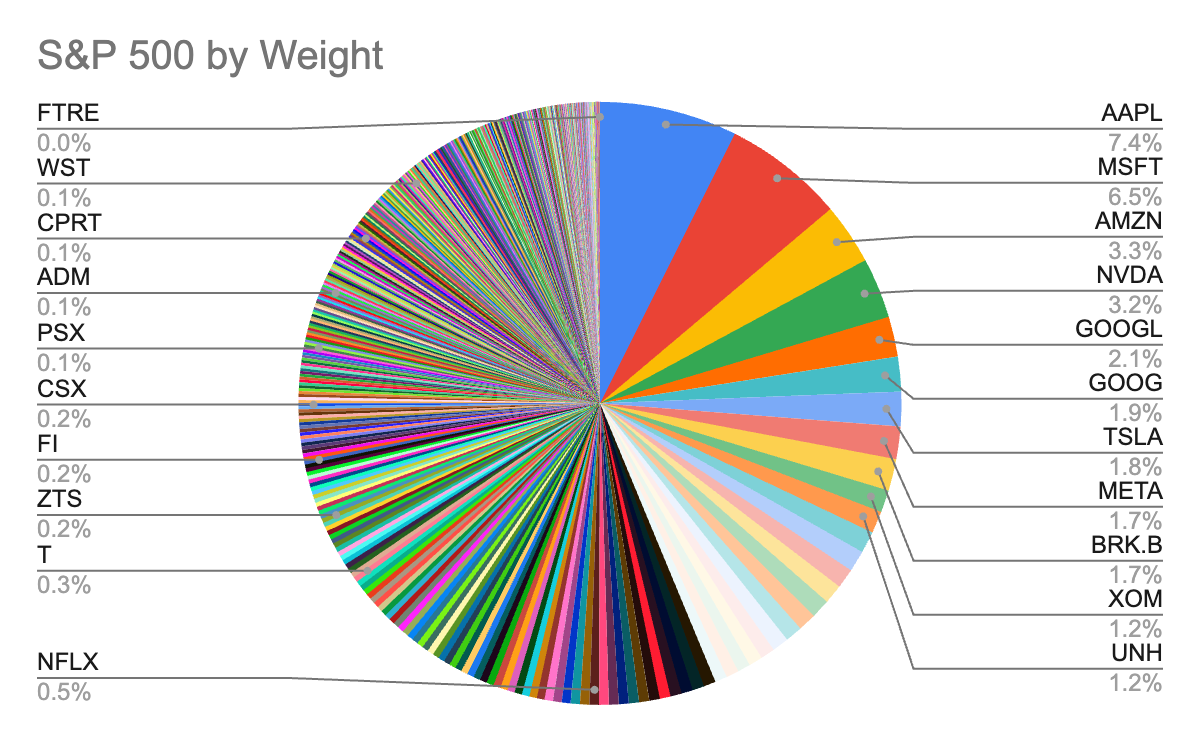

If you read my prior article about the genesis of capitalization-weighted indexes, you remember that a pie chart of the S&P 500 looks like this:

Although the S&P 500 is the de facto large-cap benchmark, most stocks in it are small caps – and most have tiny weights, as you can see by the psychedelic-looking left side.

Weighting indexes by market cap was a step forward from Charles Dow and Edward Jones’ stock price weighting, but it led people to wonder: do index-following investors always get the best performance when the biggest companies have more weight?

No.

In fact, it’s usually the opposite.

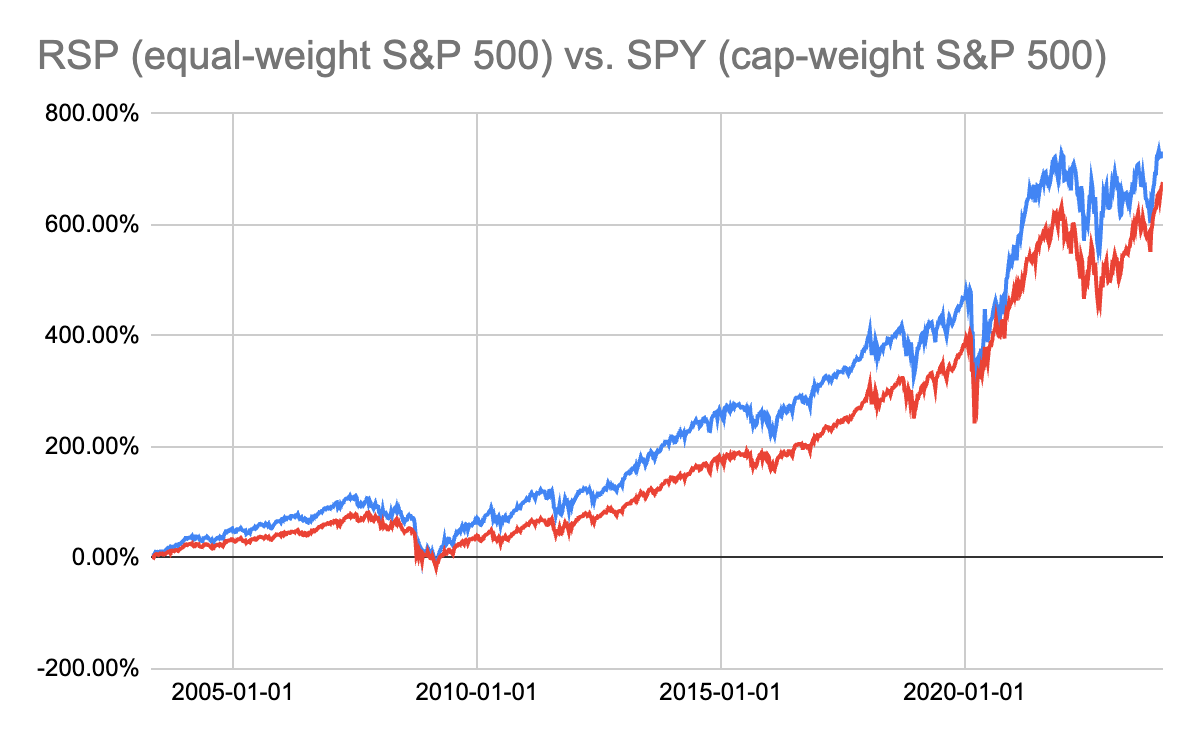

An equally weighted S&P 500 index debuted about 20 years ago. Not coincidentally, the INVESCO S&P 500 Equal-Weight ETF (NYSE: RSP) debuted at roughly the same time.

Despite having more than double the annual management fee (0.20% vs. 0.09% for the SPDR S&P ETF (NYSE: SPY)), and despite being a boring index fund, RSP has noticeably outperformed its cap-weighted brother since inception:

It’s not a fluke: academic evidence has shown small caps to do well, and the equal-weight index gives them more voting power.

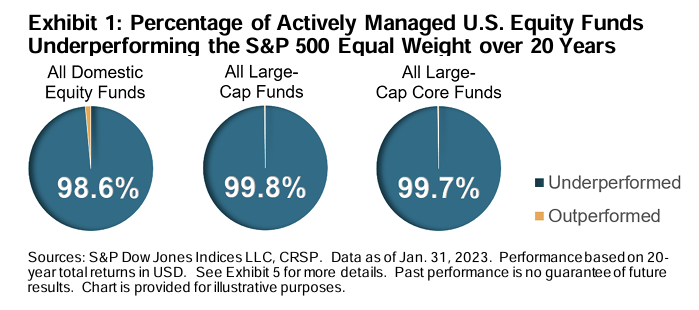

Equal-weight S&P 500 beat nearly 100% of US fund managers

Embarrassingly, if the equal-weight S&P 500 were an active manager, he or she would have earned massive bragging rights by outperforming very close to 100% of mutual funds over the past 20 years.

It would almost seem that you needed only to buy an S&P 500 equal-weight index and your investing life would be complete.

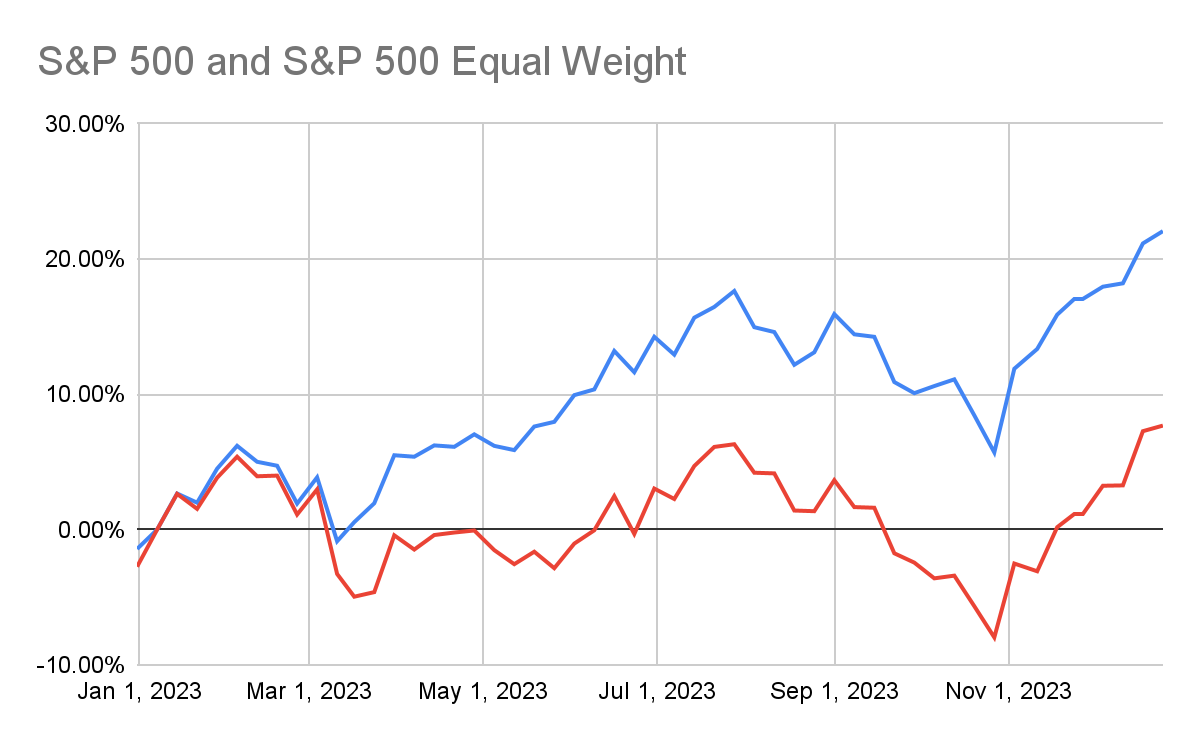

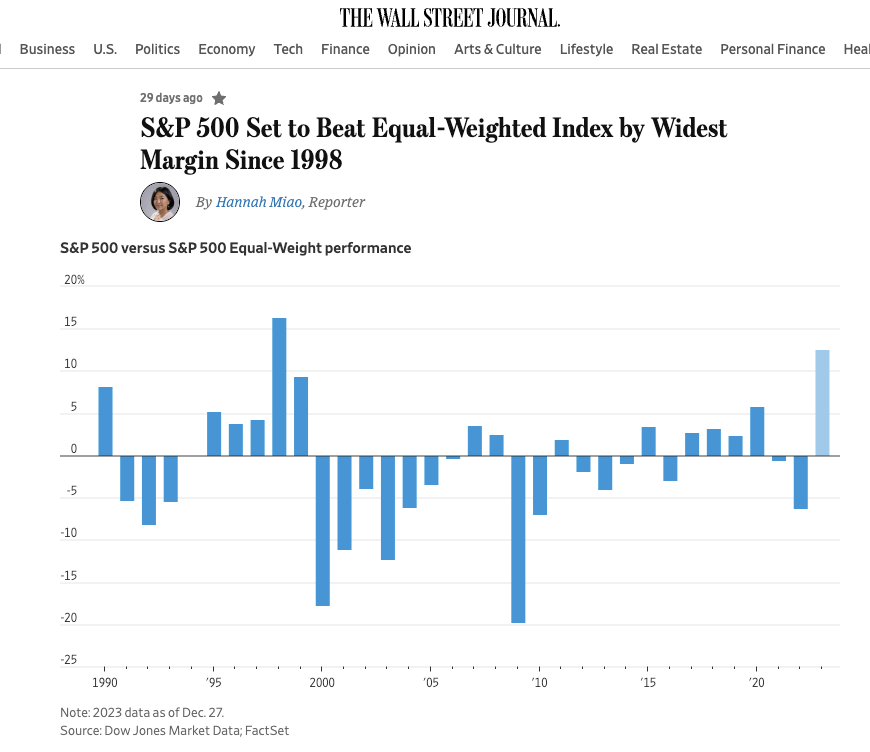

Then 2023 happened:

Different “factors” (reasons stocks move) dominate at various times – size, dividends, growth, etc. – and 2023 was the year of large caps dominating with a vengeance. In fact, only 24% of S&P 500 constituents beat the index in 2023, which is one of the lowest proportions ever.

The Magnificent Seven’s triumph was not a bad thing: these stocks were widely held by investors. It was, though, a low point in the equal-weight’s otherwise-stellar storyline.

Why did large caps trounce smaller stocks in 2023?

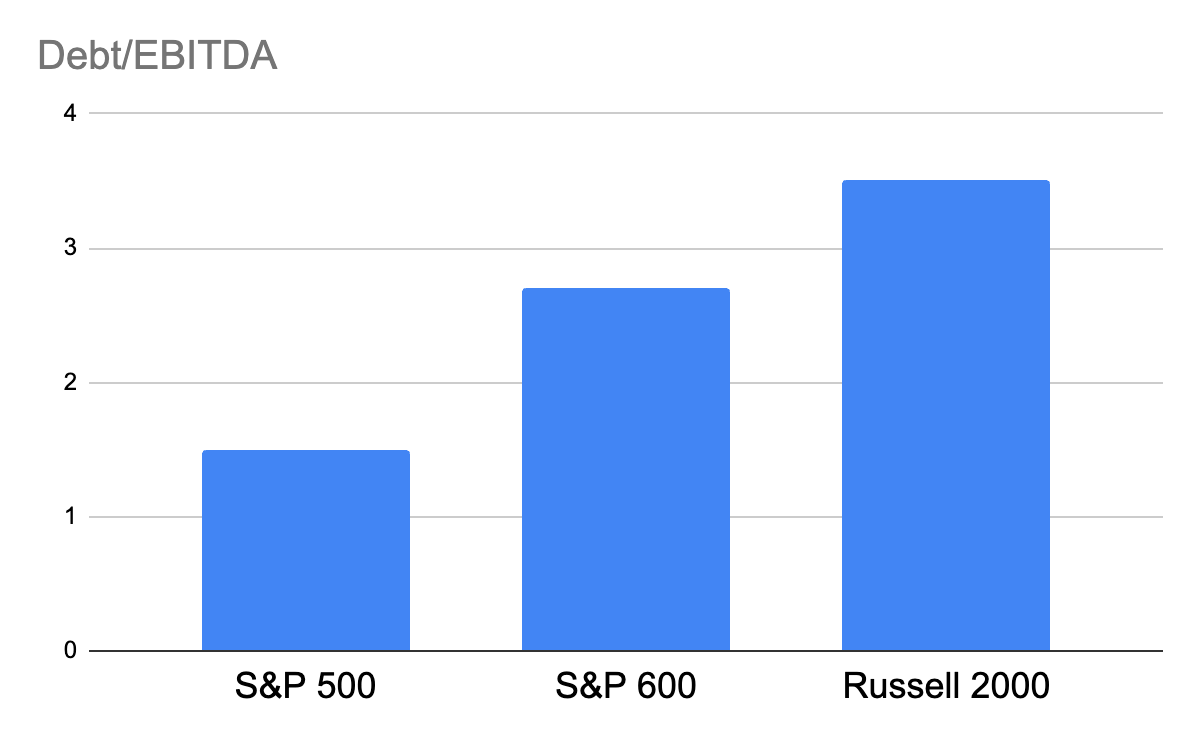

Partly, investors were just fired up about large tech stocks and kept buying them despite rising interest rates. Partly, rising rates slammed smaller companies (which have both more debt and a greater percentage of floating-rate debt than large companies) disproportionately.

Enter: Smart Beta

The term “smart beta” was coined by a consultant at Willis Towers Watson in 2006.

It’s largely a marketing term, which irks some practitioners because it’s used so broadly. (It really irks Bill Sharpe, coiner of “beta,” presumably because of the implication that his beta may be the “dumb” beta.)

Let’s sidestep the nomenclature debate and simply define smart beta indexing as any act of creating a market-ish index using factors aside from market cap or price.

Equally weighting the S&P 500 could be, therefore, a primitive version of smart beta. Again, the main point is to a) make an index to follow – the “beta” part – that b) channels factors other than market cap – the “smart” part, at least hopefully so.

Smart beta has been hot with investors, drawing in half of ETF inflows in some recent years. But not in 2023: actively managed ETFs drew more inflows.

Given smart beta’s track record, though, it’s not surprising that smart beta still has believers and some are asking if this current relative soft spot marks a great time to buy into smart beta funds.

Enter: MarketGrader

“Smart beta” is a broad term, and detractors sometimes make the erroneous assumption that the term connotes only some repackaging of size, value, momentum, and volatility factors. These are frequently used smart beta factors, but they are far from the only factors.

And this matters when judging smart beta.

A firm called MarketGrader is a good example of an exception.

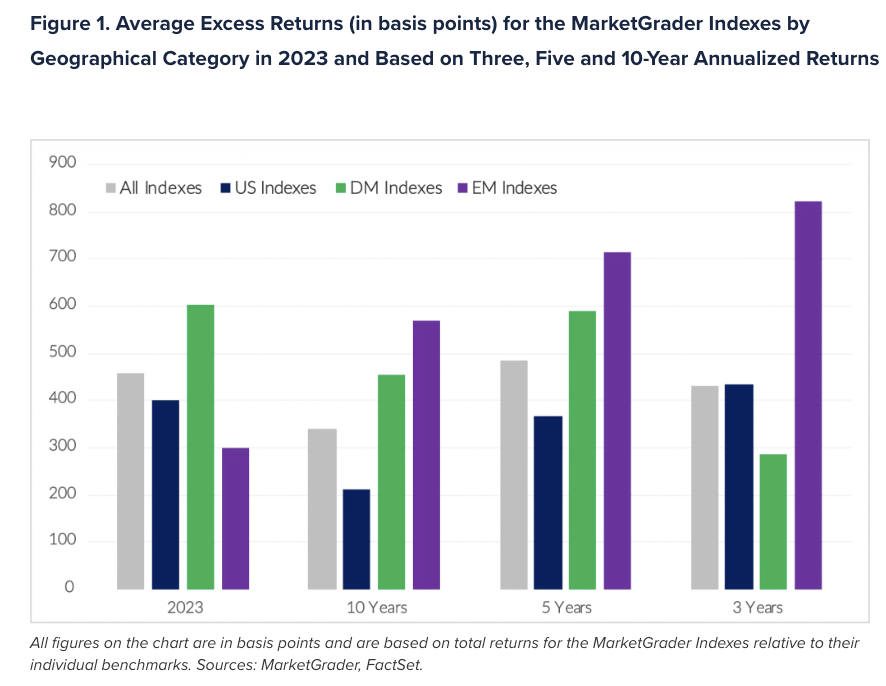

MarketGrader uses 24 separate factors in creating its indexes, instead of the typical few. Its style is largely focused on GARP, or growth-at-a-reasonable-price investing. And it did relatively well in 2023, with 75% of its indexes outperforming their benchmarks. In full disclosure, I brought MarketGrader to BBAE for collaboration, so naturally I smile when I see these good results. But it was the egg that came before the chicken: I brought MarketGrader to BBAE because I knew that for a decade, 47 of MarketGrader’s 52 indexes have beaten their benchmarks annually (47/52 = 90%), by an average of 4.42 percentage points.

Yes, I’m doing a bit of trumpet-blowing here, but I feel that MarketGrader deserves credit for doing so well in a tough environment for smart beta. (Plus, they transparently do their own performance review and put out a report card with the blow-by-blow on what worked and what didn’t.) Sure, 75% outperforming is lower than their usual 90%, but it makes one wonder how well their strategies will do in a market more conducive to smart beta.

In fact, in 2023, only three of their now-64 indexes were negative (two were Chinese and one was consumer staples, which had a notoriously poor performance as a sector).

MarketGrader’s average outperformance across its US, developed market and emerging market indexes remains strong:

BBAE’s MarketGrader Portfolios

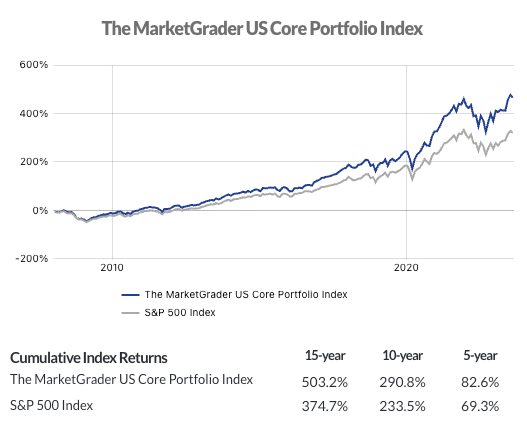

I would be remiss if I did not mention that BBAE offers not one, not two, but three different (and exclusive) MarketGrader products to you, our readers. Please note that because these products are very new – literally created for BBAE – their real-world track records are just starting to build. MarketGrader based the indexes they follow off of high-quality backtests, which is generally held to be the best way to start an index, but keep in mind that the below results are from backtests, and backtests may or may not represent future performance because of different market conditions, tracking error, and other reasons.

- BBAE MarketGrader Core Portfolio: This is a bread-and-butter smart beta portfolio that seeks to deliver comparable-or-better returns as the S&P 500 with similar-to-lower risk.

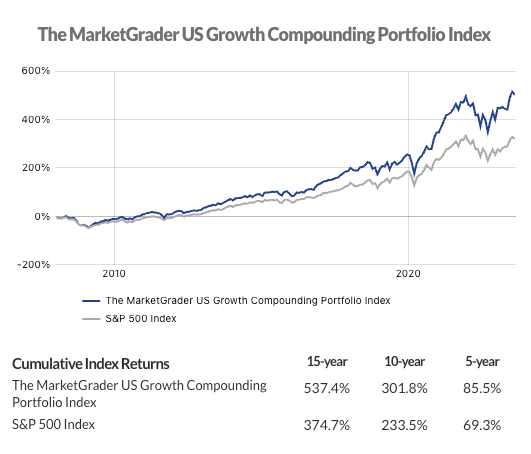

- BBAE MarkerGrader Growth Compounding Portfolio: Think of this as a relative of the Core portfolio that’s designed to be a better fit for capital appreciation seekers willing to take a bit more risk.

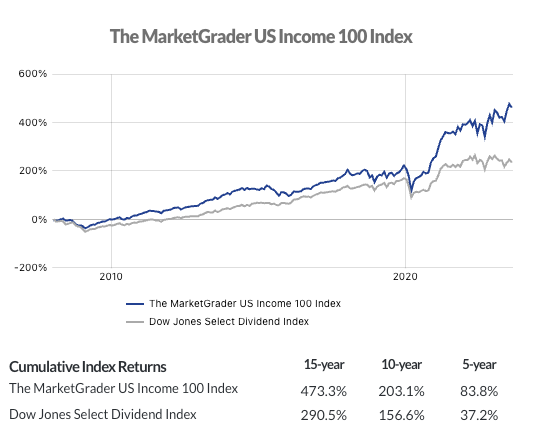

- BBAE MarketGrader Growth & Income Portfolio: This portfolio is especially unique in that it targets a 4.5% to 5% yield and capital appreciation. As a former dividend guy, I find the test results – respectable capital gains on top of a far-above-market yield – to be especially impressive.

I can’t tell you what 2024 will bring for the equal-weight S&P 500, for smart beta writ large, or for MarketGraders’s 24-factor indexes.

But I can tell you that I’m not shy about inviting you to try our MarketGrader products because I truly believe in them. You can take a closer look here.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares of SPY. BBAE has no position in any investment mentioned.