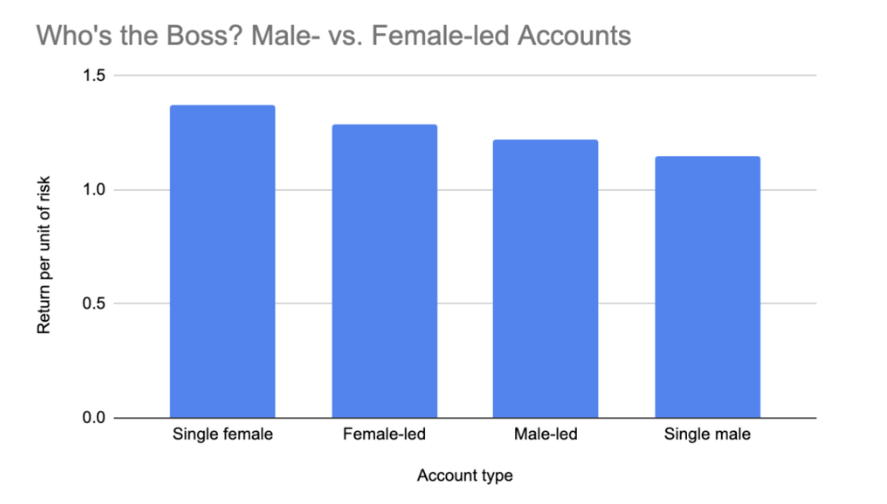

My recent Forbes article on how and why women don’t invest as much as they should won’t be my most popular article. And it’s too fact-packed to win any literary awards. But it’s an article that means a lot to me because it addresses a real problem: Even though women make better investment choices than men when they do invest (see below), they tend to sit on the investing sidelines, missing much of the benefit that decades of compounding wealth through investing bring.

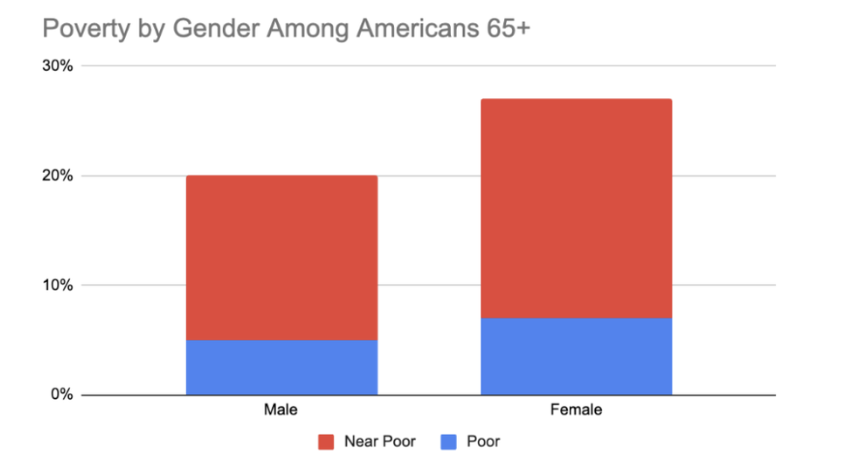

And because of this, at least in part, women are more likely to end up poor come retirement (Especially an issue with single women and single mothers in particular).

Women invest better than men – when they invest

Admittedly, the notion of not investing enough is a first-world problem. Even in the US, scores of people – male and female – are living paycheck-to-paycheck (or worse) and would love to be in a financial situation where they’ve got a steady, decent-paying job, debts paid off, and are accumulating enough savings to worry about how to invest it.

But it’s a problem nonetheless, and we don’t need to be deep believers in Regan-era trickle-down economics to envision that with more women aware of investing, society as a whole would be healthier.

As I mention in the Forbes piece, academic research is showing that women’s low financial literacy is a main barrier for them. I’ll subjectively add to that a related concept: attention and awareness of the importance of investing.

Mental real estate, in other words: If you’re a female in US society, investing isn’t as likely to own a meaningful plot of your mental real estate as it is for guys.

I’m talking statistically – and believe culture is a big driver. It’s slightly analogous to how car repair skills were traditionally passed from father to son a generation or two ago (these days, increasing wealth and increasing car complexity has made this less common).

The good news is that things are changing. They’re changing quickly if you measure change in a generational sense. They’re changing more slowly if you expect it sooner.

More women have started investing proactively

Fidelity found that 67% of women are investing outside of retirement plans now, versus just 48% in 2018. Even if we count COVID-boom avarice as a temporary catalyst, that’s still good progress.

Women have been out-graduating men in US colleges for some time now, to the point that American society has a getting-to-be-big problem with men falling through the educational cracks. Glass ceiling, gender bias, and all, if graduation trends keep up, women seem mathematically on track to at least match men’s earnings in a time-for-money-sense simply by virtue of dominating the higher-skilled jobs.

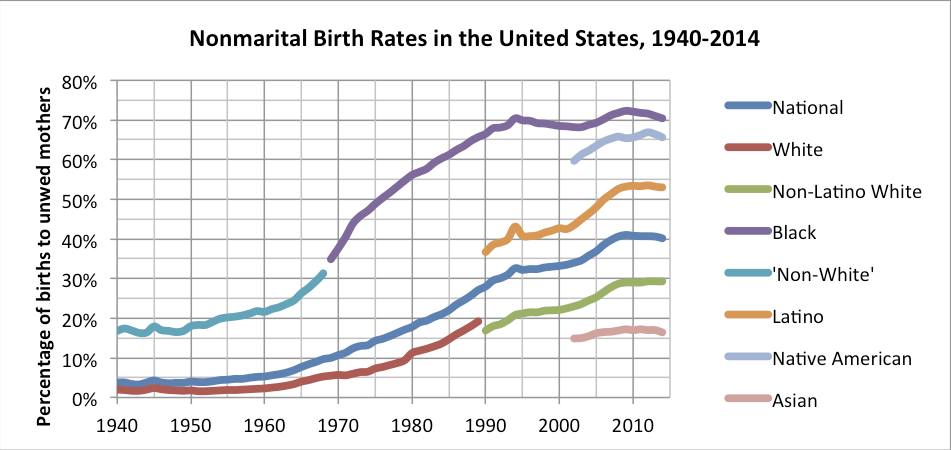

I’ll put in a good word – and financial justification – for striving to keep the family structure intact, even if that’s not how my own life has gone: Families have worked for humans for the past 300,000 years or so – in fact, humans still live together in extended families in many parts of the world today, which both provides camaraderie and shares the burden of child rearing. The nuclear family is largely a 20th century US-led creation that offers a big benefit – career mobility; going wherever the best job is – at the expense of those extended family benefits.

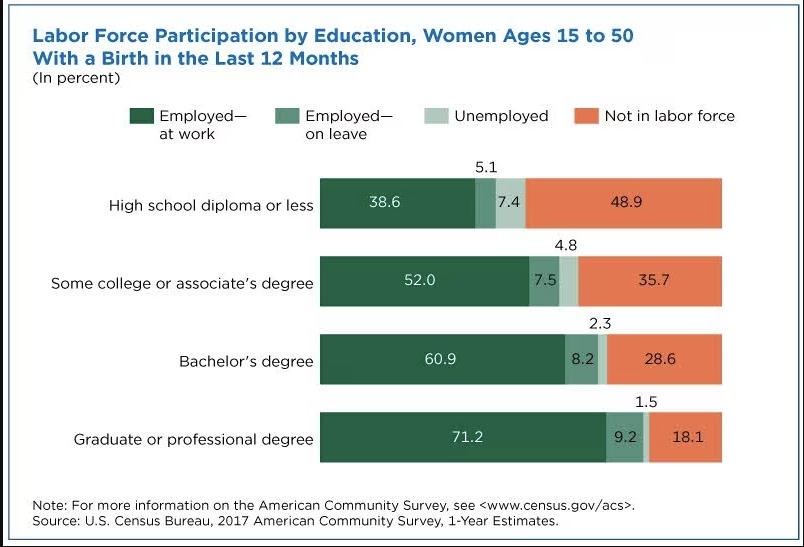

Hardest hit by the non-investing “epidemic:” single mothers

Women entering the workforce caused wages to decline, and caused childcare to be an industry – but good childcare that follows good protocols and has background checks and webcams and makes people comfortable is also very expensive: In fact, it’s 74% of income for single-parent households. If you’re a low-income female, it’s no surprise that you’re much more likely to drop out of the labor force after giving birth than if you earned more: You’d otherwise just be working to pay for daycare, and you’d probably rather spend the time with your kid(s) anyway.

I don’t think staying home with kids is even remotely imperfect – in fact, I think it’s wonderful, noble, and a great contribution to society. Rather, my point is that as we’ve moved from extended families to nuclear families to single-parent “families,” while at the same time shifting to well-being in retirement depending less on family support and more on how much lifetime wealth compounding each solitary individual participates in, it’s clear that families, rather than single women – who must take time off for kids, and for whom the grueling hours or frequent travel of many high-paying careers are often not realistic – are financially better fit to be the units having kids.

Of course, nobody sets out wanting to be a single parent. But it happens – a lot, unfortunately. And while there may be a few unwed dads willing to help support their kids’ unwed mothers through retirement, I’d bet it’s just a few.

Getting more women aware of the importance of investing, financially literate, and participating in investing from an earlier age won’t fix everything, but it will help – immensely. Even for high-earning professional women in happy marriages, who wouldn’t want to reach retirement a lot wealthier?

Women’s retirement wealth benefits women – as well as entire families. But retirement wealth starts with investing – ideally, as early as possible.

Now that participating in the stock market has become a prerequisite for a comfortable retirement for just about anyone, let’s hope that shifting cultural norms and financial literacy trends align to make this happen for just about everyone.