Weekly Roundup: 2024 Fantastic for Stocks, Staying Invested, Gold, Small Caps

US Market Having a Better 2024 Than Anyone Expected

Great news: US stocks are outperforming the highest of the high expectations.

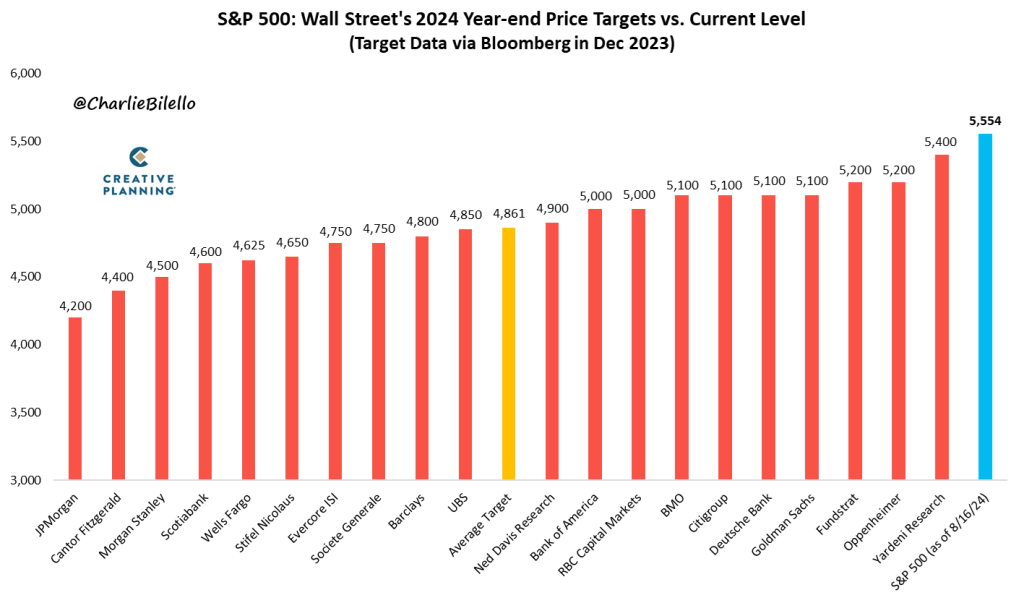

I remember giving a talk in December in which I showed a chart of how dispersed various investment bank/research 2024 shop price targets for the S&P 500 were. At the time, many of them had been drifting up as the market rose, which I joked about at the time.

Turns out, they were all wrong.

As Charlie Bilello’s chart shows, the market is blowing past all the pros’ expectations. While I don’t know each bank’s exact logic (and candidly, year-ahead guesses for the market are just that: guesses, versus scientifically applied logic), I’d wager that the Fed’s thus-far soft landing plays a big role in this big outperformance.

The sidestory here is that predictions just tend to be really, really wrong. I’ll share more data on this topic in a future piece, but in a social science like economics, hardly anything is predictable, offensive as that may be to predictors.

A Reminder to Stay Invested

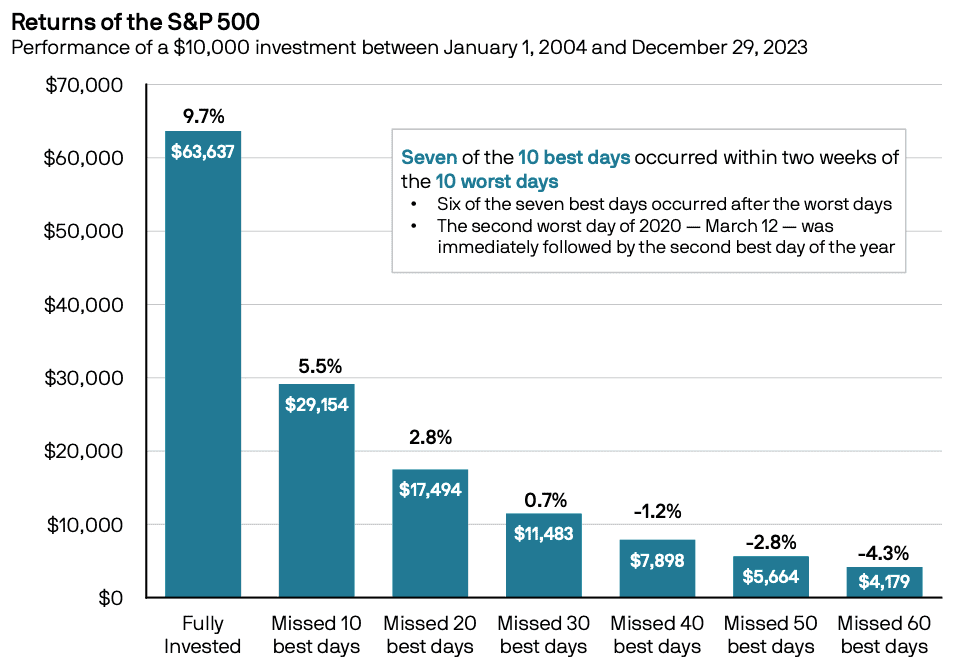

I’ve talked about this a lot, because it needs to be talked about a lot. The US stock market has a great history of usually going up, but that up-ness is very non-incremental (ditto for downness, for that matter): Just a handful of days (and a handful of stocks) are responsible for nearly all of the aggregate movement, and it’s safe to assume you’re not able to jump in and out in such a way as to only get the best days while avoiding the bad ones.

Sam Ro of Tker.co recently shared a JP Morgan graphic with some updated data along these lines; it’s quite similar to a graphic I’ve shared in the past, but for this particular point, I don’t mind being slightly repetitive.

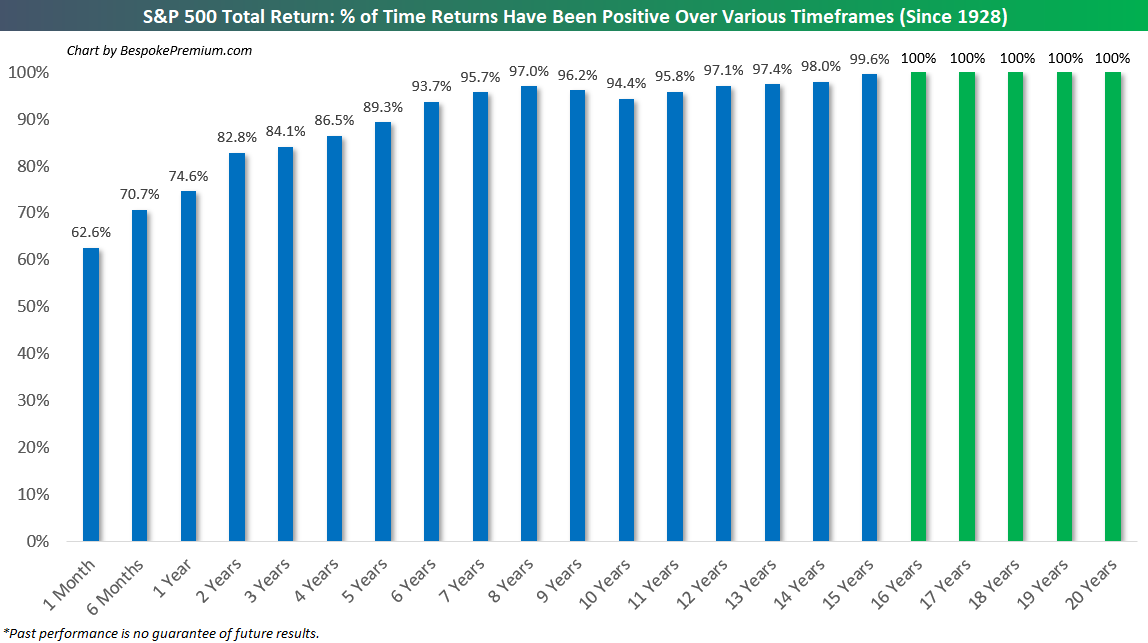

Speaking of Sam, he also recently shared a Bespoke Investment Group graphic showing that at least from 1928 to present, you’d have had a hard time losing money in an S&P 500 index fund if you’d held long enough.

I know from Dalbar Research that the average US mutual fund investor has, at least over the past 20 years or so, earned roughly 4% annually when the market returned 10% annually, so the real problem is people either deliberately trying to time the market, or accidentally doing so, by buying during periods of peak excitement and selling during moments of peak despair. (Case in point: In 2021, a bull market year, more money went into US stocks than in the previous 19 years combined.)

So please, do your best to not be one of these guys.

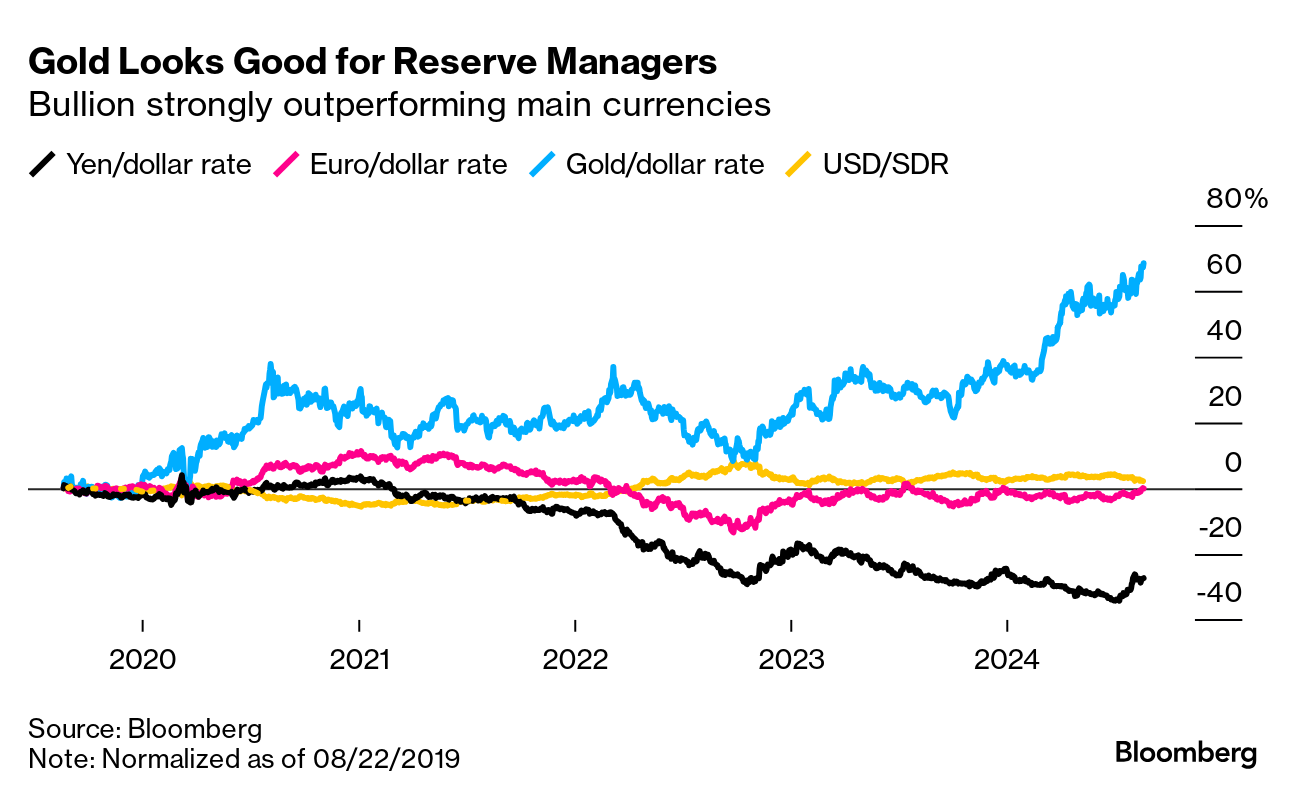

Record High Gold Prices

Gold bugs, delight. A slightly weakening US dollar along with an extremely likely US Federal Reserve rate cut in September have pushed gold to all-time highs.

Here’s a three-year chart of the US dollar relative to a basket of currencies. It hasn’t weakened tremendously this summer, but presumably geopolitical fears were enough to spook investors into more gold, and when any country’s interest rates drop, that country’s bonds become less attractive to outside investors, which lessens currency demand.

Gold tends to be a religion for a certain group of investors, and many of them are convinced that long-established governments are going to implode any minute. I’m not like this, and I’ve considered them biased tribalists (many were saying US and UK inflation were untameable, and they were dead wrong about that, and likewise, they were dead wrong about the US dollar blowing apart when the Fed dropped rates after the Global Financial Crisis – the dollar rose). Generally, these folks have tended to underestimate the US economy, but as Charlie Morris pointed out to me in a recent BBAE interview, gold has outperformed the S&P 500 since 2000.

To be fair, that’s impressive. I own a bit of a gold ETF, but I’m wondering if like many other things these past few years, gold is showing bubble tendencies.

Money Leaving China

Nothing directionally surprising about this, but I was surprised by the suddenness and the magnitude of the change. The question for investors is this: Chinese stocks (those trading on US exchanges as American Depositary Shares, or ADSes, which are pieces of larger blocks of “foreign equivalent” securities called American Depositary Receipts, or ADRs) have appeared beaten down for a few years.

Along the way, various pundits – in each case, comparing current Chinese stock valuations to prior ones – declared: “Chinese stocks are cheap; it’s time to buy.”

Except it wasn’t.

Now, will there eventually be a bottom from which Chinese stocks do finally rebound?

Maybe. The one thing I would not do is liken the history of China’s market to that of the US, as US investors are often tempted to do with nearly all emerging markets.

The US market has always come back from whatever ill has befallen it. US investors implicitly “know” that stocks always come back. But technically, that’s better written as US stocks have always come back.

It’s probably not a stretch to think: Because US stocks have always come back, they likely always will come back. It’s a much bigger stretch to think: Because US stocks have always come back, foreign stock markets, too, will always come back.

Chinese stocks may come back – I’m not saying they won’t. But I don’t think it’s smart to buy them (or any non-US stocks) simply because they’re trading for a lot less than they did in the past.

Mean reversion isn’t as guaranteed elsewhere.

Small Caps Poised to Rebound (or Not)?

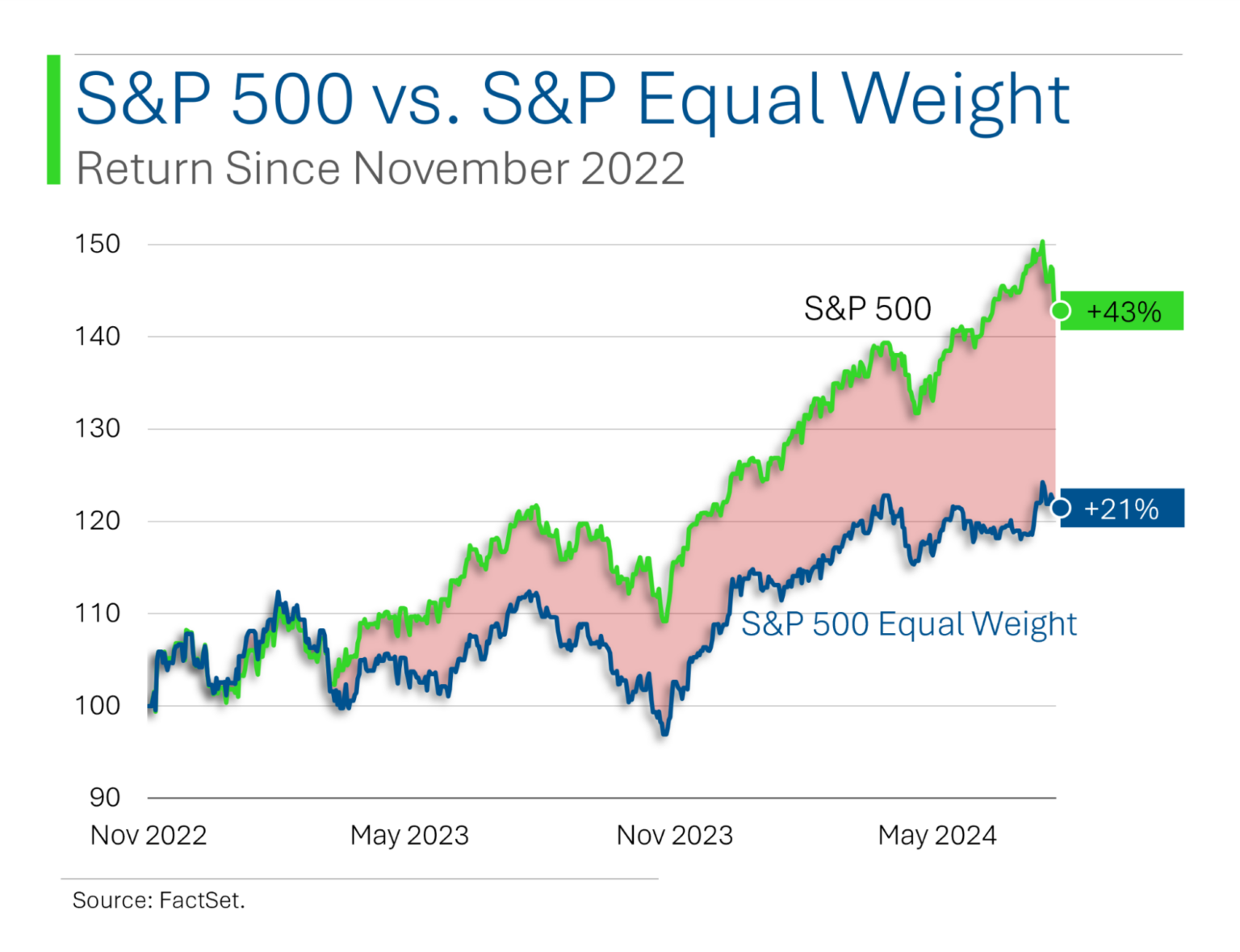

Speaking of mean reversion, another visual to complement another point I’ve made before: Small caps still look cheap relative to the overall US market:

The S&P 500 Equal Weight index isn’t even a purely small-cap index, but it takes a step in that direction by democratizing the weighting.

While I’d definitely bet on mean reversion here – not only is this the US market, but historically, the S&P 500 Equal Weight has outperformed its more famous cap-weighted brother – remember that mean reversion for two variables can happen by one going up or the other going down (or a little of both).

Small caps might see multiple expansion, for instance, as interest rates fall (smaller public companies tend to have a lot more debt, with more at variable rates, too, though they’re also more domestically focused and thus more sensitive to the US economy), or the pricey large caps could just get cheaper.

Don’t believe anyone who says he (or she) knows absolutely, positively for sure which one will happen.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.