Weekly Roundup: A Good S&P Year Ahead, China Stimulus, Chat GPT ETF, Cheap REITs

Rate cut at market high = decent returns to follow?

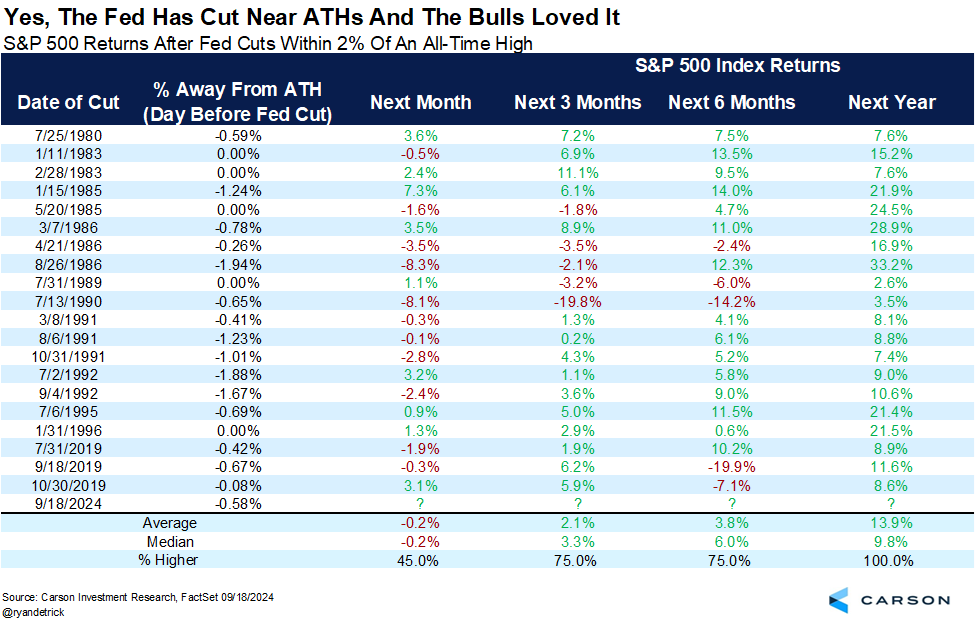

My mental bar for data mining gets lower by the year (data mining is where someone wants a certain thing to be true and thus hunts for or cherry picks data to support it; because economics and finance are overflowing with data, this tends to be easy to do), but Ben Carson showed a chart (cited as well by Sam Ro) illustrating that since 1980, decent returns have followed with the Fed cuts rates when the S&P 500 is within 2% of an all-time high.

The average next-year return of about 14% is a bit above the S&P 500’s long-term average, and the median return of about 10% is very close to it. Not earth-shaking, but good enough for most investors.

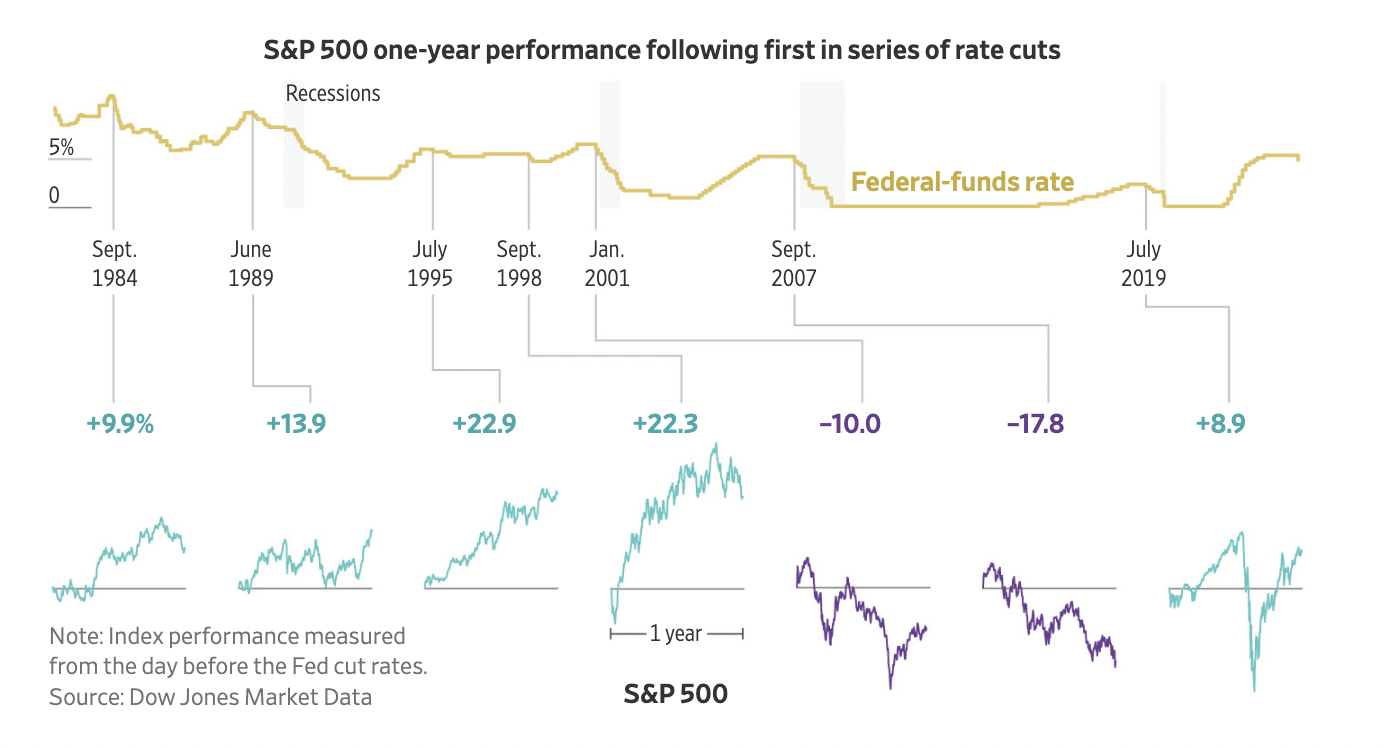

The Wall Street Journal posted a similar article with a different-looking-but-same-in-substance graphic showing that generally, the market goes up following rate cuts. (The gold line is the Fed Funds rate, and the mini-charts below it are the year-after price movements following cuts. The takeaway is that five out of the seven post-cut years are positive.)

The Journal notes, correctly, I believe, that the market future really hinges on the economy.

I tend to take “this is what has happened in the past”-type logic at 50 cents on the dollar. As the failure of the inverted yield curve as a recession indicator shows (some might point out that the recession is supposed to come when the curve re-inverts, which is… now), this time can be different when it comes to past patterns.

China Stimulus

The CSI 300 Index rose 4.3% and then another 1.5% following a huge and wide-ranging stimulus from China (recap article by my friend Jared Blikre of Yahoo! Finance). I think the optics are great: The People’s Bank of China (PBOC) even held a press conference and took questions – transparency practically unthinkable in normal times – which shows, at a minimum, that the government is taking China’s economic issues seriously enough to upgrade its response playbook. On the monetary side, they appear to be doing what they can. Nothing has been announced on the fiscal side yet.

There’s a history, though, of the Chinese market reacting positively to stimulus news in the near term – as a momentum trade – and then going right back to the way it was before a few days or weeks later. I can’t predict what will happen this time. As I told the BBC, much of the announced liquidity-enhancing efforts technically make liquidity available; they don’t require its use. You can lead a horse to water, but you can’t make him drink.

State governments will likely use PBOC loans to buy unsold apartments. Insurance companies may use state financing to buy stocks (and this is probably the most direct driver of the stock bump). Will ordinary citizens buy more apartments now that mortgage rates and second-home down payment requirements are down? Maybe? Easier financing will help on the margin, but across the world, when people feel worried about the economy, they tend to be less eager to take on debt.

Still, there’s no such thing as a one-size-fixes-all simulus, so as long as Chinese markets and PBOC alike see this as one of many steps forward, it’s a step in a positive direction.

ETFs based on ChatGPT trying to approximate top investors

Matt Levine of Bloomberg recently talked about a story that was too juicy not to talk about here.

Financial academics like to distill things to quantitative essences, which they can more easily measure, manage, and manipulate. For instance, Matt shared a paper whereby AQR Capital Management attempted to reduce Warren Buffett to two factors.

A new company called Intelligent Alpha (press release here) is using ChatGPT, Gemini, and Claude – which it collectively calls its “investment committee” – to mine publicly available information, in particular including qualitative communications, from and about these prominent investors and create ETFs that match their vibe.

From the prospectus:

“The list of personas targeted by the ETF — besides Buffett, Druckenmiller and Tepper — will include Dan Loeb, Paul Singer and others, though the fund’s holdings may not necessarily reflect the real-life bets by those investors.”

CEO Doug Clinton, who I noticed had a pretty amazing body transformation, per below – I’m wondering what his fat-loss secret is – digs Levine’s writeup.

Should you buy these ETFs?

I can’t say, of course. Matt points out that the prospectus indicates a lot of human intervention. For a quant strategy, that would generally be frowned upon. These ETF strategies are computer-generated, but I’m not sure that should count as quantitative if the picks are coming from a large language model. Or should it? It’s new territory for us all.

The irony Matt concludes with is that the normal theoretical appeal of computers for investing is that they’re infallible – or at least they sidestep human flaws (of which there are many). Humans represent the flawed execution of an ideal, whereas machines can execute the ideal ideal.

Except with ChatGPT robo-ETFs, in which case a machine is hoping to approximate a presumably fallible facsimile of a flawed human.

REITS have room to run – but you have wait for it

Friend of BBAE Roger Conrad is a dividend guru. As a former dividend guru myself, I have a soft spot in my heart for fellow dividend gurus.

Roger is most known for his energy expertise, but if he has a “minor,” it’s in REITs – real estate investment trusts. And Roger says the Fed rate cut is good for REITs – sort of.

High rates were bad for REITs in capital markets because yield “competitors” – debt-based investments (bonds, CDs, etc.) – pay more. They were also bad for REITs operationally because they stalled acquisitions and made new developments costlier, Roger notes – in fact the S&P Real Estate Sector Index dropped by ⅓ during the rate-hike period from January 2022 through October 2023 – and that’s including some big gains from data center REITs, which have been the exception.

I’ve talked in these pages about the woes of commercial real estate: Compared to housing, commercial property transactions are few and far between, so downturns take time to show effects, but now that the “marks” are coming in low, the “comps” get marked down, bank collateral gets marked down, and a nasty circle ensues.

The Wall Street Journal, and many others, have spilled a lot of ink on this topic.

Roger points out that the S&P Real Estate index rose nearly 40% in the past year in anticipation of lower interest rates – although ironically, REITs dropped after the Fed’s 50 basis point cut, presumably because Jerome Powell didn’t seem confident enough about a bold rate-cut path beyond this first cut.

Roger jumped on the BBAE podcast recently to talk about an apartment complex REIT he really likes. Housing has been underbuilt, and 3% mortgages have trapped would-be sellers in their properties – keeping supply off the market – because nobody wants to sell and buy half the house for the same monthly payment unless they absolutely have to. We may not see 3% mortgages again, but rate cuts help at the margin.

Roger’s new view is nuanced: He’s bullish on REITs, but only in the long term; he thinks REIT price increases have closed the valuation gap in the near term. And he thinks the REIT market is a stockpicker’s market – some will thrive and some will plunge. In other words, the REIT sector is not a sector you want to invest in via ETF, if Roger’s right.

Expensive Health Insurance

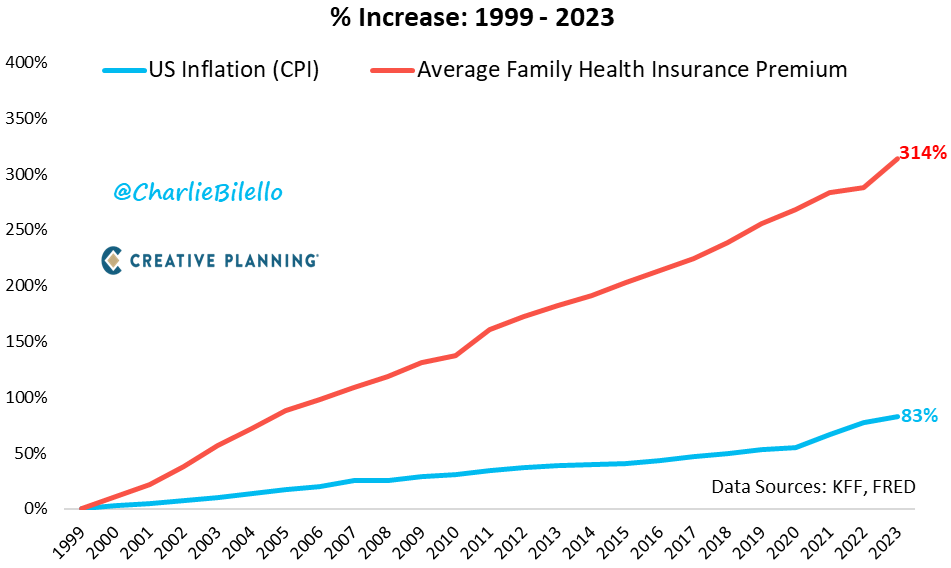

I’ll keep this one quick. If you’ve been feeling like your health insurance is consistently becoming more expensive, you’re right. A graphic from Charlie Bielello of Creative Planning shows how much health insurance costs have inflated relative to overall CPI for the past quarter century.

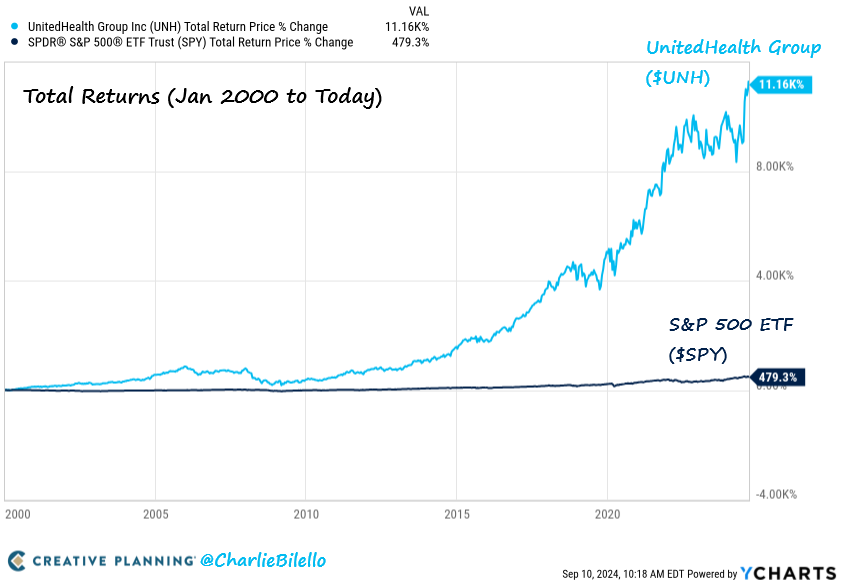

It’s bad for you, but it’s good for someone else – and that “someone else” is the health insurance industry. Charlie shows the chart of UnitedHealth Group (NYSE: $UNH), the largest insurer in the US:

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares in SPY and VOO. BBAE has no position in any investment mentioned.