Weekly Roundup: Good Inflation News, WSJ Likes Small Caps Now, Recession Update

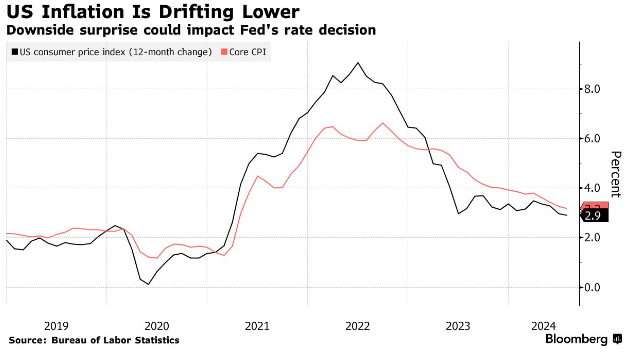

The best big-picture news of the week was that the CPI (one measure of inflation) rose by the lowest amount since early 2021 – just 2.5%, annualized – through the 12 months ending at the end of August. If that doesn’t sound that dazzling, it isn’t. But it is a positive thing for the economy.

Readers with young eyes or good glasses can see that red-line core CPI – which removes food and energy (on one hand, they’re still real costs; on the other, they’re especially volatile, so analysts often wonder what inflation looks like without them) – is a touch higher than all-in CPI.

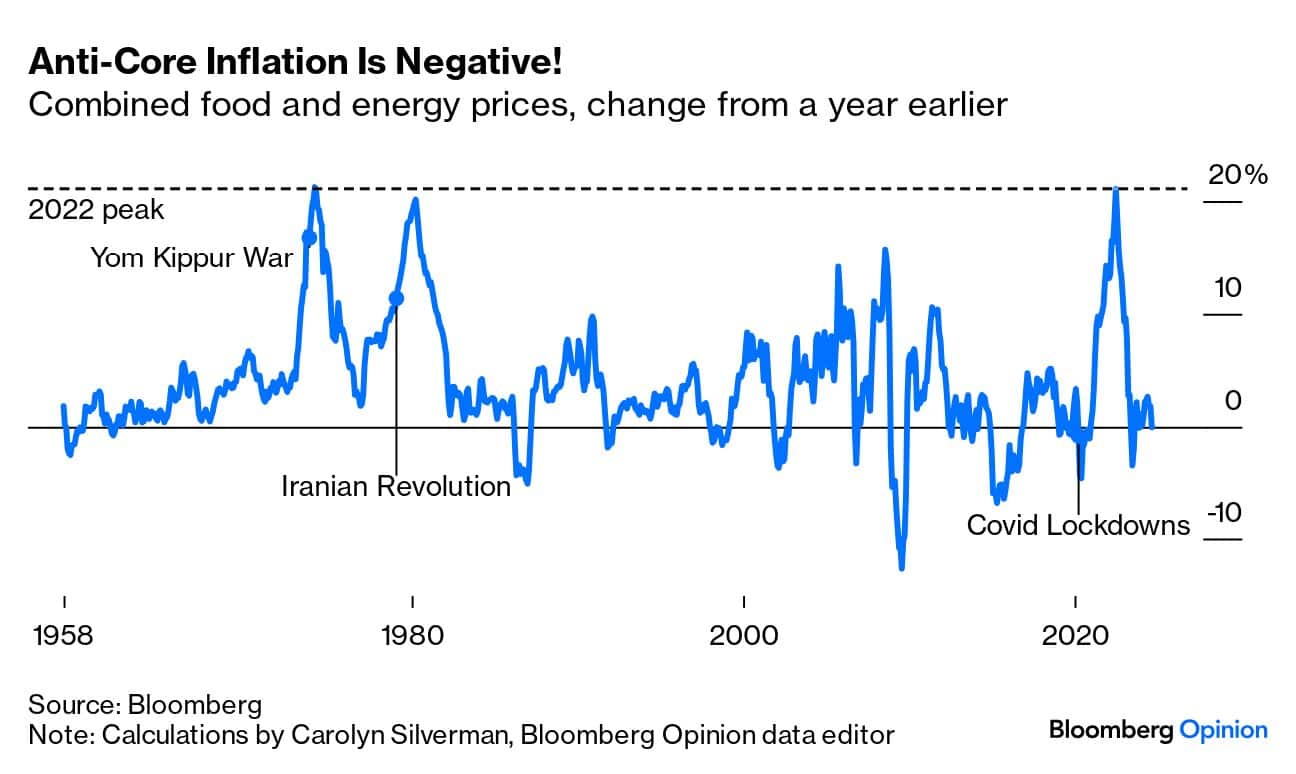

That’s because food and energy volatility is moving in the right direction, thanks to falling oil (and thereby gasoline) prices:

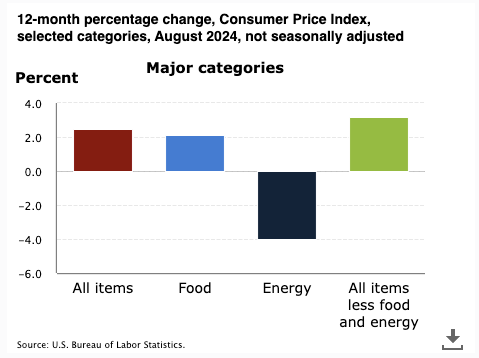

In fact, it’s all from energy – food is still inflating, albeit less than overall CPI. As Bloomberg’s John Authers points out, oil has deflated so much that even combined with food, food and energy as a group are inflation-negative, which happens now and then, but not terribly often:

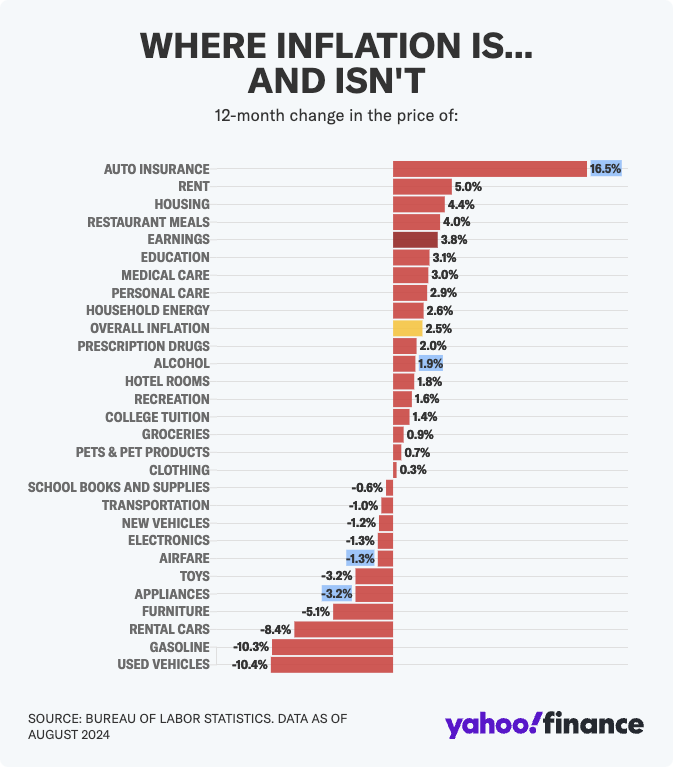

The BLS has a line-by-line breakdown of inflation (or deflation) line, but here’s a quick graphic from Yahoo! Finance showing highlights:

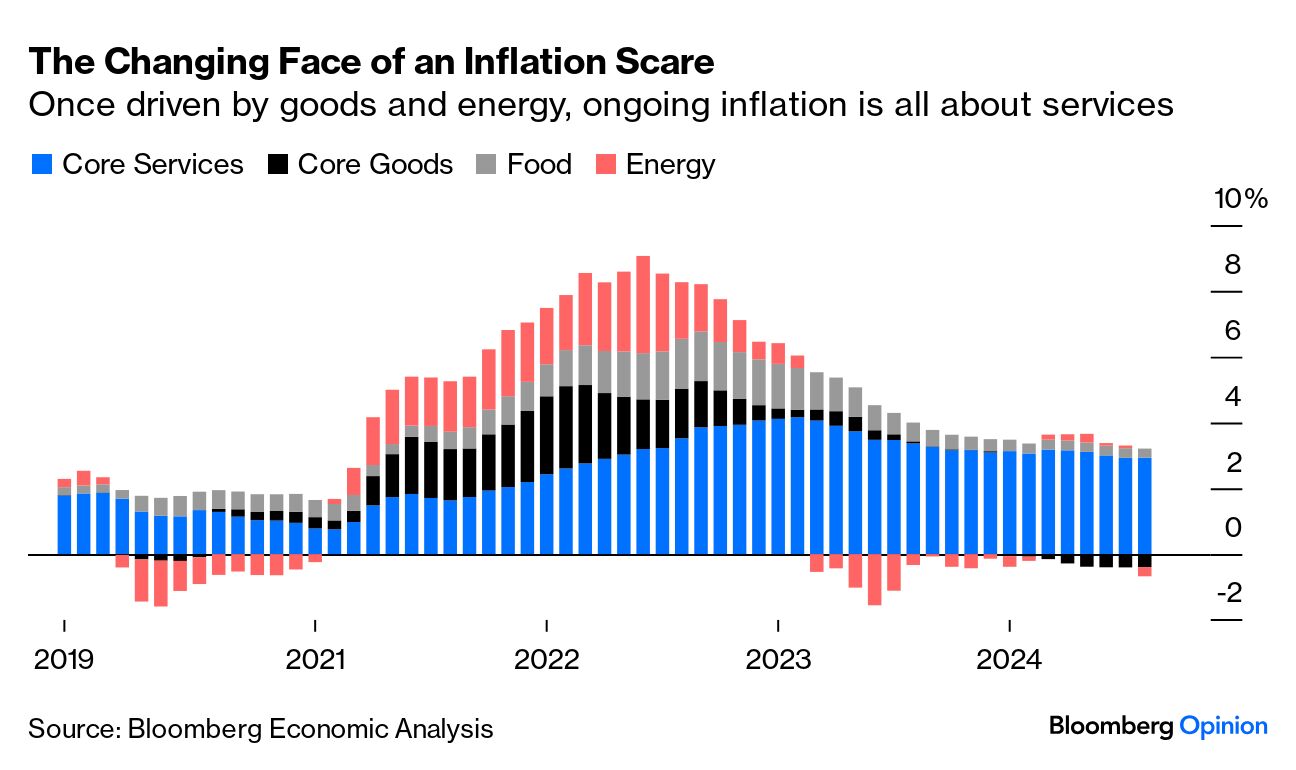

Bloomberg has been doing such a good job with visuals lately that I’ll share two more. The first shows how big the services category, in blue below, has been to overall inflation. If you hear anyone talking about “stubborn” inflation, you can tell them, if they don’t seem like they already know, that it’s really just service inflation that’s stubborn. But stubborn it is:

Economics is seldom about anything in isolation. Inflation coming down nicely is a good thing. The Fed targets about 2% inflation, but 2.5% is getting close.

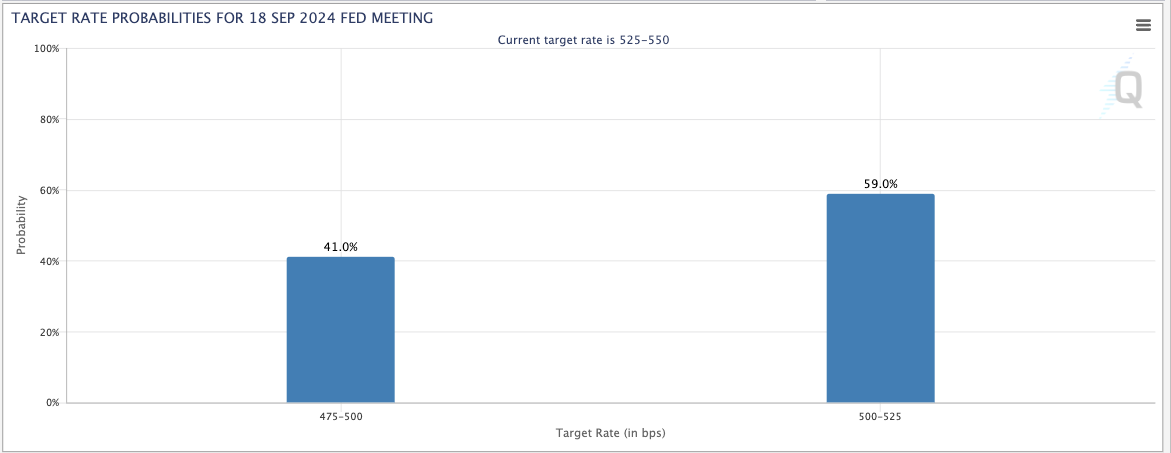

Markets have been positive. The S&P 500 is up roughly 1.6% over the past five days, as I type this. But the reason they’re not even more positive is the expectation that the Federal Reserve will go lighter when it cuts rates in a few weeks – investors are betting that a 25 basis point cut is more likely than a 50 basis point cut, according to the CME FedWatch Tool:

(If you’re curious how the “tool” works, it says, albeit in fine print, that the current target Fed Funds rate range is 525 to 550 basis points, or 5.25% to 5.5% in normal-person speak. The right bar shows 59% odds of the Fed Funds rate ending up in the 500-525 basis point range (indicating a 25 basis point cut), and a 41% chance of it ending up between 475 and 500 basis points, which would require a cut of 50 basis points. It might be more intuitive to just show the odds of each size cut, but this is just how they do it.)

Anyway, lower rates mean higher equity valuations, so boring as some of this nuance may seem if you’re new to investing, it fits into the “big deal” category for most serious market watchers – hundreds of billions or even trillions of dollars in wealth can come and go in an instant, based on Fed decisions.

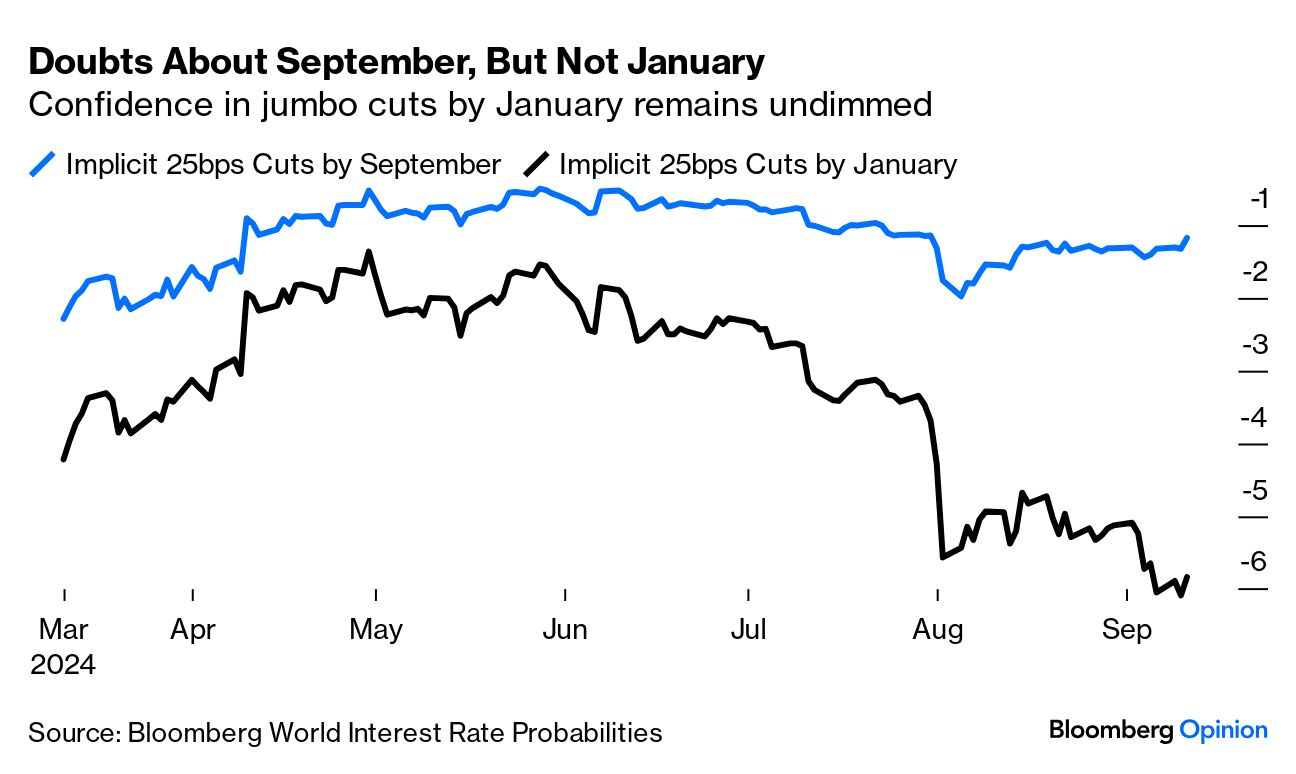

Well, sort of. A more positive perspective is that while expectations of September’s cut may have softened slightly, the market still expects quite a bit of cutting by January – roughly six 25-basis point cuts, or 1.5 percentage points.

We’ll get there, in other words.

Wall Street Journal pro-small cap piece

I’ll make this a quick hit because I’ve talked about cheap small cap valuations a bit, but it’s good to see more mainstream press take notice.

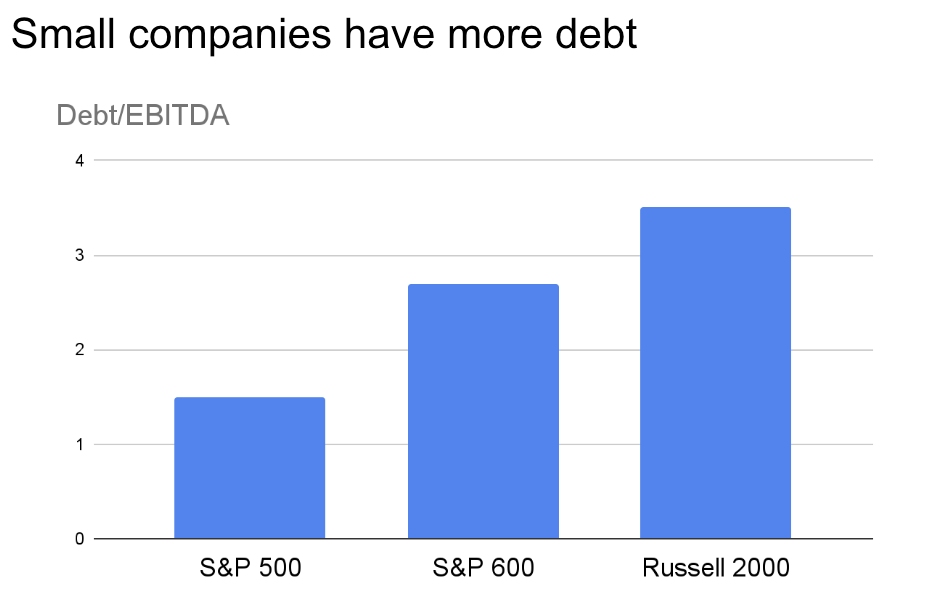

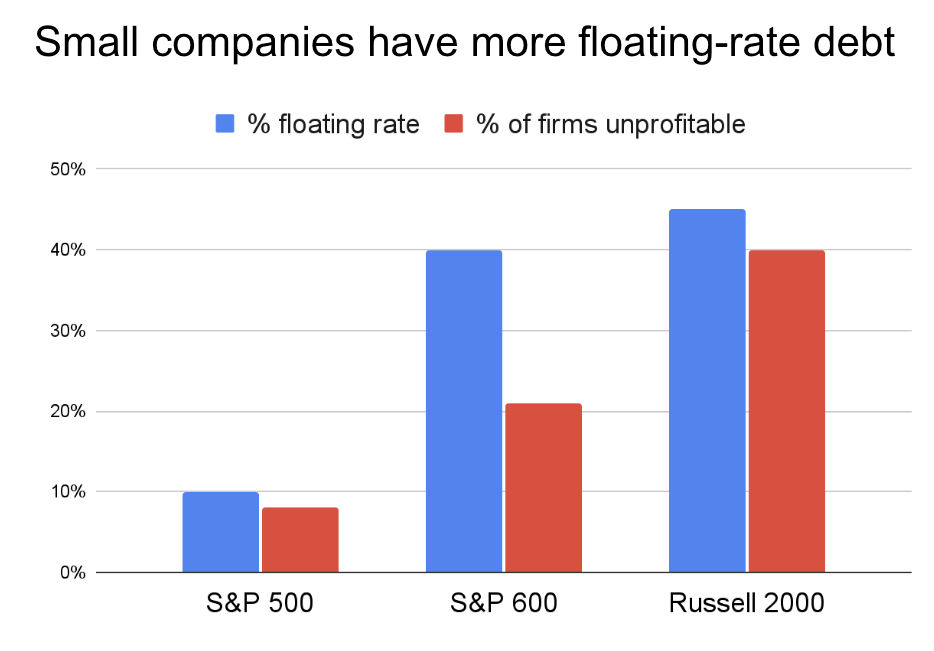

The storyline is/was that because small caps tend to have more debt, and have more floating-rate debt, than larger public companies, they were disproportionately smacked down by high rates. See two slides from a presentation I gave last winter below:

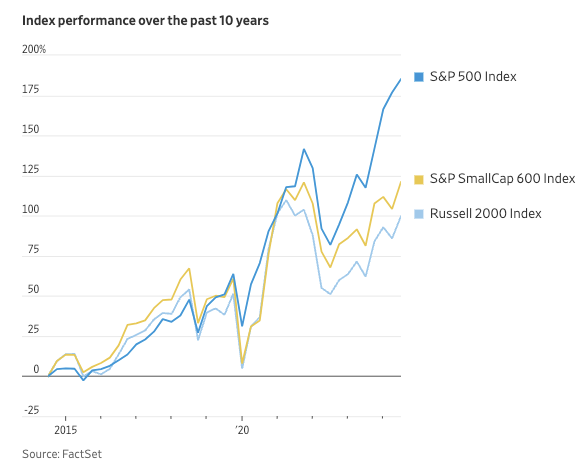

As such, and as a graphic from the Journal article shows, small caps started to lag behind over the past few years:

But with US interest rates set to drop, folks are seeing lights at the end of the tunnel. To quote a quote from the Journal piece:

“But analysts and investors are increasingly optimistic about small-caps’ potential to outperform large-caps in the months ahead, driven by the likelihood that the U.S. won’t fall into a recession and that interest rates will fall by as much as 1.5 percentage points by the end of 2025, says Sam Stovall, chief investment strategist at CFRA Research. “According to Wall Street analysts’ earnings estimates, stocks on the S&P SmallCap 600 are expected to see a 22.1% rise in earnings in 2025 versus 14.8% for the S&P 500,” he says.”

Yield Curve Un-inversion = Recession?

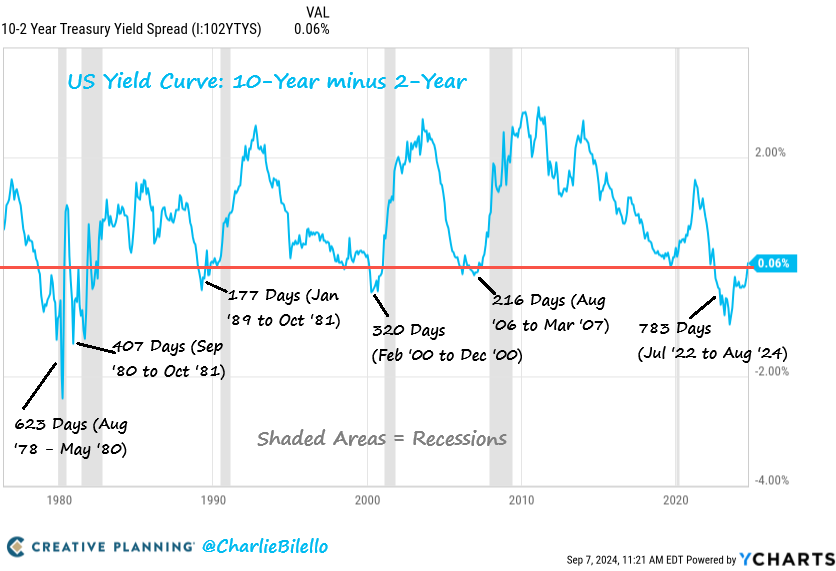

Another quick follow-up: I mentioned recently that the yield curve was uninverting, pondering if this meant even less chance of recession, considering that the usual “inverted yield curve = recession” logic, which had been accurate for every US recession since the 1950s, hadn’t applied despite a particularly long inversion (if not the longest ever).

I wanted to add that since my earlier piece, I’ve seen takes from a few analysts that, technically speaking, recessions have tended to start once the inverted yield curve uninverts, which just took a lot longer to happen this go-round.

With that logic, we may indeed see a recession (which would be bad, incidentally, for small caps, who sell a lot more domestically). But I tend to agree with economist Claudia Sahm, who I spoke with this week, who says it’s simply too early to tell.

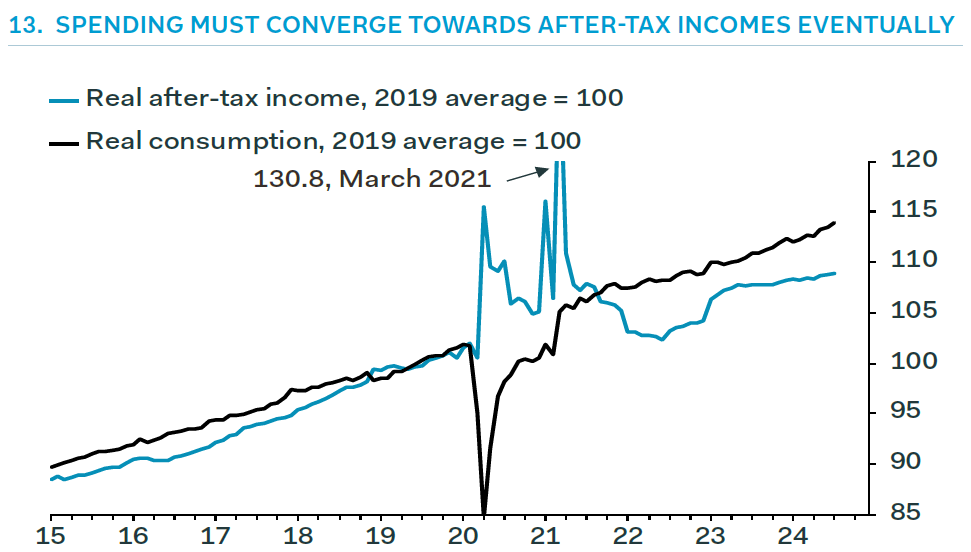

Without overindexing on John Authers’ wonderful visuals this week, it’s worth noting that while Americans’ income has not yet recovered to pre-COVID levels, American spending is steady as a rock. I’m not sure if that’s always a good thing.

Slow IPO year(s)

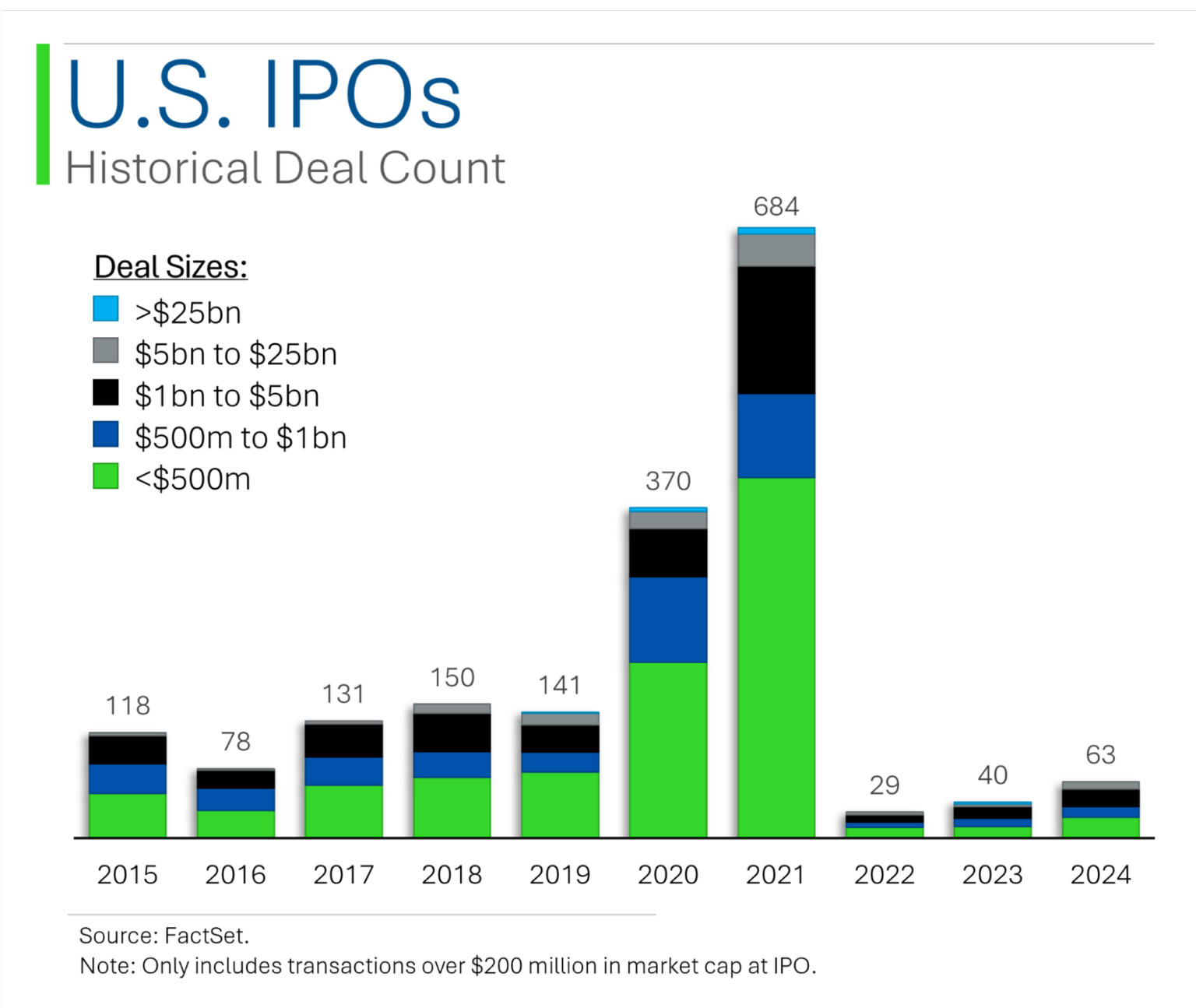

Been wondering where the IPOs are?

I haven’t. IPOs have been shown to be pretty poor investments, statistically. But I was surprised to see the magnitude of the IPO cliff after the market tanked post-2021. What’s weird is that while you’d expect 2022 to be a slow IPO year because the market was down – nobody wants to debut their company when valuations are depressed – with the market ~30% higher than it was in 2021 (exact numbers depend on exact times; I ballparked mid-2021 levels of the S&P 500), you would think that valuations are good enough for more potential new listings to come out of the woodwork. I suppose that 2021 was such a boom year that it pulled forward several years of supply.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.