Weekly Roundup: Lower Inflation, Higher Interest Rates, China Tariffs, Mystery Stock

Berkshire Hathaway’s mystery stock revealed

A few days ago, I wrote in the BBAE Blog that despite expectations, shareholders had not yet learned the identity of a mystery financial stock that Warren Buffett had been buying, and had been asking the SEC for special permission to not disclose, so as not to boost the stock price too much before Berkshire Hathaway (NYSE: $BRK) was finished building its position (which Berkshire received).

Well, now Berkshire’s 13-F form has disclosed that it’s insurer Chubb (NYSE: $CB) – a stock that promptly rose on the announcement. We can assume by virtue of the disclosure that Berkshire’s 6% ownership in Chubb is likely the limit for now, too.

Inflation

If there’s ever a story that keeps on giving, it’s inflation.

And I don’t mean that in a good way. I’m slightly tired of it. You may be, too. But it affects both our daily lives and our portfolios.

Inflation confuses people – apparently even Joe Biden. “Inflation was 9% when I took office. Now it’s 3%,” he’s been saying (it was actually 1.4% when he took office, but close enough right?).

In reality, prices have risen nearly 20% since Biden took office. In fairness, I don’t think US Presidents have all that much power to sway inflation one way or another, so it’s not his fault, but maybe it’s not a bragging point, either.

Anyway, the most recent CPI report showed a 3.4% price increase in the last 12 months through April, which is a touch better than the 3.5% increase for the last 12 months through March.

The inflation news was good news for the stock market: The Dow Jones Industrial Average crossed 40,000, albeit in mid-day trading, for the first time ever.

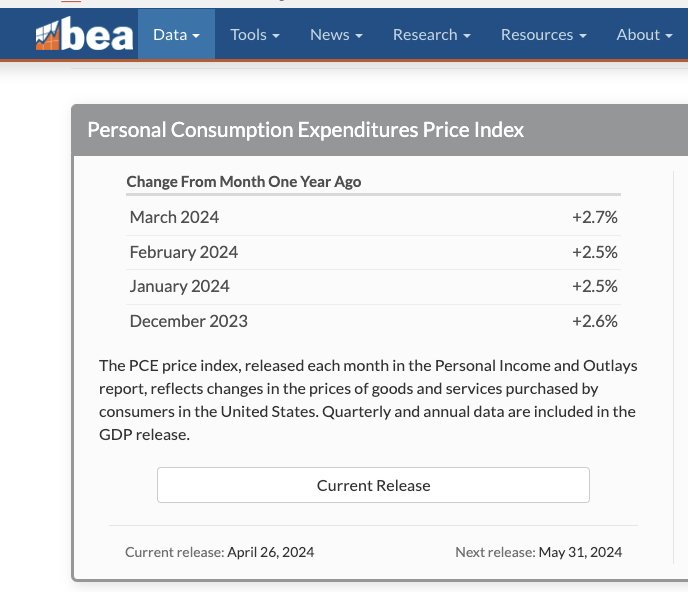

The inflation news was disappointing news to Fed Chair Jerome Powell, who said inflation is not coming down fast enough. To be fair, he was also citing a 0.5% April increase in the producer price index, and the Fed generally looks at Personal Consumption Expenditures to measure inflation (instead of CPI), and PCE has not yet started trending down.

Source: US Bureau of Economic Analysis

Interest rates: stop trying to predict them

You care about inflation because you’re paying more for margarine. Your portfolio cares about it because it may prompt central bankers to raise rates.

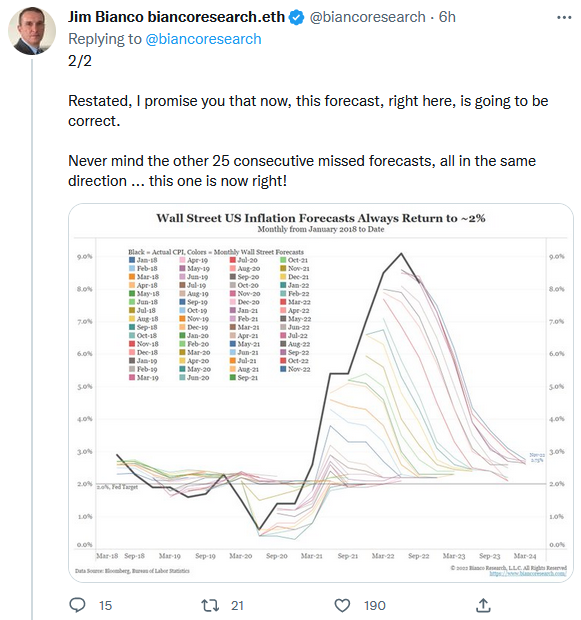

If there is one lesson about interest rates I can impart, it’s that they’re nearly impossible to predict, especially in times of volatility, which are really the only times predictions are useful.

The below graphic is a little old by now, and deals with inflation versus interest rates, but the same principle applies: Economic prediction is almost a joke when you look at how bad predictions are.

On December 27, 2023, do you know what odds the CME FedWatch Tool (could it have a better name, guys?) gave of a March 2024 rate cut?

90%.

That’s right. And it didn’t happen.

Markets were expecting seven to eight rate cuts this year. The Fed was predicting three or four.

Morningstar was saying five cuts a month and a half ago.

Just a few days later, Minneapolis Fed President Neel Kashkari said we may see no rate cuts for 2024.

Bond King Bill Gross – the guy who created the first bond fund – is in the flat-to-higher camp, even suggesting people not buy bond funds. (If you’re new to this stuff, know that if “new” interest rates go up, nobody wants to buy older bonds paying lower interest rates – unless their price drops.)

Bill Gross is talking more about Treasury rates, versus the Fed Fund rates that the Federal Reserve quasi-controls, although over the long haul, they tend to move similarly. And blogger Charlie Bilello, who also shared Gross’ tweet, makes a good point: Rates are pretty decent these days, and one seldom buys a bond fund for capital appreciation anyway.

For what it’s worth, Powell said a 2024 Fed Funds rate hike was at least unlikely, if that’s any comfort.

Who’s right?

Nobody. It’s all guessing.

Joe Biden issues new China tariffs

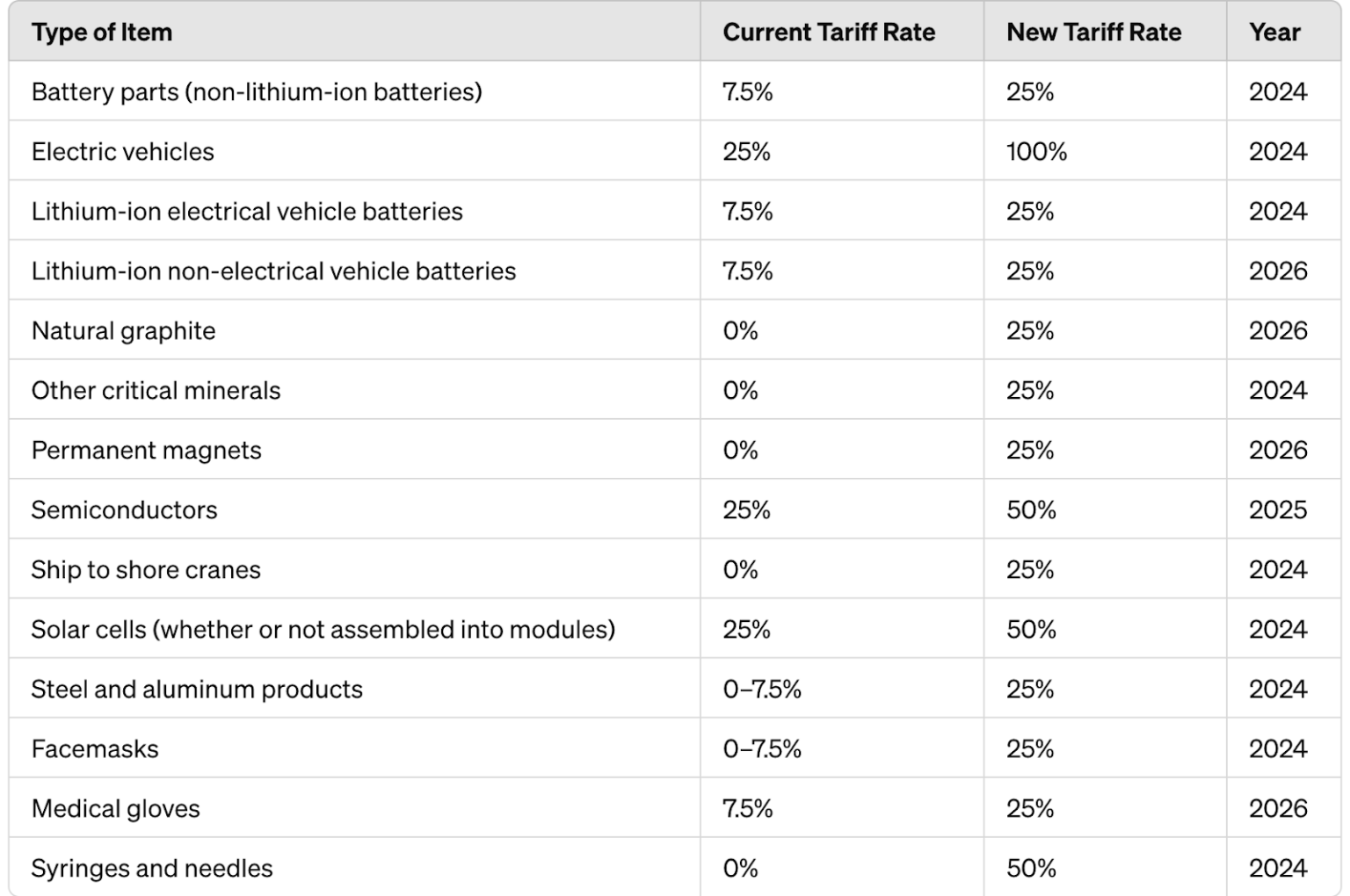

Speaking of inflation, President Biden recently substantially hiked tariffs on various goods imported from China, and perhaps most notably on EVs.

Bill Bishop of Sincisom compiled a handy table below:

Predictably, the National Retail Federation complained, and some reporters pointed out that Biden had previously lambasted Donald Trump’s China tariffs – “Trump doesn’t get the basics. He thinks tariffs are being paid by China. Any freshman econ student could tell you that the American people are paying his tariffs.” – but it’s certainly fair to say that writ large and over time, China’s trade policies toward the US have been more imbalanced than the US’ toward China.

But, still, people were surprised by the size and suddenness of these tariffs, which might appear election-serving. And, of course, they could be subverted by routing goods through Mexico and Vietnam.

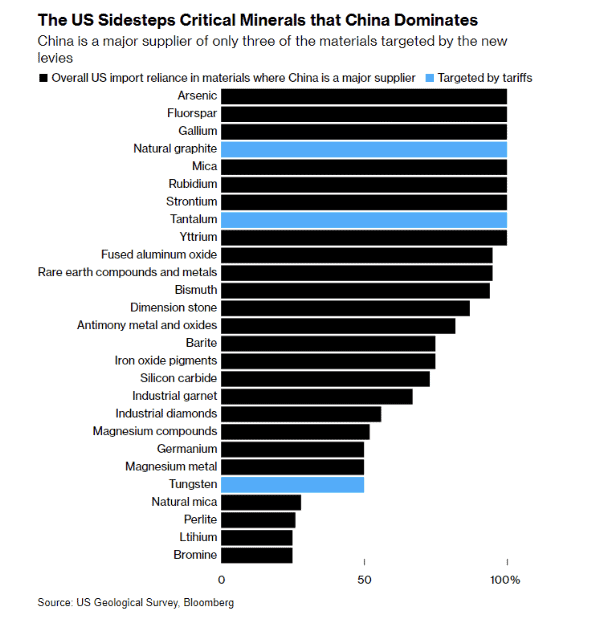

What’s probably more feature than bug, and something China would understand, is that these new tariffs were tightly targeted. As Bloomberg pointed out, the new tariffs were mostly absent in things like rare minerals, where China is a predominant supplier.

In fact, Bloomberg’s James Mayger points out a related irony in solar panel manufacturing materials: The US government may want to impose tariffs, conceptually, but hasn’t because the US needs these materials, LIkewise the Chinese government previously announced an export restriction on them, but backpedaled because its own firms wanted that revenue.

The business side isn’t always the tail wagging the anti-tariff or export restriction dog – NVIDIA and other US chipmakers have certainly lost business over semiconductor export restrictions – but sometimes it is. While US-China trade has been slowly shrinking, the emphasis should be on “slowly” – both countries benefit too much to kill a golden goose.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares of Berkshire Hathaway. BBAE has no position in any investment mentioned.